Employee Incentives: What to Know About Accounting for Profits Interests Units

In today’s market, many private companies seek to retain key talent through profit interest awards, which can present unique accounting complexities. Profits Interests Units (PIUs) are a form of equity compensation typically issued by limited liability companies (LLCs) and are popular with private equity investors as a way to incentivize management. PIUs are based on the company’s future value and are awarded to employees for their services to the company. Usually, the award does not require the contribution of capital from an employee. Many nuances can exist for such employee incentives, and an accounting team should consider the main features of PIUs plus the related accounting guidelines and tax implications.

Compensation matters: defining PIUs and how they are classified

PIUs act as a form of equity compensation in exchange for services. A company can issue PIUs to anyone affiliated with the organization: various levels of management, employees, specialists, and stockholders alike. A PIU can also have different names, such as an incentive program, appreciation plan, or management units.

These future profit shares enable a holder to receive an allocation of income or distributions in a liquidation event, such as the sale of the company. PIUs often have vesting requirements based on employee service. In addition to participation in the equity upside of the company, another benefit is that a PIU is tax free to the recipient upon issuance, as any increase in value is considered a long-term capital gain from a tax perspective. The structuring of PIUs is not standardized; indeed, the term “PIU” is often used to identify many types of awards outside of an equity unit. Designing a PIU allows for considerable customization, which lends to its popularity with limited liability companies backed by private equity investors.

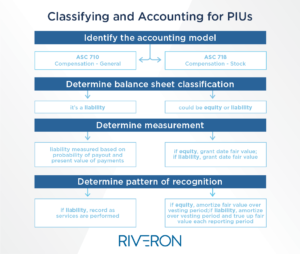

Under US GAAP, PIUs may be classified as deferred compensation or share-based payments. Due to the range of customizable features a PIU can include, balance sheet classification requires scrutiny of the related agreements and review of the applicable accounting guidance – either ASC 710 or ASC 718. In either case, a valuation at the issuance date most likely would be necessary. Depending on whether certain features are included in the award structure, PIUs may also be recognized as a liability on the balance sheet. Generally, a company’s operating agreement outlines all classes of legal equity that the company is authorized to issue, including PIUs, and accounting teams should review these agreements for the features each class holds. These might include voting rights, pre-emptive and related rights, distribution and liquidation rights, and other relevant terms and provisions which will impact classification and subsequent accounting.

Accounting requirements of PIUs present a common challenge for private companies

During a meeting with the Financial Accounting Standards Board (FASB), the Chair of the Private Company Council noted that PIUs were a challenging area for private companies from an accounting perspective. This often is compounded by the expectation that PIUs have no value at issuance, which would seem to require minimal related accounting. However, an entity should begin by evaluating all the relevant provisions of PIUs and the related agreements to determine the substance of the compensation agreement. Based on that evaluation, an entity should assess if PIUs’ features are more akin to a deferred compensation or profit-sharing arrangement or share-based compensation. If a PIU is similar to a deferred compensation arrangement or profits sharing arrangement, an entity will follow ASC 710 (Compensation – General), but if a PIU is more similar to a share-based payment arrangement, the entity should apply ASC 718 (Compensation – Stock).

The guidance in ASC 710 and the guidance in ASC 718 vary significantly in terms of specificity and prescriptiveness. The guidance in ASC 718 is relatively specific and prescriptive and, consequently, more complex. By contrast, the guidance for deferred compensation arrangements within ASC 710 is brief and sets forth broad guidance for measurement and recognition. The difference between the two sets of guidance is primarily related to the calculation and timing of expense recognition. While PIUs can have variability in their structuring, PIUs are often accounted for under ASC 718 due to their inherent value being indexed to the performance of a company’s equity.

Finding the accounting model that fits

In addressing accounting issues, the US Securities and Exchange Commission (SEC) advises companies to examine the legal form of the PIU instrument and determine whether it is considered most similar to equity versus a performance bonus or profit-sharing arrangement.

