The Critical Role of Accounting and Finance When Preparing for an IPO

An IPO journey involves significant effort, and anticipating six key accounting and finance challenges can empower an IPO-track company to succeed on the path to going public.

An initial public offering (IPO) is one of the most significant challenges in a company’s evolution. It’s also an exceptional opportunity to transform and elevate a business while creating a monetization event for investors. While an exciting prospect, the IPO process can cause new stringent requirements resulting in the need for additional finance and accounting efforts and specialized knowledge. The path to becoming a public company can take several months, during which key challenges can arise, from navigating the timeliness of the audit to issuing SEC-compliant financial statements. By anticipating these challenges, accounting and finance professionals will be empowered to navigate the IPO journey on schedule and with confidence.

IPO readiness: What’s required before ringing the bell

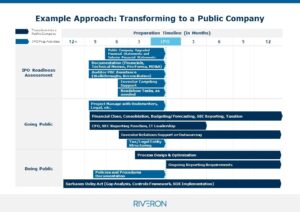

As companies consider taking the monumental step toward going public, accounting and finance professionals play a critical role, working collaboratively with cross-functional teams and external advisors to ensure success. A sound approach, as depicted below, typically begins with a readiness assessment.

A Prepared Approach to IPO Success

From a finance and accounting perspective, an IPO readiness assessment can examine a company’s financial reporting capabilities, accounting processes, controls, and other key factors.

An effective assessment of financial reporting capabilities might include reviewing relevant accounting standards; reviewing the controls framework and existing gaps; exploring a company’s current business intelligence and management’s related future vision; anticipating tax provisioning and new tax-related processes such as the transition to a C-corp; and determining whether financial reporting practices are SEC-compliant and which new financial reports (e.g. public quarterly reporting) will need to be created.

During this stage, IPO-track companies can also assess corporate accounting processes (e.g., financial close, accruals, etc.) and matters related to financial operations (e.g., order-to-cash processes, quarterly reporting by jurisdiction and entity, etc.), audit readiness measures, and other elements under the purview of the Office of the CFO.

IPO timing considerations

A thorough IPO readiness assessment can help develop a tailored plan for taking a company public, and it’s best to get started 12-18 months before the intended IPO event. Even with a comprehensive plan in place, accounting and finance leaders should remain aware of potential obstacles that can cause delays or other barriers to IPO success. Achieving a company’s target filing timeline is almost always the most critical consideration in the IPO process and hinges on a number of parties – legal, ops, tax, accounting – to collaborate to meet the intended timeline. While the audit of the financial statements may seem like a given as companies speed toward that timeline, coordination with the company’s auditor to produce SEC-ready financial statements can be one of most challenging facets of the process. IPO-track companies need to be mindful that effective coordination with a high-quality, independent audit firm can make or break intended timelines.

Six challenging points on the path to an IPO

The US Securities and Exchange Commission has specific requirements for companies planning to go public via an IPO. In practice, six key areas often add complexity to the IPO process, and accounting and finance teams should be aware of these areas to prepare for the incremental work and expertise required.

1. Completing auditor independence procedures in a timely manner

The audit cycle is highly impactful to accounting and finance teams, and audits can become much more complex surrounding an IPO event. Most private company accounting teams will already be familiar with typical aspects of the audit cycle, in which an AICPA-compliant external auditor will audit a company’s financial statements and footnotes to ensure everything is accurate and complies with relevant tax or labor laws or industry-specific guidelines. During an IPO journey, a company must undergo an audit aligned with the requirements of the Public Company Accounting Oversight Board (PCAOB). At a recent conference, the PCAOB stressed the importance of enforcing audit quality. And, an IPO-related audit involves a greater degree of regulatory oversight, breadth, and rigor compared to the audits of private companies, with the goal of safeguarding stakeholders and ensuring financial transparency.

