Vue by Riveron

Empower your executives to make faster, data-driven decisions

Today’s private equity-backed and high-growth companies face many challenges as they seek to optimize reporting and decision-making. Leveraging your existing applications, VUE by Riveron automates the extraction and integration of financial and operational data — turning it into one source of truth. Using a proven approach and low-code platforms, we transform your existing data to develop real-time, ready-to-use dashboards. Our solution for automated reporting eliminates manual efforts, is easy for staff to maintain, and enables leadership to make informed decisions.

To address common business challenges such as…

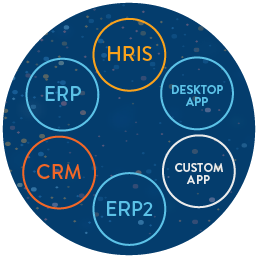

Lack of integration across critical business applications…

VUE by Riveron integrates your companies’ financial and operational data

Limited resources, including personnel and budget…

VUE by Riveron automates manual processes allowing more time for analysis and decision support

Limited performance visibility…

VUE by Riveron delivers tailor fit reporting with key performance indicators

client success story

Reduced report production time from weeks to minutes for a PE-backed company

A recently acquired, private equity-backed online marketing company needed an automated reporting solution for its financial and operational reports. The company’s finance team spent weeks each period integrating, cleansing, and analyzing data required for management reviews. With a one-time investment and 8-week timeline, VUE by Riveron helped the company eliminate data inconsistencies and manual errors, reduce report production time from weeks to minutes, and provide management with self-service analytical capabilities through intuitive dashboards.

Phased approach

We maximize performance visibility for private equity portfolio companies and their stakeholders through a three-phased approach.

Define

We partner with management teams to identify and define key business metrics, align reporting priorities, and determine data availability and integrity.

Develop

We develop automated connections to your disparate data sources and extract, integrate, and transform the data using advanced, low-code analytical tools to create a one source of truth.

Deploy

We deploy customizable, real-time automated KPI dashboards that are easy for staff to maintain and enable leadership to make informed decisions.

Does automated reporting make sense for your business?

Many of the organizations we work with who are trying to determine if an automated financial reporting solution is right for them answer “yes” to the following questions:

- Are you consistently delayed or late in closing your books and miss deadlines in preparing timely financial statements?

- Is your legacy ERP system deficient and not integrated across other critical business applications or kpi dashboards?

- Is your finance team overwhelmed by limited bandwidth, budgetary constraints, and manual processes?

- Are your financial statements riddled with inaccuracies and inconsistencies?

- Does your leadership and other stakeholders require real time operational, financial, and actionable insights to make clear decisions?

The benefits of automating your financial reporting

When properly put into play, automation provides FP&A teams with data that is cleansed and easily accessible, highlights KPIs, produces exceptions for review, and is valuable at all levels of the business.

The right kind of automation solution strengthens visibility into the business. This includes:

- Structured data extraction processes which pull data from singular or disparate sources, applying formatting that flows seamlessly into final reports and aids data management.

- Data workflows, which streamline company processes while identifying quality issues prior to final analysis. Additionally, data workflows facilitate testing and validation.

- Data set storage that includes date- and time-stamped information and is customizable for version control and historical analysis.

- An expanded platform – including self-service dashboards – and suite of financial reports, which allows teams to navigate through key metrics, conduct ad hoc analysis, and drive business decisions.

VUE by Riveron eliminates obstacles by leveraging intuitive platforms allowing Riveron’s team of highly skilled professionals to set up the solution in weeks and reduce report production to minutes without changing existing client technology. This also makes it easy for client teams to utilize and maintain for KPI reporting and performance visibility.

Connect with an expert

Interested in seeing how VUE by Riveron creates one source of truth for operational reporting and financial metrics? Connect with a member of our team for a live demonstration.

Interested in seeing how VUE by Riveron creates one source of truth for operational reporting and financial metrics? Connect with a member of our team for a live demonstration.

No Executive Leaders or Managing Directors matched your search.

Related Insights

Insights

Private Equity Teams Can Boost Value and Visibility Through FP&A Automation

Effective automation strategies enable PE-backed FP&A teams to guide better decisions and elevate the value of portfolio companies.

Success Stories

Post-Acquisition Integration and Accounting for a Leading Private Equity Fund

When a leading private equity fund acquired and merged several businesses, Riveron was engaged to support with financial reporting, audit preparation, and purchase and technical accounting.

Insights

Making Smart Technology Decisions During the Private Equity Investment Period

For companies entering into a partnership with a PE investor, it is important to consider technology needs prior to and following the transaction.

Insights

Expert Q+A: How Finance Teams Can Make an Impact During Annual Planning

An interview with a Riveron financial planning and analysis (FP&A) expert explores how savvy CFOs are tackling the 2024 budget season with a cautious-yet-growth-minded approach to annual planning.