Contingent Consideration, Acquisitions, and Selling Shareholders: What Accounting Teams Should Know

CFOs and their accounting teams should understand factors that determine whether contingent consideration should be accounted for as compensation or additional purchase price.

With recent upswings in the market related to mergers and acquisitions (M&A), more companies are entering into business combinations and might not have deep experience with the complex accounting issues arising from these types of transactions. Specifically, accounting teams should understand several key aspects related to accounting for contingent consideration[1].

Commonly referred to as an earn-out, contingent consideration is a concession in the form of cash, shares, or other consideration that mitigates a key risk the buyer or seller is facing to get the deal to the finish line. For example, an earn-out provision could hold back a portion of purchase price until certain performance metrics are met. These provisions would be paid contingent upon the performance of the post-acquisition company.

When a deal involves contingent consideration, accounting teams will need to determine if those payments represent compensation expense in the post-combination period rather than purchase price. Depending on the results of that analysis, the accounting is substantially different.

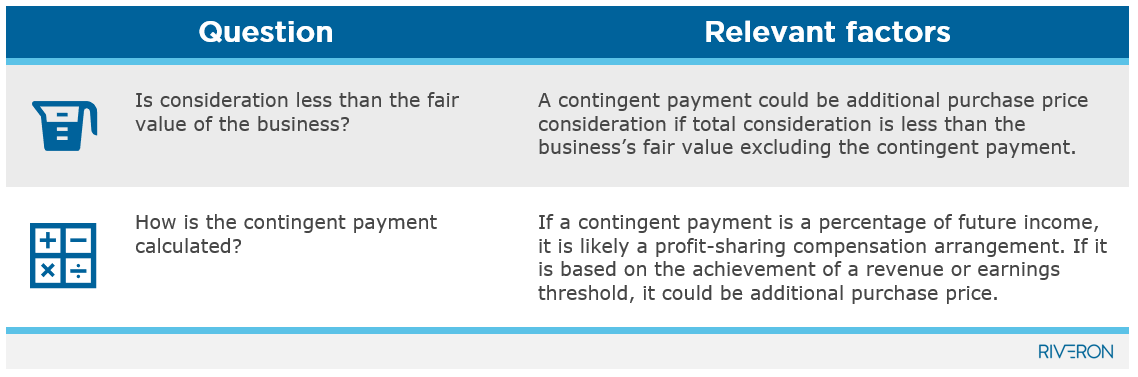

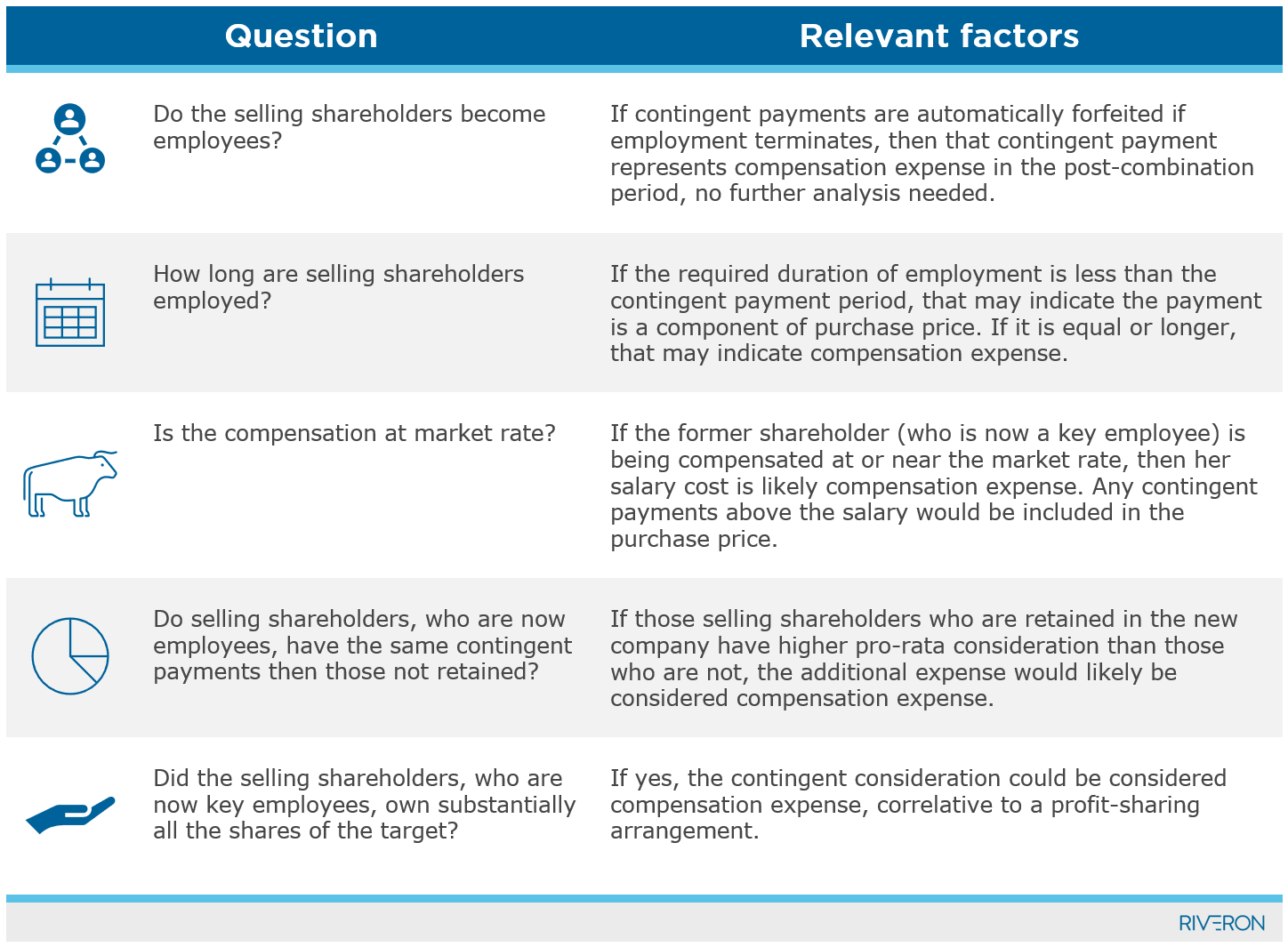

Key factors to understand and evaluate:

ASC 805 outlines several factors to evaluate, including continuing employment by selling shareholders and duration of such employment, levels of compensation for selling shareholders compared to other employees, incremental payments to employees, number of shares owned by selling shareholders, any linkage of consideration to valuation, and the formula for determining consideration.

Regarding the value of the business and payment calculations:

Source: FASB ASC 805 Business Combinations 55-24 to -25, “Arrangements for Contingent Payments to Employees or Shareholders”

Factors that involve selling shareholders or those becoming key employees, post-acquisition:

The nature of the relationship between the selling shareholders’ continued employment and the contingent consideration arrangement is a key accounting consideration. Understanding the implications of these arrangements will ensure appropriate financial reporting to stakeholders. The following factors should be carefully evaluated in the context of the transaction and the intent of future contingent payments. Accounting teams should weigh the facts and circumstances of each factor when choosing how to account for contingent payments.

