Best Practices for Avoiding Integration Pitfalls

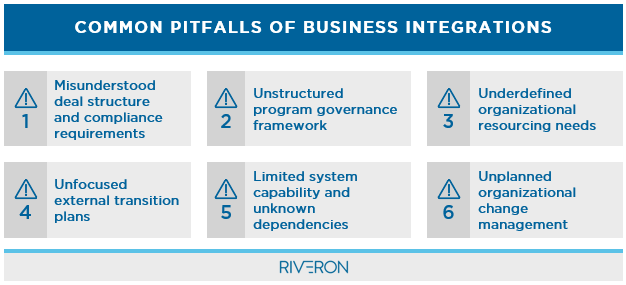

Deciding to acquire and integrate a new business can favorably position an organization for measured growth. During the pre-close planning phase, thoroughly assessing people, processes, and technology provides a foundation that allows the company to capture synergies and develop a roadmap for integration success upon deal close. Success requires navigating the financial and operational landscape to mitigate risks and avoid issues that can disrupt an otherwise promising acquisition. Here are six common integration pitfalls:

Using a growing manufacturing company integration as an example, here are some difficulties the company experienced during its integration with related best practices and ways to mitigate each scenario:

(1) Misunderstood deal structure and compliance requirements

Integration best practice: At any point of change—whether planning for a merger or the effective date of a new regulation—organizations should ensure ongoing adherence to regulatory and quality standard mandates by assessing, monitoring, and transitioning applicable certifications and compliance frameworks. Additionally, streamlined legal documentation and communication are essential for companies to ensure timely and uninterrupted interactions with vendors, ownership partners, and other impacted parties. Proactive transition practices—across all legal structure and compliance requirements—ensure a seamless shift between existing and future stages.

Example pitfall: Early in post-close execution, the legal entity name associated with the Federal Employer Identification Number (FEIN) of the company was changed but not broadly communicated to the operating teams. As a result, all previously completed and executed federal paperwork used for legal agreements with vendors, governing entities, and other ownership documents was incorrect. Without a confirmed legal name and FEIN number, business activity was directed to the legacy entity. This included critical vendors supporting employee payroll, who were unable to perform contracted activities and further delayed initial integration transition activities.

Additionally, industry credentials and standards such as ISO certifications can be critical for continued manufacturing operations. During the pre-close period, minimal time was dedicated to planning or executing an ISO transition from the legacy company to the new entity. At transaction close, ISO certifications for legacy manufacturing sites had expired, resulting in immediate non-compliance across certain required safety procedures and processes.

How to mitigate:

- Proactively identify functions with dependencies on entity structure (e.g., employee payroll, banking relationships, tax burdens, etc.), where changes in legal entity structure and naming conventions will cause an immediate disruption to any planned transition activities.

- Clearly define industry-specific legal, compliance, and regulatory requirements and ownership of these requirements during the pre-close planning phase.

- Ensure alignment across teams involved in developing purchase and transition service agreements and the teams creating pre- and post-close execution plans.

- Communicate deal structure and known contingencies, including transition service agreement support timelines, responsible party, and escalator fees, as well as any planned adjustments to the legal entity and reporting/ownership structure, and changes to go-forward naming conventions and associated tax registrations.

- Develop a detailed transition plan for compliance-related matters, including specific industry certifications, operating licenses, and other statutory reporting requirements. Once developed, communicate with regulatory and compliance vendors to ensure awareness of impending changes and allot enough time for upcoming audits.

(2) Unstructured program governance framework

Integration best practice: To remain aligned and true to the vision of the transaction, it is imperative to implement a centralized program management mechanism that drives process standards, centralized communications, and reduced overall disruption to the business.

Example pitfall: The manufacturing organization lacked formal post-close kick-off and planning meetings to fully establish the role of the Integration Management Office (IMO), responsibilities of functional workstream leadership, and key integration milestones. Post-close planning processes were completed ad hoc and not fully defined or assigned, with true ownership sign-off and alignment. Further complicating the process, during execution of planned integration activities, multiple lines of reporting and cross-functional dependencies (and agendas) created confusion as to who was responsible for certain activities, who needed to be informed of planned changes, and when specific transition activities needed to occur.

How to mitigate:

- Set post-close expectations and define responsibilities during the pre-close planning process or as part of the Day-1 activities and communication strategy.

- Leverage formal program kick-off meeting(s) and regular update meetings that include active leadership participation, defined meeting agendas, required attendance, and cross-functional input.

- Identify and communicate specific organizational roles and responsibilities (i.e., responsibilities assigned to the executive steering committee versus the workstream leadership versus the IMO) to drive accountability and to measure progress against defined activities.

(3) Underdefined organizational resourcing needs

Integration best practice: During an integration, the focus must be maintained on real-time assessments of resourcing requirements across each functional workstream. Even though pre-close resource planning activities may outline a post-close resourcing framework, standing up an independent organization may require additional headcount to truly operate as a standalone organization going forward. Also, when the activities included as part of the transition service agreement are transitioned to the new organization, it is imperative to assess the ability to support the end-to-end business processes through the current resourcing and headcount so that any gaps can be identified and filled.

Example pitfall: During diligence, the organization needs to assess current and future-state headcount requirements. As pre- and post-close planning commences, each functional area should measure business needs requiring adjustments to the current operating model (inclusive of headcount needs).

At the manufacturing organization, a limited end-to-end process analysis was conducted. Certain functional areas delayed the design for go-forward core processes and delayed the requirements-gathering process related to resource needs. As a result, the analysis repeatedly presented additions to functional workstream responsibilities and required incremental headcount additions throughout the post-close transition period. When additional processes transitioned from the legacy company support toward becoming the responsibility of the go-forward entity, it became clear that the current team did not have the bandwidth to handle the future-state processes.

