Now’s the Time to Transform FP&A: The 2024 Guide for Strategic CFOs and Finance Teams

For better forecasting and strategic impact, now is the ideal time to transform your company’s capabilities in financial planning and analysis (FP&A).

What is FP&A transformation?

FP&A transformation usually involves an investment in technology and in the automation of business planning, performance management, and cost control, which play a vital role as finance shifts its emphasis from backward-looking reporting to aiding in business performance and improved operations.

Ready to transform your organization’s FP&A capabilities? The right moment is now — after the team has completed the heavy lift of annual planning and budgeting. Initiating FP&A transformation during the first half of the year is a strategic choice for CFOs and finance teams. As companies make use of technology and automation, it can drive proactive financial management, starting the year with momentum for impactful change.

In an increasingly data-driven world, the need for effective financial planning and analysis (FP&A) has never been more critical. Savvy CFOs and finance leaders understand that the early part of the year is the most opportune time to transform the FP&A function and apply recent lessons learned — while annual budgeting pain points are still recent enough to recall.

But it’s not just about rolling out well-timed improvements. FP&A transformation is also about tapping into automation and elevating the impact of the FP&A function. For finance professionals, helpful automation goes beyond streamlining repetitive tasks — it enables a better use of real-time insights. This shift empowers companies to move from hindsight to foresight, driving a proactive financial approach. By implementing automation in FP&A, finance teams can focus on strategic analysis and obtain immediate insights into a company’s financial performance and key performance indicators (KPIs), ultimately enabling better decisions.

Where can FP&A teams make an impact through transformation?

FP&A transformation initiatives can significantly improve how the company handles reporting and analyzing essential financial and operational data, like strategic planning and cash flow management. The initiatives outlined below can lead to substantial improvements in various critical areas, including:

- Planning & Forecasting: Implementing an integrated software solution for business planning with what-if modeling and scenario planning allows the FP&A team to assess budget suitability in real time.

- Cash forecasting and management: Providing rolling short-term global cash visibility with drill-down capability into any category will enable more robust financial planning and analysis. In addition, the process can be streamlined by further automating the reconciliation of bank statements to cash transactions.

- Conducting variance analysis: By comparing actual outcomes with budgeted or forecasted outcomes, organizations can identify variance triggers, enhance budgetary accountability, and make corrective actions.

- Cost management: Transitioning to a “zero-based budgeting” approach can reset a company’s cost base so that spend is directed toward its highest use.

- Financial close processes: Enabling real-time integration with enterprise resource planning (ERP) and other source systems, collaborative workspaces, and pre-configured task and project templates will enhance a company’s approach to each financial close cycle.

Through a well-suited approach, financial processes and reporting can be streamlined to automate tasks, enabling corporate financial analysts to generate quicker and more precise assessments of a company’s financial well-being. Automated reporting practices will empower FP&A teams to use financial models and tap into data in a nearly real-time manner to support decisions with more accuracy and better timeliness.

The role of technology in elevating the FP&A function

The modernization of an FP&A organization is significantly enabled by the adoption and use of technology. Embracing new technologies for FP&A goes beyond merely discarding old systems. By building on the strengths of existing technologies and adopting new ones, organizations can transform their FP&A processes, driving more accurate forecasts and improved performance. Technology plays a critical role in advancing the FP&A maturity of an organization, contributing to its overall financial health.

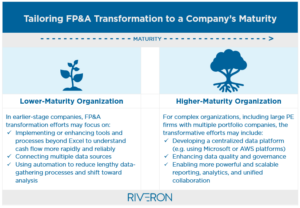

A tailored approach: considering maturity in FP&A transformation

Transformation insights for companies with FP&A functions that are earlier in the maturity curve:

For early-stage companies in FP&A maturity, technology serves as an accelerant for their progress. By developing the FP&A functions, early-stage companies can adopt a more data-driven and strategic approach to financial planning and analysis, supporting the company’s growth and strategic decision-making.

This involves evaluating their current practices, identifying areas that require enhancement, and constructing a compelling business case for integrating FP&A business partnering.

Private-equity-backed portfolio companies and other small- to mid-market businesses often work with their advisors to transform the FP&A function by implementing solutions that utilize ERP, CRM, or operational systems. By employing an ETL tool such as Alteryx, a company is able to transform its data model, enabling the finance team to present the output effectively in a performance visualization tool like Power BI or Tableau.