Source: FASB ASC 805 Business Combinations 55-24 to -25, “Arrangements for Contingent Payments to Employees or Shareholders”

Companies should further review any additional contracts (e.g., non-compete contracts, consulting contracts, or property lease agreements) that include contingent payments because contract provisions are often critical in identifying the accounting impact.

How this guidance applies in an example acquisition scenario:

Company A is being acquired by Company B. All executives at Company A are shareholders of Company A and are becoming key employees of Company B. The acquisition has a one-year earn-out period contingent on hitting growth targets in revenue, and earn-outs are being paid out pro-rata based on the executives’ share of ownership percentages prior to the acquisition. To be eligible, executives joining from Company A must remain employed at Company B for at least one year.

In this example, all costs would be considered compensation expense in the periods after acquisitions. For an executive from Company A whose earn-out is tied to a performance target and requires continued employment at Company B, such payments would be considered compensation expense, even if the payments are described as an earn-out in the employment agreement. Typically, payments that require future service and would be forfeited by an employee’s termination should be considered compensation expense.

By contrast, if executives’ earn-outs had been deferred on the date of Company A’s acquisition and remained contingent on hitting earn-out targets—but would be paid without any requirement of continued employment at Company B—those payments would have been included as part of the purchase price.

With the recent increase in the volume of mergers and acquisitions, companies should understand when contingent consideration is accounted for as part of the purchase price versus compensation expense. Since most employees of an acquired business typically continue in their role after a transaction, this distinction can have a material impact. The nature of the contingent consideration impacts the accounting treatment and should be thoroughly analyzed for all business combinations.

[1] A forthcoming article will examine the current business combinations guidance and its impact on classification of a transaction as an asset acquisition or a business combination