Navigating Net Working Capital in Mergers and Acquisitions: Key Considerations for Deal Success

In the M&A lifecycle, buyers and sellers often overlook important nuances related to net working capital and wait until the end to negotiate one of the key components of operating a business. Here are related considerations for avoiding common pitfalls and guiding deal success.

Net working capital (NWC) is often a gray area for sellers when preparing for a transaction process, while buyers are trying to analyze and capture a clear picture of the resources required to operate the business post-transaction.

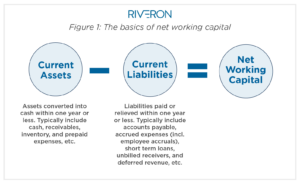

NWC refers to the difference between a company’s current assets and its current liabilities on its balance sheet (Refer to Figure 1 below). It is a measure of a company’s liquidity and, along with certain metrics, an indication of the company’s ability to manage its use of cash.

In the context of mergers and acquisitions (M&A), NWC is often misunderstood, and the underlying methodology and calculations may have an impact on the ultimate purchase price. Because of this, understanding all aspects of NWC is critical. Typically, deal terms are on a cash-free and debt-free basis (i.e., all unrestricted cash and outstanding third-party debt to finance the business at close remains with the seller). Additionally, an adjustment mechanism is included in order to set an agreed-upon method between buyer and seller for calculating a purchase price adjustment (i.e.., dollar-for-dollar increase or decrease to the purchase price), if needed, based on a worded definition, an exhibit of historical average NWC, or a collar setting a floor and a ceiling that NWC will fall within at close. An adjustment mechanism is typically used in US-based transactions, whereas European deals favor a lock-box method with funds held until closing NWC has been concluded. Depending upon the transaction structure, several factors must be considered to position the company or asset for a transaction.

Important factors for transaction success might include industry (examples provided in more detail below), company history, customer or vendor arrangements, accounting policies, and more.

It is important to consider a company’s historical NWC trends and the effect of seasonality, acquisitions, divestitures, or growth on NWC. For example, seasonality related to a retail business would result in different impacts depending on when the transaction is expected to close. Since retail businesses typically experience an increase in consumer purchasing during the winter holidays, NWC (specifically inventory levels) would be expected to peak in anticipation of this period, with lower NWC levels following the winter holiday season. Similarly, if a manufacturing company recently completed an acquisition, NWC considerations would need to be analyzed for increased inventory levels, including any new product SKUs and related impacts and vendor or customer arrangements taken over.

Accounting policies play a factor in many regards for purposes of accuracy and consistency in reporting. For example, when minimum commitments, absorption costing policies, restricted cash arrangements, factoring of accounts receivable (A/R), bad debt or inventory reserves, payroll accruals, and deferred revenue need to be considered for purposes of appropriate methodology and comparability in trends. For instance, if a company has historically capitalized labor but not overhead into inventory but is being acquired by a company that capitalizes both labor and overhead in line with US generally accepted accounting principles (GAAP), such as utilities, rent, repairs, and maintenance, etc., then analysis should be performed to understand the implications of these costs being directly expensed to the profit and loss (P&L) as period costs rather than being absorbed and recognized as expense using the matching principle in accordance with GAAP.

An adequate level of working capital impacts continuing operations post-close

In a typical transaction, the investor seeks to purchase a business with an adequate level of working capital on Day 1 so the company can seamlessly continue its normal operations following the acquisition close. It is important that the business has enough working capital at the closing date, or it may otherwise struggle to pay its bills, submit new orders to suppliers, and pay employees without an additional infusion of equity capital from the recent acquirer. For example, upon the closing of an acquisition for a convenience store, a buyer expects the store shelves and refrigerators to be stocked with a normal level of products rather than be left with the burden to inject additional cash into the business to purchase inventory Day-1. A properly set working capital target and adjustment mechanism ensures the buyer will not bear this burden.

To achieve this, buyers focus on the quality of the working capital, placing more scrutiny on the composition of the working capital components and the underlying assets and liabilities to be delivered. Quality assessments typically analyze accounts receivable, inventory, and accounts payable profiles (aging, concentration, etc.), and cash conversion metrics (e.g., days sales outstanding, days inventory on-hand, and days payables outstanding). Additionally, adjusted net working capital as a percentage of trailing revenue can be used as a comparative performance metric within industries (e.g., construction companies) with respect to its typical accruals impacting net working capital calculations (cost vs. billings in excess or deferred revenue as a percentage of trailing annual revenue, accrued payroll days, etc.).

Buyers, sellers, and advisors have paid increased attention to net working capital — particularly as companies have struggled with supply chain disruptions and inventory management issues.

