Equity Capital Markets Advisory

Our Equity Capital Markets Advisory practice draws upon years of Wall Street and Big 4 leadership, providing you with services that are unparalleled in their excellence.

Our strong relationships with Wall Street and top audit firms stand us apart, allowing us to offer expert advice in capital markets, investor relations, FP&A, and audit readiness. We are advisors to C-Suite executives and boards, and our seamlessly integrated project management is executed by a team of experts who have steered hundreds of innovative companies through their IPO journey.

Come, partner with Riveron, to take your business to new heights with guidance and expertise that is unmatched. Welcome to a simplified, seamless, and successful path to going public.

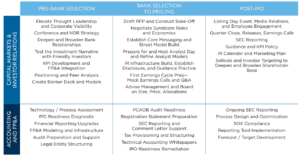

How we help

Riveron’s Capital Markets Experience

Capital Markets & Banking

Bulge bracket equity capital markets and sales, investment banking, and ECM advisory

Institutional Portfolio Management

Portfolio managers, directors of research, Chief Investment Officers

Investor Relations & ESG

Chairman of the Board of the National Investor Relators Institute (NIRI) & Industry leading ESG practice

Audit & Accounting

Former Big 4 executive leader advising throughout the IPO process

Financial Planning & Analysis

Heads of Corporate FP&A for large public companies

Why Riveron?

- We provide a seamless, integrated approach throughout the IPO journey

- Our ECM Advisory & Investor Relations fees are success-based and reimbursable to you from the bank syndicate

- We are your long-term partner— serving the Office of the CFO— before, during, and after your most important transactions

No Executive Leaders or Managing Directors matched your search.

Related Insights

Insights

Contemplating an IPO in the Next 12-15 Months? An Important Wall Street Conference Season is Here

CEOs and CFOs eyeing an IPO in the coming months must prioritize engagement with public investors and market influencers, utilizing conferences as key opportunities to refine their narrative and gauge investor sentiment.

Insights

The Critical Role of Accounting and Finance When Preparing for an IPO

An IPO journey involves significant effort, and anticipating six key accounting and finance challenges can empower an IPO-track company to succeed on the path to going public.

Insights

Gearing Up for an IPO? Make ESG Part of the Equation

ESG programs play a crucial role in determining IPO success. Get the details for assessing your ESG readiness before going public.

Insights

Readying for Success as the Public Offering Market Warms Up

Companies considering an initial public offering (IPO) will need to properly prepare in order to take advantage of ideal timing based on market conditions.