The diligence and pre-close planning phases faced a major pitfall from the standpoint of failing to conduct a thorough employee population analysis; during these stages, a comprehensive review of employee work locations was not completed. Later, a post-close analysis revealed additional local, state, and cross-border tax registration requirements. This post-close understanding further delayed certain tax registration activities and created additional risk associated with accurate employee payroll withholdings and taxing liabilities.

How to mitigate:

- Clearly define and design future-state processes, with assigned responsibilities, to fill gaps previously satisfied by transition service agreement support and legacy company resources.

- Understand resource requirements associated with the of the go-forward entity. This should be based on the desired organizational structure and associated responsibilities and should clearly identify roles that will need to be transitioned, eliminated, or externally sourced.

- Outline the known geographic footprint of the go-forward employee population to fully scope and understand local, state, and international tax registration, compensation and benefits, and payroll processing requirements.

(4) Unfocused external transition plans

Integration best practice: Critical partnerships with customers and vendors should be carefully transitioned during integration activities to ensure revenue streams and vendor agreements are uninterrupted. Ongoing and transitioning relationships should face minimal impacts during this process.

Example pitfall: During defined integration processes, customer fulfillment and vendor awareness require significant coordination. The manufacturing company’s customer transition was delayed due to a lack of initial planning related to a system migration, which caused downstream delays in transitioning customers to a new desired platform for invoicing and order processing. This jeopardized the ability to seamlessly transition customers and independently fulfill orders for large-volume customers.

The manufacturing company’s vendor transition plan relied heavily on legacy company volume discounts and continued transition service agreement support (i.e., vendor management, payment, and other administrative activities). Overly reliant on legacy company support, the go-forward entity was ill-prepared to transition and independently support the ongoing vendor relationships deemed critical for the go-forward supply chain process.

How to mitigate:

- Define detailed customer transition plans for each key customer account, and coordinate with sales, operations, and finance to ensure a seamless transition and conversion of the desired customer base.

- Outline formal conversion timelines for capture of all required customer documentation and incorporation of updated information within each customer master record.

- Document key vendor terms and conditions, as well as timeline requirements to establish the go-forward entity with each vendor.

- Communicate changes to a defined set of customers and vendors to ensure awareness of timelines, new requirements, and any change or impact to existing service level agreements.

(5) Limited system capability and unknown dependencies

Integration best practice: In the diligence and pre-close planning phases, information technology assessments must be comprehensive and align with the investment thesis and future state resourcing requirements. Post-close, this will ensure that the outlined technology roadmap can support the short-term and long-term needs of the integrated organization.

Example pitfall: When integrating technologies, many disparate systems and business applications can be complex, and scope changes often further complicate the process. Across its infrastructure, hardware, and software applications, the manufacturing organization had a fragmented approach to IT diligence and planning, and it did not possess a holistic view of the IT environment, required integration points, and data dependencies. When additional applications were identified after initial go-forward decisions were made, the already defined IT transition plans had to be changed, which created rework and relied on inadequate existing technology to support ongoing business operations.

Further complicating the integration, several technology initiatives had to occur simultaneously to accommodate all required activities prior to any service agreement expiration dates. This included enterprise resource planning (ERP) system implementation, Active Directory migration, and network stand-up. As a result, ERP user acceptance testing had to be adjusted to ensure Active Directory set-up and network coverage, which would allow users to access software required for testing and system acceptance.

How to mitigate:

- Design and document an overall IT strategy, leveraging infrastructure, resource capability, and planned organizational growth.

- Incorporate IT strategy as part of planning activities to outline system dependencies, data elements to be integrated, and specific use cases for desired go-forward or end-state business applications.

- As part of the planning process, include specific target dates for infrastructure and application migrations activities to avoid conflict and resource constraints caused by other dependent integration requirements and network support needs.

- Document all business applications required to run the end-to-end business, from sales through operations, accounting, and reporting. Understand the use of each business application and determine if applications can be streamlined to simplify the IT roadmap and maintenance of systems.

- Compile current and expected future-state IT costs (inclusive of infrastructure, hardware, security, resource, consulting, and other elements) to support a robust future-state financial picture. This should appropriately guide decision-making processes, such as outsourcing certain technology capabilities or choosing an all-in-one solution versus implementing several fragmented systems.

(6) Unplanned organizational change management

Integration best practice: From diligence through post-close planning and execution, change management is a foundational element of a successful integration. Providing direction about processes, next steps, and eventual outcomes (even at a high level) is necessary. This ensures that all functions throughout the organization are prepared for each incremental change associated with the transition and allows for better understanding and ultimate adoption of changes.

Example pitfall: During pre- and post-close stages, when planning implementations for multiple business applications, details and eventual outcomes were only known to the individuals involved with the system design and configuration. This resulted in confusion throughout the transition period, with employees unaware of the systems in which future state processes would occur, when system access would become available, or how training would take place. A lack of ongoing and transparent communication created additional work, which meant desired future-state processes must be clarified in retrospect, plus there will be many incorrect assumptions or mistakes that needed to be addressed.

How to mitigate:

- Create a detailed communication plan that includes functional area, target audience, purpose, owner, status, and distribution medium.

- In conjunction with pre- and post-close planning, document communication milestones and monitor these milestones with the larger program to stay on track for execution. As a part of the IMO, define responsibilities related to communication throughout the transition based on the content and audience.

- With any anticipated or unanticipated changes to the pre- and post-close plans, issue proactive communications to target audiences to keep individuals updated on transition and next steps.

By following best practices and mitigating the six common integration pitfalls, companies can ensure a sound integration approach. A sound approach will align with the investment thesis, support the planned growth trajectory, and allow the go-forward organization to achieve business outcomes in its desired timeframe.