Tax Technology

Staying up to date on the evolving tax environment can be overwhelming for an organization’s tax department. As the corporate tax function matures and modernizes, it’s important to not only understand the reporting and regulatory environment but also how to leverage technology for automation and accuracy.

Riveron can assist organizations striving to transform tax processes for scale and efficiency. Our team of experts understands both the complexities of tax reporting and regulations and the technology tools to help clients create efficient processes and reduce risk.

Digital Tax Solutions

There are many tax technology solutions to assist with tax automation and tax calculations. Knowing which system to select, how to implement, and how to integrate with existing ERP and CPM tools, can be outside the daily responsibilities of a tax professional. Riveron helps clients identify platform requirements, select the best system based on their business requirements, and implement using both tax and system expertise.

OneStream platform modernizing financial consolidation, planning, budgeting, forecasting and reporting – learn more

Bloomberg Tax’s advanced tax tools make your work less complicated. Access everything you need to build a winning tax strategy — with less stress.

With OneSource Tax Provision, time, accuracy, and efficiency are critical when it’s time for your corporate financial close.

With Corptax, we’re transforming tax through technology, business process expertise, and industry-best support.

Avalara Cloud-based sales tax calculation platform.

How do I choose the best tax technology solution for my business?

Different systems may be most beneficial to your business based on the industry, company size, and complexity of the organization. We have a proprietary software selection scoring system that your team completes during the software demos. It is configured to highlight your business requirements and the relative importance of each feature and function of the offerings.

How does tax technology integrate with other Process improvement finance & accounting systems?

Each of the systems shown above ( OneStream, Bloomberg,…) integrates with ERP and CPM systems like NetSuite, OneStream, SAP, and Oracle. Before implementing a tax technology solution, our team identif ies the source data for tax calculations in financial and other systems to optimize the sensitivity and connectivity for accurate and complete

reporting

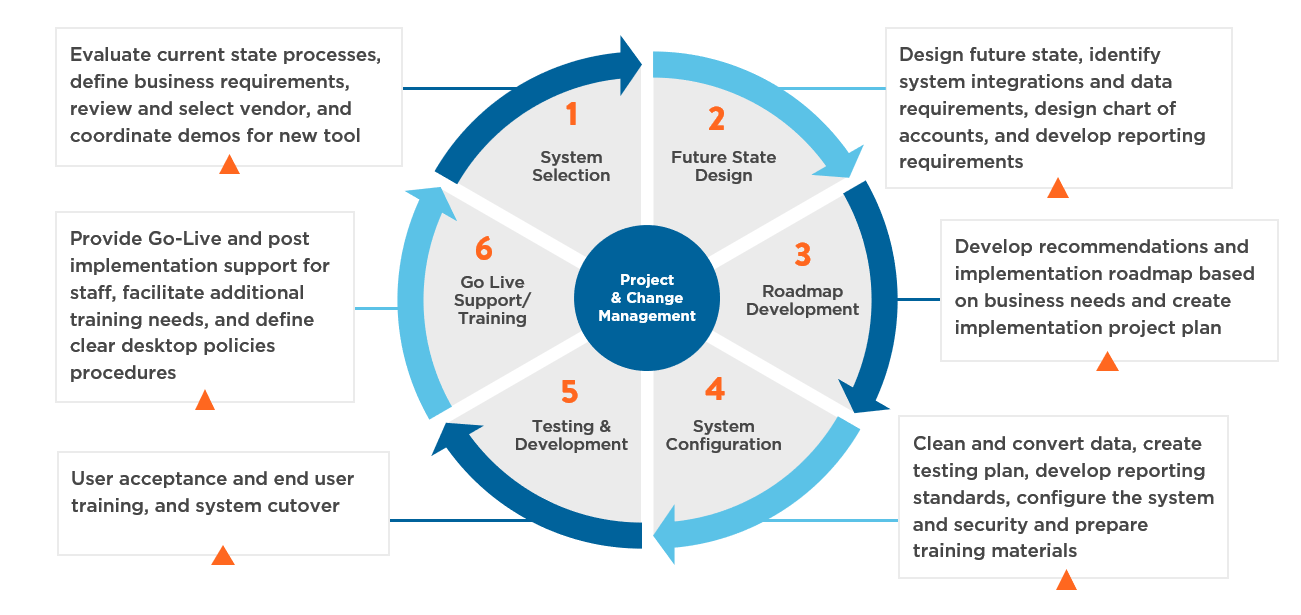

Riveron Approach

With a blend of public and industry tax accounting experience, Riveron identifies opportunities for efficiencies within a company’s tax department through process optimization and technology enhancements. We provide a comprehensive approach to navigating tax reporting by developing a streamlined process that will provide structure and mitigate inherent risk. With in-depth knowledge of both tax-specific and data analytics software, we help identify the best tools for each organization’s unique needs

If you’re ready to learn more about how Riveron can assist with your income tax accounting needs, consult with one of our tax experts today to learn more.