As audit preparedness measures are an essential part of IPO success, a timely audit process hinges upon the team’s ability to proactively navigate auditor independence. Auditor independence is not the responsibility of management, as it entirely falls to the audit firm. But, when management notifies external auditors of the plan to go public, auditors must adhere to a new standard of independence and cannot perform any audit or review procedures without having their PCAOB level independence verified by their national compliance office. In the best-case scenario, these independence procedures only take a few weeks for the auditors to complete. In a worst-case scenario, the verification process can be quite lengthy, and in some instances, identified independence issues by the audit firm may require the company to switch auditors and have new audits completed over one or more annual periods, which could span months.

For example, consider a company that has a significant joint venture that is planning to go public, and that joint venture is audited by a smaller regional firm that is different than the auditor of the IPO-track company. When a joint venture is significant to the results of the IPO-track company, the company’s auditor will not only have to consider its own independence, but also the independence of the auditor of the joint venture. This may include determining the scope of non-audit services that have been provided by the audit firm, such as preparing parts of the financial statements. Discovery of these issues can require a change to the audit plan that may require incremental procedures, and if these audit-related issues are not identified by the parties involved in a timely manner, it will create delays in the IPO filing.

Another example could involve an IPO-track company with international subsidiaries that have historically allowed the subsidiaries’ finance teams to operate in a fairly autonomous manner. These teams may contract with local firm affiliates of the audit firm to provide non-audit services, such as tax provision preparation. While these services may not be material to the overall financial statements, a lag in identifying these relationships could create issues for the audit firm’s compliance with independence standards which could delay the company’s IPO filing as a result. While these scenarios may seem remote and more of problem for auditors, companies should be mindful that anything that impacts the audit will trickledown, impacting the company’s overall planned IPO timing.

Auditor independence can often cause significant delays in the planned timing of an IPO if not prepared for in advance.

2. Preparing SEC-compliant financial statements

Similar to the uplift in auditor independence, there are more robust disclosure requirements for management to prepare and a higher degree of audit procedures required by the PCAOB. The introduction of new concepts can be complicated and unfamiliar for teams that have historically operated at privately held companies. Accounting and finance professionals anticipating an IPO will need to become well-versed in matters such as:

- Segments – Companies preparing for an IPO will be required to present financial information under ASC 280, Segments which requires identifying operating segments based on how a company’s chief operating decision maker views the business and allocates resources. Financial information for each segment, such as revenues, profits/losses, and assets should be disclosed.

- Earnings per share (EPS) – EPS is a critical new metric for companies going public and one that will carry significant weight for investors. Companies will need to calculate historic basic and diluted EPS as well as pro forma EPS. Companies will need to understand their current share structure as well as any potentially dilutive securities that could result in additional common shares such as warrants, convertible debt, preferred equity instruments, share-based awards, and other equity contracts.

- Pro forma disclosures – For significant acquisitions, companies will be required to disclose pro forma financial information to reflect the impact of the acquisition on the financial figures as if the acquisition had happened at the beginning of the year. This will drive additional revenue and income disclosures that could require incremental effort surrounding the historical income statements of acquired companies as well as an understanding of the required adjustments within the financial statements.

- Enhanced revenue recognition disclosure – ASC 606 provides several practical expedients for private companies that are not permitted for public companies, such as election to not disclose disaggregated revenue, select contract balance information, contract costs, remaining performance obligations, or some significant judgments.

- Additional considerations – Any previously elected private company alternatives must be reversed and recorded under the applicable accounting standard as if the alternative was not previously elected. For example, amortization of goodwill is only permitted for private companies, and there is a different accounting treatment for variable interest entities (VIEs). The incremental PCAOB procedures could also result in additional selections for previously tested accounts, new testing of accounts previously deemed immaterial, or additional consultations on concepts that were previously audited and received a sign-off. Internal controls also face greater scrutiny as companies prepare to go public and will need to comply with Sarbanes-Oxley regulations.

Ultimately, management should ensure the company has the bandwidth and expertise to accommodate public company disclosure requirements and incremental demands — or engage external or interim support.

3. Communicating company performance via the MD&A

Management’s discussion and analysis (MD&A) is an additional section within an SEC filing that focuses on the key drivers of changes in a company’s performance over the prior period, such as changes in operating and cash flow results as well as key risks, trends, and liquidity. While there are requirements and rules surrounding MD&A, it serves as an opportunity to discuss the business, risks, and results from management’s point of view highlighting what a company does well and why.

