Finance and Accounting Strategies for Newly Acquired Companies

When acquired by a private equity fund, a new portfolio company can expect numerous changes, especially in its approach to the finance and accounting functions. Common struggles include the transition from cash to accrual accounting, relying too heavily on reviews to detect errors, and contending with new finance and accounting technologies. By understanding and addressing these common challenges, a portfolio company’s team can be better equipped to operate and grow.

COMMON CHALLENGE #1

Underestimating the transition from cash to accrual accounting

Prior to an acquisition by a private equity firm, many organizations use the cash basis for internal and external reporting. Converting to US GAAP often creates challenges for many of these organizations – one of the most significant being recording revenue and expenses in the proper period.

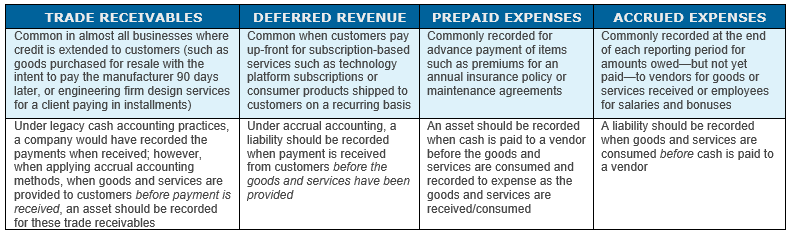

Generally, under accrual accounting, revenue should be recognized as goods and services are provided to customers, and expenses should be recognized when goods and services are used. As such, revenue and expenses often need to be recognized in a period other than one in which a cash exchange occurs. Some frequently encountered examples for companies undergoing this change include trade receivables, deferred revenue, prepaid expenses, and more.

These examples capture some of the required changes but do not tell the entire story. Often, when companies first switch from cash accounting to accrual accounting, some may try—with varying levels of frustration—to continue to use previous processes and methods. For example, companies might use Excel, which can be cumbersome and highly manual, or the team realizes it must abandon the software systems that do not integrate well with the reporting methods preferred by the private equity firm. A change in accounting basis is complex and requires a thorough analysis of current processes, gaps, and solutions.

A portfolio company’s accounting departments often lack resources or may be unaccustomed to sophisticated reporting systems that can manage the conversion to accrual accounting. In such cases, starting with a thorough analysis of the current state reporting process. An effective approach includes understanding which financial statement line items and ledger accounts are impacted and the processes associated with those line items and accounts. From the assessment, pain points and changes can be specifically identified and implemented for the move to accrual accounting.

A key step to a successful transition is using a dedicated project team, with a requisite knowledge of differences between cash and accrual accounting, to lead a thorough assessment and initiate new processes.

COMMON CHALLENGE # 2

Relying solely on financial reviews to detect errors

Although some basic internal controls or similar processes are usually in place, many organizations rely heavily or exclusively on financial statement reviews to detect potential errors and prevent misstatements in their financial results. These reviews may compare actual results to prior periods, or they may compare actual results for forecasted, or budgeted, results.

Overreliance on high-level financial statement reviews carries a risk that important issues may go undetected due to offsetting or immaterial variances. While often necessary for a robust internal control environment, financial statement reviews are usually not sufficient unless used in conjunction with other processes and controls. To shore up the financial reporting process to ensure timely and accurate reporting, the following changes should be considered for implementation:

- Monthly balance sheet reconciliation: Balance sheet accounts should be reviewed at least quarterly, and high-risk balance sheet accounts should be reviewed monthly. A balance sheet account may be high-risk for various reasons, including both quantitative and qualitative factors. Balance sheet reconciliations should be completed timely and include sufficient documentation of balances, transactions, and reconciling items. All balance sheet account reconciliations should include proper segregation of duties – a preparer and appropriate level reviewer.

- Review and approval of material and non-recurring journal entries: Any non-recurring journal entries should be flagged and included in a monthly review by appropriately assigned reviewers – reviewers should ensure the journal entries include sufficient documentation and support to justify the entry. A materiality threshold for journal entry (“JE”) approval should be established. JE approval processes are often put in place within a company’s enterprise resource planning system (ERP), but a separate materiality threshold should be created. For example, a company that posts non-automated JEs could implement a materiality threshold for any entries to cash or accounts payable over $10,000 to be reviewed by the controller or CFO. This review will ensure entries above the organization’s defined materiality level are subsequently reviewed by a designated higher-level approver.

- Review and approval of accounting treatment of vendor invoices: Certain vendor invoices should be flagged for accounting treatment review prior to posting any entries. Consider implementing a process with the accounts payable team to flag invoices for accounting review. For example, a vendor invoice for computer software should be reviewed to determine the proper timing of recognizing the expense.

- Comprehensive month-end checklist of key activities: A finance function with strong controls will create a comprehensive checklist of monthly activities from the beginning of the month until the last day of close. The checklist should aim to identify all activities, inter-dependencies, preparers, reviewers, and due dates. Adherence to the month-end checklist will ensure all activities are completed, identify any potential bottlenecks in the process, and that the monthly close results in timely and accurate financial statements.

COMMON CHALLENGE # 3

Leveraging and adapting technology for scalable financial reporting

One of the main changes a company can expect post-acquisition is increased demand for detailed, accurate, and timely financial information. This demand includes increased pressure to close the books each month in a timely manner and to dissect and analyze financial data, which can be especially challenging for companies accustomed to extended or unformalized close timelines and steady-state reporting with predictable questions. To equip accounting and finance teams to quickly address the increased post-acquisition needs, management should evaluate the following considerations:

- Which current manual processes add time or unnecessary complexity to the close process? Can those manual processes be automated? Manual processes generally drive added time and/or unnecessary complexity in the close process and, in many cases, can be streamlined or eliminated via automation of these tasks. Common examples include the reconciliation of data loaded from ERPs to consolidation system and account reconciliations. Both can be streamlined via automation to allow teams to limit manual tasks, shorten the close timeline, and provide teams a greater ability to timely analyze results.

- Does the current suite of financial systems allow the finance and accounting function to meet expanded and accelerated reporting requirements? Upon acquisition, management should quickly act to determine if the current systems have sufficient functionality to support the enhanced reporting needs. A common pitfall is that companies are not able to quickly respond to new financial requests due to time-consuming manual work needed drill-in to results in instances where consolidation systems do not house transactional data and such data is not separately consolidated in a location such as a data warehouse.

- If the company plans to implement a new or upgraded ERP or financial reporting system, what level of training and change management is needed? User-training and change management are paramount to ensure users are prepared to use a new system on Day 1. Often, new portfolio companies will implement a financial system without considering the amount of training and change management that is needed to achieve the expected level of efficiency and optimization. The result, in many cases, will be users who do not fully adopt and realize the expected benefits from the new system, and those users will often regress back to using more time-consuming, manual workarounds. Such inefficiencies detract from the desired benefits of a new systems.

Accounting and finance teams can improve and streamline the transition to becoming a private equity portfolio company by understanding the conversion to accrual accounting, enhanced reporting processes, and implementing or adapting technology to enable these improvements. Modernizing the approaches can pave the way for companies to achieve the intended growth and scalability often desired when transitioning to private equity-backed operations.