Corporate Accounting Teams: Pillar Two Requires a New Set of Books – Are You Ready?

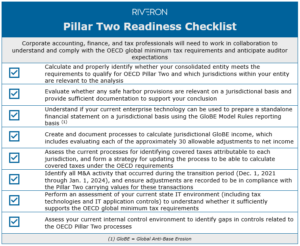

For multinational entities, OECD Pillar Two will involve a cross-functional effort because it impacts quarterly reporting, annual audit cycles, and more. Corporate accounting and tax professionals will need to team up to address the new requirements, and Riveron’s Pillar Two Readiness Checklist can serve as a good starting point.

In 2024, many public and private companies will be required to comply with the global minimum tax requirements outlined in OECD Pillar Two. While the Pillar Two guidelines will likely result in tax impacts for all multinational entities that meet certain revenue thresholds, compliance will involve more than just the corporate tax department—including the need to create a new set of standalone financial data across all relevant jurisdictions. Plus, certain audit firms have begun to release detailed practical application guidance, including Pillar Two readiness assessment procedures and timing considerations. In response, CFOs and controllers should establish an approach now to anticipate financial reporting requirements and auditor expectations in a timely and comprehensive manner.

Does my company have to comply with OECD Pillar Two requirements?

- If the company’s GAAP/IFRS consolidated revenue is greater than 750 million euros in any two of the past four years and has operations in more than one country,

- Then the company’s corporate accounting team may need to produce new separate legal entity trial balances by January 2024 for every jurisdiction with less than a 15% effective tax rate,

- And the company will need to report its global top-up tax on the Q1 2024 financial statements.

The global minimum tax is expected to affect many functions at multinational enterprises, and it’s essential to prepare proactively to avoid issues in the first quarter of the year and beyond. For public companies, Pillar Two compliance will involve calculating and recording quarterly tax expense and relevant disclosures starting in the first quarter of 2024, so it will be important for corporate finance and accounting teams to accurately capture standalone financial data and understand the tax liability across all relevant jurisdictions as soon as possible. Private companies subject to Pillar Two will need to determine their estimated annual tax liability in Q1 2024 in order for tax payments to be accurate and avoid underpayment penalties. In addition, private companies will be required to comply with annual reporting requirements.

The checklist below outlines how accounting and financial reporting professionals can help their organization get ready for Pillar Two compliance.

Pillar Two Readiness Checklist for Corporate Accounting and Tax Professionals

Beyond Tax, Pillar Two Readiness Is a Cross-Functional Exercise

As companies navigate accounting for OECD Pillar Two requirements, CFOs and controllers are paying attention and realizing that compliance involves a whole new set of books — and their teams will not want to be caught off guard in 2024.

In response, adept CFOs and corporate accounting leaders are already developing and mobilizing effective approaches. Companies can ensure Pillar Two compliance by evaluating any current gaps in financial data and appointing in-house or third-party resources who can manage the cross-functional effort, accurately calculate the global minimum tax liability, and anticipate the expectations of auditors—ultimately ensuring year-end readiness.

In addition to the checklist above, learn more about preparing for Pillar Two and calculating your company’s global minimum tax liability by reading Riveron’s related guide.