Equity interest is typically indicated by “instruments that provide the holder with substantive voting rights and pari passu dividend rights,”

By contrast, performance bonuses or profit-sharing arrangements are usually characterized “when few if any assets underlie the special class, or the holder’s claim to those assets is heavily subordinated.”

The SEC also notes that issuers should consider “any investment required, and any put and call rights that may limit the employee’s downside risk or provide for cash settlement.” And, in cases best accounted for as performance bonus or profit-sharing arrangement, “any returns to the employee should be reflected as compensation expense, not as equity distributions or minority interest expense. Further, if the employee remitted consideration at the outset of the arrangement in exchange for the instrument, such consideration should generally be reflected in the balance sheet as a deposit liability.”

It is important to perform an analysis of the PIU features and determine proper accounting at the early stage. The balance sheet reflects differences between ASC 710 and ASC 718 models regarding recognition, measurement, and the classification of the profit interest units. For example, ASC 718 provides a framework for evaluating whether an award should be classified as equity or as a liability. If the PIU is classified as a liability, the entity has to take on additional costs to remeasure the future value at each reporting date through the settlement date. Understanding these nuances is equally important when structuring the features of the PIUs.

Additionally, footnote disclosures are oftentimes required with both equity and liability PIUs. Evaluation of these awards may also result in deferred tax assets.

Looking at Liability Classifications

Legal obligations, or liabilities, are established when PIUs are structured and issued. The structure of these instruments may provide employees with downside risk protection, which can have an impact on the classification of these units on the company’s balance sheet.

An example of terms that could require liability classification would be when awards must be redeemed should the employee be terminated.

Also, awards that have a guaranteed value feature are also typically classified as a liability. For instance, if terms are written for the holder to have a minimum distribution regardless of the company’s overall equity value, the employee benefits from this insulated risk of loss in a manner different than an equity ownership risk, and the accounting for the company would likely be a liability.

Possible Tax Benefits and Impacts of PIUs

One of the reasons that PIUs are becoming increasingly popular is because of the significant tax benefits. When a PIU is issued, the liquidation threshold is typically set at the current equity value, and therefore investors view it as effectively a $0 value. As a result, applicable tax laws consider the holder as a partner or anticipated partner and becomes a way for employees to receive non-taxable compensation, subject to tax from long-term capital gains. It is important to consider PIUs from both accounting and tax advisory perspectives. Here, PIUs might be viewed differently because the fair value for GAAP financial reporting would take into account expected company performance and appreciation in valuing the units for the purposes of recognizing compensation expense if vesting is associated with the ability to participate in distributions.

For instance, drawing from a similar FASB example, if an employee is granted a PIU when the company is worth $100 million, the employee will only receive distributions once the value of the company has increased to over $100 million. If a new executive joins and is granted PIUs one year later when the company is worth $150 million, that employee only participates in the equity appreciation of the company above $150 million. While conceptually similar to a vanilla stock option with a strike price set at the share price upon issuance, the interplay between a threshold set on the company’s equity as a whole and a service-based vesting condition make the valuation of such units more complex than can be calculated with a standard Black Scholes model.

Another issue that impacts the accounting from a tax perspective is whether an employee gets a “K-1” or “W-2” allocation. An employee without a PIU receives a “W-2”. On the other hand, an employee who has a PIU in the company is ineligible for a “W-2”. Such an employee receives a partnership return as their salary is classified as a guaranteed payment in the form of a “K-1”. From a tax and accounting perspective, a company granting PIUs to its employees will have “K-1” partners, not “W-2” employees.

Private equity-backed companies have gravitated toward PIUs for good reason. They are attractive for their ability to be tailored to specific company means and values, and for compensating the contributions and partnership of talented employees. To accommodate for PIUs’ growing popularity, accounting teams need to be familiar with the inherent complexity, ask questions about the nature of any potential equity compensation, and get ahead of things early. Accounting teams should be asking about these types of awards any time there is a transaction, a key hire, or a rollout of key employee retention strategies.