FP&A transformation considerations for mature, larger, or more established organizations:

FP&A transformation may present more complexity for mature, larger, or well-established organizations. By leveraging advanced technology, these organizations can create a responsive and adaptive financial planning environment that enhances agility and supports their FP&A modernization efforts—at the desired scale. This not only increases operational efficiency and effectiveness but also enhances risk management through sensitivity and scenario analyses.

Data platforms that are used for for reporting gain greater significance within more mature organizations. Here, the focus extends beyond ensuring centralized data access to structuring it within a data warehouse and creating a common data model that can be shared across FP&A and other functional areas. In more mature organizations, the reporting layer can also become more sophisticated, with considerations for deploying corporate performance management “CPM” software for planning and forecasting, as well as other BI and analytic applications. The landscape for these tools can be expansive so proper selection and implementation become critical factors in making the FP&A organization more efficient and effective.

Three key focus areas for effective FP&A transformation

Effective FP&A transformation necessitates a focus on three key areas: improving automation, guiding FP&A through better use of data, and enhancing avenues for improved decision-making.

(1) Developing more advanced techniques for FP&A automation

Adept CFOs are transitioning from automating basic tasks (such as manual data collection, data consolidation, reconciliations, and report formatting) to advanced budgeting and forecasting techniques, enabling real-time collaboration and analysis.

Example: How automation streamlined FP&A success in a highly acquisitive healthcare organization

A fee-for-service healthcare provider had grown through multiple acquisitions and faced FP&A challenges because each of its acquired organizations compiled financial information in an autonomous manner. This required the finance function to align dozens of autonomous financial planning practices with the executive leadership’s top-down growth targets. The organization’s traditional Excel-based budgeting processes had been time-consuming, exceeding 1000 hours. Implementing a CPM system (such as Workday Adaptive) streamlined the financial planning and analysis process by providing collective views in real time, reducing the need for multiple rounds of budget revisions.

The key benefit of employing advanced automation is that the techniques allow the Office of the CFO to reallocate employees’ valuable time from transactional activities to strategic analysis and improve the performance of business operations. This shift enables FP&A to focus more on the future, steering the business rather than just explaining past financial results.

(2) Helping finance lead with unified, useful data

CFOs and finance leaders can address data quality issues by developing a unified data model for the FP&A organization. This involves thoughtful investment in all stages of the data pipeline, from ingestion to analytics, enhancing the analysis of financial statements, trend identification, and strategic insight generation.

Streamlining data processes is necessary for organizations seeking to enhance their financial performance. Employing technologies, we can effectively transform transactional and other source data for scalable reporting. The most efficient way to do this is by creating a standard operating model for data exchange, which also helps eliminate manual data transfers between applications. This allows us to easily access the data using appropriate reporting tools, improving forecasting accuracy or our decision-making through scenario modeling.

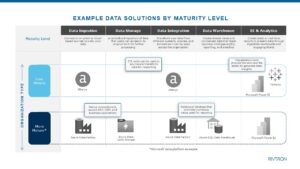

As noted above, maturity (of the FP&A function itself as well as the technology landscape) is a major factor in the approach to elevate an organization’s finance function through better data. Technology solutions can be tailored to match company maturity levels, ranging from simple setups for growing companies to complex data platforms for larger, more established organizations.

![]()

Examples from earlier-maturity companies

Example #1 – a consumer products company

Using VUE by Riveron, one organization improved cash flow forecasting by using the automated reporting solution to retrieve and prepare the data driving the company’s 13-week cash flow model. A beauty products manufacturer needed to connect directly to its ERP and payroll system to facilitate faster and more reliable inputs into their cash flow reporting tool. Through this process, the company is able to aggregate accounts receivable (AR) and accounts payable (AP) aging, sales, and other inputs. The consolidated data is easy to view on a tab that can be quickly used to summarize receipts and disbursements.

This process highlights the importance of data pipelines well-suited for an early-maturity organization because the process is not fully automated but tackles more than 50% of the effort. The FP&A team’s time can now move to more important tasks like analysis.

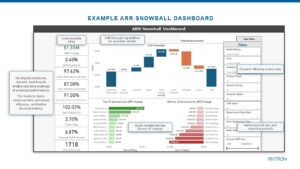

Example #2 – a software-as-a-service (SaaS) company

For example, the FP&A function at a subscription-based technology/SaaS company needed to better understand its revenue in order to make decisions about optimizing the product mix or resource allocations for investing in growing revenue streams, so the company developed an automated reporting solution to look at the Annual Recurring Revenue (ARR) by building an ARR Snowball dashboard to categorically review opening and closing ARR balances and what is driving that change. This transformed the finance team’s ability to go from reactive Excel models to real-time revenue analysis with live connections to source data within their ERP and CRM systems.

