5 ESG Facts That CFOs Should Know

Want to think outside the box to grow the bottom line? Then now’s the time to talk ESG. While many CFOs may be tempted to place ESG on the backburner – especially during an economic downturn – that turns away a significant number of opportunities for many businesses.

More and more, ESG performance is proving to be a critical contributor to both bottom- and top-line growth, proving it’s not just an initiative motivated by social purpose. While the importance of aligning a company’s goals with moral integrity is high, skeptical finance leaders dealing with the current economic conditions might need to see how these initiatives can have financial impacts before deciding to engage.

The good news is, there is plenty of evidence to support the significant financial benefits of strong ESG initiatives. Companies that invest in ESG usually see the dividends across various P&L line items as well as in their value creation efforts, access to equity capital, and credit ratings.

Here are what we see as the top five financial benefits of ESG that every CFO needs to consider.

1. ESG drives sales growth for all companies, consumer-facing or not.

The desire for “green products” among consumers in nothing new. Research consistently demonstrates this fact with recent data indicating that more than 70% of consumers would pay 5% more for a sustainable product, which can add up to a significant impact on revenue.

But what about non-consumer-facing businesses? In the past, these companies may have been inclined to gloss over ESG benefits assuming they don’t matter as much to their clients. In reality, corporate customers are just as concerned with product sustainability as their consumer counterparts. This means that B2B companies with sustainable business practices are more likely to win contracts and grow sales, as an increasingly large portion of companies evaluate suppliers for ESG performance.

And for many organizations, it’s not just their own sustainability that counts. Depending on a company’s industry, up to 90% of its ESG footprint resides in the supply chain, making finding sustainable suppliers an absolute must. A September 2021 McKinsey article shared findings from a survey of 20 CPOs of large European companies. At the time, 20% of the CPOs were already using sustainability measures as primary criteria in sourcing decisions or supplier reviews while 60% had an idea of where they wanted to be, even if they had yet to deploy specific strategy to get there.

2. Strong operational ESG actions can drive down costs by 5 to 10 percent.

Companies with robust ESG programs typically focus on operational efficiency and waste reduction, both of which translate into lower cost of revenue. Waste-conscientiousness also drives a reduction of materials in both products and packaging, along with increased reutilization of recycled material, further driving down costs.

In addition, because ESG-focused companies are likely to ensure both ethical product sourcing and ethical employee treatment practices within their supply chains, they are more likely to avoid the high costs associated with litigation issues or faulty quality problems. Such issues can lead to extremely costly reiterations of product.

3. ESG practices can help keep many aspects of SG&A low.

At the surface level, efficient environmental polices reduce energy, water, and waste costs, directly reducing SG&A expenses. In fact, one study suggests that strong ESG performance can reduce operating expenses by as much as 60%.

ESG practices have another less obvious but equally important impact on this line item by improving talent attraction and retention practices. Research indicates that large U.S. businesses lose at least $1 trillion each year due to voluntary employee turnover. One way to stop the revolving door is to invest in ESG practices, which have been shown to contribute heavily to employee satisfaction, especially when pay equality, treatment, and labor policies are high priorities. Companies with solid ESG policies have an advantage when it comes to keeping talent, as there is significant correlation between talent retention rates and ESG performance. Well performing companies can thus reduce the high costs of attrition and finding new labor.

4. ESG drives access to equity capital.

Whether an individual company or CFO buys into ESG or not, the numbers overwhelmingly indicate that both institutional and retail equity investors value ESG performance:

- $20T in AUM sits in ESG-aligned funds globally

- 79% of U.S. general retail investors and 99% of millennial retail investors are interested in sustainable investing

- Low-carbon companies and funds received 107% return over the past five years

To seek out and engage these ESG-minded equity investors, companies must be making progress on the ESG front and talking about it, too. Additionally, enhanced ESG performance elevates companies ESG scores with providers like MSCI. As just one player in the ESG ratings and indices space, MSCI offers over 1,500 ESG-aligned investment indices. This means companies can also gain access to a significant amount of passive funds by improving their ESG performance.

5. Good ESG ratings impact credit ratings, which impact everything else.

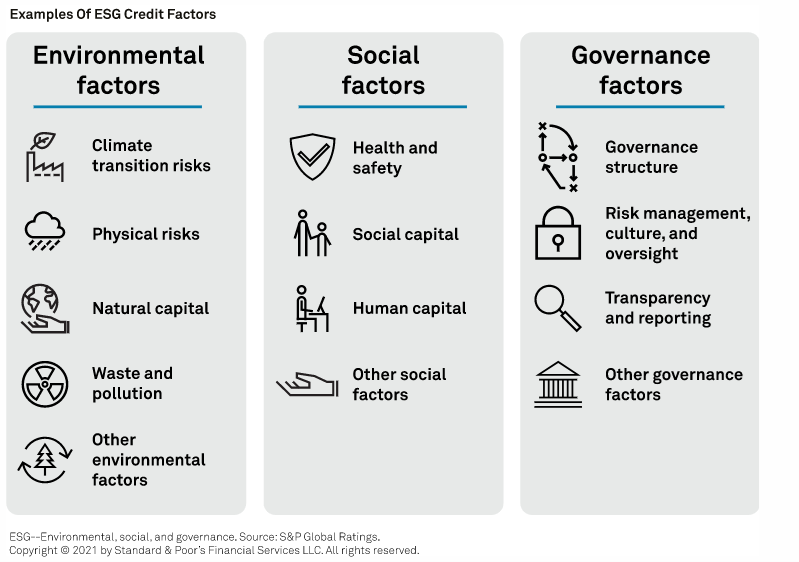

A good ESG rating can impact a company’s overall credit appeal. According to S&P Global Ratings, the ESG factors that affect or influence creditworthiness include:

Such factors can drive up to 14x higher cost of debt. But those companies that are deemed ESG savvy will be able to borrow at a lower rate, which will have a direct and positive impact on the company’s interest expense on the P&L. Over the long term, lower debt costs add up to significant savings. And in times of stress such as today, they give companies liquidity at the cheapest rate possible. A lower interest expense could be a key differentiator to boost EPS metrics this recession.

Clearly, credit ratings are pivotal to success, especially in difficult economic periods, and they have the power to impact all types of financial statements including the balance sheet. At the same time, they impact the likelihood of equity investment as companies with low credit scores are seen as riskier investments. The bottom line: public companies need good credit ratings and solid ESG programs are one way to get them.

Cutting ESG programs will cost much more than it will save.

When times get tough, all companies must decide where to cut back. While ESG programs might make an appearance on the chopping block, it’s important to think twice before making any drastic changes. Yes, ESG programs represent a cost. But the ROI can be critical both in terms of your financial statements and your ability to continue attracting investors.

Next time you speak with senior management about where ESG falls on the company’s priority list, share some of these critical metrics. And when your ESG project gets the green light, consider contacting Riveron. We can help your team find a peer set, benchmark your ratings, discover weak spots, and write policies that get results and ensure your ESG initiatives deliver to their fullest potential.