Private Equity Teams Can Boost Value and Visibility Through FP&A Automation

Private equity teams should automate what they can, allowing finance professionals to focus on driving value.

The current economic challenges demand a better —and real-time— understanding of performance, both internally and in the market. While visibility into performance is always a business imperative, finance teams at private equity-backed businesses are feeling this strain more acutely than ever before.

Inflation, workforce constraints, and other impacts of economic uncertainty are noticeable at all levels, from private equity (PE) fund leadership to the financial analysts working within portfolio companies (PortCos). In parallel with responding to pressing volatility, these teams need to take the right actions to elevate the transparency, timeliness, and ultimately the value offered to PE firms through the financial planning and analysis (FP&A) function.

Why visibility matters – and why it can’t wait

In order to make sound decisions, PE operating partners and upper management need to have timely analysis supported by ample context regarding the drivers within the business. In other words, PE teams need great visibility across their entire portfolio, requiring strong finance teams within each PortCo. If a PortCo is newly acquired, its FP&A team may need to adapt to the rigor of a PE-backed environment. Here, it is not uncommon for FP&A teams to be earlier in their journeys, using less sophisticated processes and technologies or being understaffed and therefore unable to use and develop newer tools and approaches. This means leaders often need to upskill the finance function, which can be costly because it goes beyond simple training or additional headcount and often involves technology initiatives that enable automation.

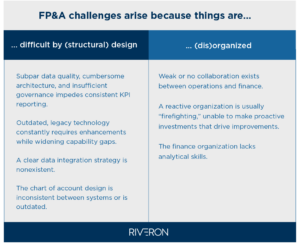

Successful automation efforts must be done in a cost-effective manner, and leaders guiding these initiatives should be prepared to first resolve the most prevalent issues. Manual FP&A processes and data inconsistencies often lead to four core automation challenges: (1) performance metrics do not align with the value levers of the business; (2) reporting is often stale and lacks the operational insight necessary for decision-making; (3) multiple sources of truth create incremental reconciliation exercises; and (4) finance resources appear to always be stretched, creating a “hero culture.” While these four challenges are seemingly universal to FP&A teams, their root causes may vary from company to company, and they fall into one of two categories: structural design or organizational.

No matter the root cause or approach to addressing FP&A ills, PE firms would be wise to consider the benefits of weaving automation into their operations.

The value-add offered by automation

FP&A is built on data, but its analyses drive strategy. That missive is hard to execute on, given the status quo of data quality.

PE firms struggle with getting reliable reporting and data from PortCos, where FP&A teams fall short in aggregating and standardizing data on a consistent basis. Without clear, consistent reporting, how can leaders derive strategic, actionable insights?

Automation may be the answer.

The right kind of automation solution strengthens visibility for PE firms through an elevated FP&A function. Benefits include:

- Structured data extraction processes which pull data from singular or disparate sources, applying formatting that flows seamlessly into final reports and aids data management.

- Data workflows, which streamline company processes while identifying quality issues prior to final analysis. Additionally, data workflows facilitate testing and validation.

- Data set storage that includes date- and time-stamped information and is customizable for version control and historical analysis.

- An expanded platform – including self-service dashboards – and suite of financial reports, which allows teams to navigate through key metrics, conduct ad hoc analysis, and drive business decisions.

When properly put into play, automation provides FP&A teams with data that is cleansed and easily accessible, highlights KPIs, produces exceptions for review, and is ingestible at all levels of the business.

Evidenced through Riveron’s various client engagements, companies can see substantial results such as:

A leader in data management implemented an automated workflow to create KPIs for various reporting periods, while incorporating additional monthly data. This eliminated the need to update the 250+ MB file previously used to identify KPIs and reduced the process from a full day to 20 seconds.

A global veterinary network created an automated, consolidated general ledger, balance sheet, and working capital forecast model. This freed up the FP&A team from making manual adjustments and allowed them to focus solely on scenario testing and gathering insights.

A national back-up power supplier used automated reports to enhance data-driven decision-making, enable self-service analytics with real-time performance analysis, and aggregate data from disparate sources. Beyond eliminating five days’ manual effort per month, reporting accuracy increased from approximately 50% to more than 95%.

Do more with less

With the ability to access data from all areas of the business, PE firms should seek automated FP&A solutions – trading antiquated, manual processes for the immediate insights that automation offers.

By doing so, FP&A teams can realize their full value through focusing on organizational performance, identifying areas of improvement, and developing strategies that move the business forward.