Examples for improving mature organizations

There have been successful cases in which larger corporations or certain private-equity-backed portfolio companies have developed a centralized data platform using data platform technologies from Microsoft or Amazon Web Services. The approach involves selecting appropriate data ingestion tools, creating a data lake, and using ETL and governance tools for data structuring in a warehouse. The resulting planning and analytics layer enables powerful reporting and analytics.

This improved data infrastructure ensures higher quality, more accessible, and actionable data. Although initial data cleaning is time-consuming, establishing repeatable processes allows for minimal oversight and more time for strategic analysis.

(3) Making better decisions through enhanced data and automation

FP&A professionals need to collaborate with companies to define relevant KPIs and financial dashboards, using reporting tools for real-time financial performance insights and data-driven decision-making.

Successful FP&A teams need to drive faster, deeper insights into reporting data, which enables comparative analysis at the right level of detail and the ability to explore profit variances.

This requires a well-thought-out architectural design of planning data and actuals to be able to compare the past, present, and forward-looking information at the same level of granularity.

Example

A CPM implementation for a law firm started with reporting in mind. The team asked: how does the company want to manage the business? In order to produce the mental model for planning and reporting, sometimes it requires a change in processes. In this case, the accounting department needed to align the revenue accrual process to meet a level of granularity similar to the planning process. The team evaluated and ensured a level of comparability across organizational levels, dimensions, and reporting attributes between the firm’s plan process and actuals. This alignment allows for detailed comparison “variance analysis” of financials that helps explain the story of why the business is operating as it is.

Companies should begin CPM implementations with a clear focus on the desired reporting outcomes. This involves planning the mental model before configuration to ensure alignment with the planning and accounting processes before constructing the environment. This approach ensures that the CPM tool is effectively integrated and aligned with the company’s financial reporting and planning needs.

Automation brings about significant improvements in business units by facilitating rapid access to high-quality data and simplifying tasks associated with forecasting and budgeting.

Data quality improvement is achieved by developing a unified data model for the FP&A organization, ensuring higher quality, more accessible, and actionable data through efficient data collection.

Collaboration, on the other hand, involves:

- Defining relevant KPIs and financial dashboards with business partners

- Using reporting tools for real-time financial performance insights

- Making data-driven decision-making

Implementing automated reporting

Streamlining financial processes requires implementing automated reporting procedures. By automating tasks related to preparing and analyzing financial reports, organizations can enhance forecasting accuracy, better control cash flow and costs, and ultimately improve decision-making.

Moreover, the use of top-tier FP&A automated reporting tools such as:

- CPM: Workday Adaptive, OneStream, Anaplan, Planful

- End-to-End Data Platforms: Microsoft (Fabric), AWS

- Data Integration / Transformation: Alteryx, Fivetran, Informatica

can significantly enhance the efficiency of FP&A operations.

Key takeaways

FP&A transformation is a journey that involves embracing new technologies, empowering finance teams, aligning strategic goals with financial planning, and continuously measuring and improving performance. By learning from successful case studies and adopting best practices, organizations can overcome challenges and achieve FP&A excellence.

What are the recommended steps for a company to consider when enhancing its FP&A functions?

To enhance its FP&A functions, a company should (1) evaluate its current practices, (2) identify areas for improvement tailored to its current position on the maturity curve, (3) build a strong business case for integrating FP&A business partnering, and (4) implement improvements for maximum impact. So, whether you’re a CFO or a finance professional, embrace the journey and drive your organization toward a future of data-driven, strategic decision-making.

FP&A transformation involves technology enablement and reimagined processes.

Technology modernization in FP&A is critical, involving both the enhancement of existing platforms and the incorporation of new tech, to boost financial performance and forecasting accuracy. Empowering FP&A teams through automation, training, and building data literacy is crucial to executing successful transformations, overcoming challenges, and improving overall financial operations and decision-making.

The ideal time to transform FP&A is now – after the fourth quarter demands of annual planning are out of the way.

FP&A transformation is ideally initiated after the busy demands of the fourth quarter when annual budgeting efforts consume most of the FP&A team’s focus. As the calendar moves into the first half of the year, it presents the opportunity to implement rolling forecasts, a significant change to the financial planning and forecasting processes.

By transforming the company’s FP&A approach, CFOs and finance teams will be able to introduce speed and flexibility into operations. This shift in operations leads to increased efficiency, and more importantly, it enables FP&A teams to develop sensitivity and scenario analyses to stress test financial plans, identify potential risks for each business unit, and collaboratively chart the best path forward.