Discussing potential risks to the business, the respective impact, and how management plans to mitigate these risks will provide investors with useful information to make an informed decision. Management should also be aware that the discussion of key drivers must provide sufficient information for a reader to truly understand the reasons for a change. This will often require management to disclose some degree of confidential information, such as units sold, changes to the sales price, quantitative impacts of inflation to costs, or similar data.

It is important to have a plan for the degree of specificity on quantitative disclosures required and to work through those disclosures with accountants, advisors, and legal counsel.

4. Disclosing other financial statements, if applicable

Based on Regulation S-X for Annual Financial Reporting, the SEC may require additional financial statements to be disclosed depending on the timing of an IPO or other circumstances such as acquisitions. Below are various types of financial statements that might be required during a company’s IPO journey.

- Interim financial statements – For filers in the United States, interim financial statements will be required to the extent a company’s filing extends beyond 135 days from the close of the last quarter. For example, if a company will go effective based on a registration statement filed on August 20, the registrant would be required to include the six months ended June 30 for the current year and the corresponding comparative period. Management will need to carefully consider areas that might require attention to get quarterly financial statements to properly reflect proper GAAP balances.Examples include year-end audit and management adjustments that impact quarterly periods as well as valuations that will be required each reporting period but have historically been prepared annually. Further, these statements will require review by the external auditor for sign-off and inclusion within the registration statement.

- S-X 3-05 or 3-09 financial statements – To the extent management has made a recent material acquisition, a series of immaterial acquisitions that are material in the aggregate, a material proposed acquisition, or has a material equity method investment, additional standalone financial statements may be required.The materiality of those acquisitions or equity method investments will determine if the annual and interim statements are required and whether a comparative period may also be required. To return the most material result, the acquisitions or equity method investments will need to be evaluated based on income, investment, and asset tests.

By ensuring these material acquisitions have an audit or a review performed in advance of the registration statement, companies will significantly reduce the incremental work being done in parallel with the IPO.

5. Presenting pro forma financial information to ensure comparability

Article 11 pro forma financial information is designed to show the financial position of the new company as if the IPO and any other transactions had occurred on the latest balance sheet date, and, for purposes of the statement of operations, as if the IPO and other transactions had occurred at the beginning of the earliest period presented (i.e., the latest annual and any interim period required).

While not required for every IPO, Article 11 pro forma financial information is often required and always required along with 3-05 financial statements noted above. This can often lead to additional valuation and tax-related efforts during the filing process.

It is uncommon for private companies to compile Article 11 pro forma statements, so it can help to seek the guidance of an experienced advisor to provide specialized support.

6. Navigating non-GAAP measures according to Regulation G

While many companies already prepare non-GAAP measures for debt reporting, management reporting, or to drive bonus calculations, non-GAAP measures for an IPO are subject to Regulation G, which provides specific criteria for what is permissible, and this will likely drive adjustments to how management is currently calculating its non-GAAP measures for areas such as EBITDA, adjusted EBITDA, adjusted gross profit, free cash flow, and others.

Management will need to carefully consider the adjustments, whether they are permissible under Regulation G, how that might affect their disclosure and, in turn, impact how investors view their business.

Position your IPO for success

Part of positioning for success includes understanding required pre-IPO legal structure changes as well as choosing the most advantageous IPO entity vehicle. Changes to the existing organizational structure (such as carve-outs, mergers, and liquidations) could result in unanticipated tax consequences and liabilities. Further, entity classification changes in advance of an IPO, i.e., converting from a partnership to a corporation or to an umbrella partnership C corporation (Up-C) structure, may introduce new required tax provisioning processes and controls.

While some IPO-track companies have the expertise and capacity to navigate the IPO process efficiently and effectively, most will require additional support from strategic advisors including accounting, tax, audit, and IPO experts alongside legal counsel and investor relations professionals.

Tapping into third-party expertise can alleviate the burden of compiling the registration statement, SEC reporting, technical accounting matters, and interactions with the SEC during the comment letter process. In addition, this collaborative approach enables management to focus on the strategic aspects of the business such as improving financial close processes and operations—and driving growth.