EU to Implement Minimum Tax Directive on Multinational Enterprises: Insights for CFOs and Corporate Tax Pros

As part of the OECD’s two-pillar plan to address global taxation in the digital economy, the EU has announced it will implement a global minimum tax rate of 15 percent on multinational enterprises with a parent company or subsidiary in the EU beginning in 2024.

Globalization and the exponential growth of the digital economy has resulted in multinational enterprises earning significant income from international consumers. In 2015, the G20 recognized that international tax laws presented challenges for ensuring multinational enterprises paid representative taxes in their physical jurisdiction and in the jurisdiction of their consumers.

CFOs and corporate tax professionals should monitor the OECD Pillar Two progress in the EU, especially in Member States where their organizations have a physical or digital presence.

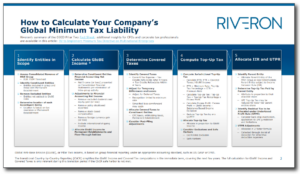

To learn more about calculating global minimum tax liability, download a related guide.

The G20 partnered with the Organization for Economic Cooperation and Development (OECD), a multinational body with 137 member countries, to form the G20/OECD Inclusive Framework on Base Erosion and Profit Shifting (BEPS), also known as the “Inclusive Framework.” In 2019, the Inclusive Framework issued its Policy Note addressing the tax challenges of the digitalization of the economy, a two-pillar proposal to address the resulting BEPS due to multinational enterprises exploiting gaps in international tax laws. At their core, Pillar One addresses the allocation of taxing rights and a fairer distribution of profits, and Pillar Two establishes a minimum tax base.

Pillar Two Implementation and Impact

In December 2022, the Council of the European Union (EU) reached an agreement to implement Pillar Two Model Rules by 2024. Through Pillar Two, the OECD expects to achieve an effective “global minimum tax” for multinational enterprises, which would be subject to Country-by-Country Reporting requirements established in Pillar One. The multinational enterprises subject to these requirements have consolidated revenue greater than €750 million and operate in the EU. The OECD estimates the revenue impact of implementing Pillar Two is expected to generate $220 billion in annual global revenue, approximately 9% of global corporate income tax revenue.

Pillar Two Rules

Pillar Two’s objective is to effectively implement a 15% effective tax rate globally to minimize the opportunity for tax planning and avoidance through operations in low-tax jurisdictions.

Note that corporations with losses in prior years are not exempt from Pillar Two rules. While losses do not create an exception, exemptions to the regulations are applicable for governmental, nonprofit, pension, investment, or real estate entities.

To achieve its Pillar Two goals, the OECD has created a framework to ensure compliance through targeted implementations of new rules.

- Income Inclusion Rule: The Income Inclusion Rule (IIR) targets multinational enterprises operating in low-tax jurisdictions, defined as a jurisdiction in which the statutory effective tax rate is less than 15 percent. The Income Inclusion Rule targets multinational enterprises that pay an effective tax rate that is less than 15% and requires a “top-up” tax, calculated as the difference between the newly imposed 15% rate and the statutorily enacted rate by jurisdiction. This top-up tax will apply to each low-tax jurisdiction in which the entity operates to ensure it is paying a minimum effective tax rate of 15 percent. The implementation of the IIR is determined at the discretion of the jurisdiction.

- Undertaxed Profit Rule: The Undertaxed Profit Rule (UTPR) serves as a backstop to ensure the minimum 15% tax is paid when the chain of ownership may result in an entity with low-tax income not being subjected to the IIR.

- Qualified Domestic Minimum Top-Up Tax: The Qualified Domestic Minimum Top-Up Tax (QDMTT) maintains the local jurisdiction’s right to impose its own top-up tax. In essence, this should ensure there will be a 15% minimum corporate tax rate globally. Currently, Hong Kong, Singapore, and Switzerland have enacted legislation implementing QDMTT.

- Subject to Tax Rule: The Subject to Tax Rule (STTR) provides a minimum nominal tax of 9% on certain intercompany transactions subject to a lower tax rate (i.e., interest, royalties). This rule is restricted to double tax treaties between developing and developed jurisdictions. This rule is likely to be implemented later than the other provisions.

Considerations for Implementing Pillar Two

In practice, multinational enterprises will need to identify key considerations under the OECD guidance to ensure compliance and appropriate implementation. These considerations will include:

- Determining entities and permanent establishments which would be considered subject to the newly imposed regulations by the OECD. Additionally, as the implementation is adopted at the jurisdictional level, the enterprise should understand each jurisdiction’s adoption process and timeline.

- Determining the Global Anti-Base Erosion (GLoBE) or Pillar Two income, which is based on group financial reporting under an appropriate accounting standard, such as US GAAP or IFRS. GloBE income also requires specific adjustments to this income, such as non-arm’s length transactions, stock-based compensation and dividends, or gains/losses that would be subject to a participation exemption.

- Calculating the jurisdictional effective income tax rate for all entities that operate in that jurisdiction. The basic consideration is taxes accrued which are directly attributable to profits as calculated in the tax provision.

- Calculating the top-up tax if the effective tax rate is less than 15 percent, and ultimately impose the top-up tax outlined in the IIR at the ultimate parent level.

The considerations outlined above are further detailed below:

The EU implementation of Pillar Two will require an increased focus on financial reporting across multinational enterprises. As the adoption of the OECD framework is determined at a jurisdictional level, additional complexities arise for entities working to plan for implementation.

Taking the Next Steps

EU Member States voted unanimously to adopt Pillar Two, with implementation to take effect for the fiscal year starting on or after December 31, 2023. It is expected that Pillar Two will be implemented on a rolling basis, with some jurisdictions leading and others following to benefit from adopting best practices and lessons earned.

CFOs and corporate tax professionals should monitor the Pillar Two progress in the EU, especially in Member States where their organizations have a physical or digital presence. In addition, engaging a knowledgeable tax advisory team can help companies navigate Pillar Two requirements and prepare for implementation in the EU and other jurisdictions as necessary.

How to calculate your company’s global minimum tax rate

Explore additional resources

CFOs and corporate tax professionals can learn more by accessing a high-level version of the Pillar Two rules with links to Fact Sheets that offer guidance in calculating a company’s global minimum tax liability. The European Commission has also published a Minimum Corporate Taxation page that includes a Q&A on this topic.