Recently, buyers, sellers, and advisors have paid increased attention to net working capital — particularly as companies have struggled with supply chain disruptions, AR collections, payroll funding, and inventory management issues stemming from the COVID-19 pandemic. Further, companies are realizing growth levels in operations while navigating the revenue (e.g., project deferment) and vendor (e.g., overseas shipment lead times or labor constraints/outsourcing needs) backlog build-up that occurred across many industries. Inflation costs and commodity price fluctuations have also impacted materials purchases and changes related to labor sourcing (internal vs. subcontract services). These impacts need to be analyzed for normalized levels of NWC, with buyers increasingly placing more scrutiny and consideration around NWC due diligence — while sellers should be using the most recent information available to better position themselves for a transaction process by understanding the true cash conversion of the business.

In typical transactions, buyers and sellers negotiate a net working capital target, or “peg,” which is the amount of net working capital that the seller has contractually agreed to deliver at the time the transaction closes. When closing (or final) NWC at the acquisition date is different from the target level, an adjustment to the purchase price is made. Closing NWC above the NWC target results in additional cash required at closing for a buyer to compensate the seller for an over-delivery, and the inverse also typically applies in an under-delivery scenario.

Considerations by industry

On an industry basis, below are some key NWC considerations to evaluate:

Construction: This industry often involves specific accounting in accordance with GAAP regarding revenue recognition, capturing billings in excess of costs and costs in excess of billings on the balance sheet. Buyers and sellers should place careful consideration around NWC related to these accounts with an emphasis on understanding the accuracy and consistency of historical project margin estimations, expected margins on incomplete projects, and any project-loss considerations. Further, the level of inventory that is required and costed to a specific project can vary depending on the type of work being performed, the nature of on-hand or drop-shipped materials, and sourcing arrangements. Companies that can effectively track their project costs incurred (materials, labor, and overhead) while managing their inventory levels and consistent customer billing practices will typically have lower and more reliable NWC requirements.

Healthcare: In the healthcare industry, accounts receivable is an important NWC consideration. Many healthcare companies operate on a cash basis, and receivable balances within their electronic medical records systems are often stated at their gross rates rather than their contractual net rates with payers. Significant analysis is often required to rebuild accrual receivable balances over a historical period. Even companies that use accrual accounting often make significant assumptions around contractual allowances, which are used to net gross receivables down to their expected reimbursable amounts. In these instances, care must be taken to understand and validate assumptions used in developing contractual allowances and the processes to update those assumptions timely. Furthermore, unapplied cash can be an issue, and if companies aren’t diligent in ensuring all cash receipts are applied to claims timely, it can result in confusion about what A/R is or isn’t outstanding and what funds may be potentially refundable. Finally, an investor may want to better understand the composition of A/R, in particular, its breakdown by payor, whether a government (Medicare or Medicaid) or private group (Blue Cross Blue Shield, United Healthcare, etc.), since those groups dictate the speed and amount of reimbursements.

Manufacturing: In the manufacturing industry, both inventory management and cost accounting are crucial factors to consider when evaluating NWC. While the level of inventory required can vary depending on the type of product being manufactured and the demand for that product, there are notable accounting impacts related to the absorption of labor and overhead into inventory, the impact of FIFO, LIFO, and weighted average costing, and variances due to purchase price or production variances. Significant impacts can arise due to the risk of unknown errors and the inaccuracy of data tracking that can influence a company’s financial statements. A company can become a more attractive acquisition target if it can both efficiently manage its inventory levels and accurately track costs on a per-unit basis without the manipulation of earnings.

Professional Services: For companies focused on professional services, the key NWC considerations are typically related to accounts receivable, both billed and unbilled, and accounts payable. Service companies typically have a lower level of inventory, which means that their NWC requirement is more heavily weighted toward cash flow management. Additionally, while margins are often high in professional services, cash conversion is typically impacted by employees being paid much faster (bi-weekly) than invoices are issued (milestone, monthly, or end of service) or collected from customers. This presents a continual need to fund payroll and payables from past gross profit or possibly debt.

Retail: For companies in the retail industry, inventory and accounts payable are critical components of NWC. Retailers typically have a large number of customers, which can result in a high level of inventory with a focus on the seasonal drivers discussed above. Consistent with inventory planning, retailers often negotiate favorable payment terms with suppliers, which can result in a fluctuating level of accounts payable throughout the year. Furthermore, outside of seasonality, retailers face the challenge of managing inventory mix and obsolescence (i.e., inventory levels managed are impacted by understanding which products to stock and how to move or liquidate existing slow-moving inventory), in addition to ensuring that an adequate reserve is recorded.

Software & Technology: The software-as-a-service (SaaS) industry is characterized by rapid innovation and short product life cycles. Depending on the revenue model, revenue related to subscription-based service models is typically analyzed by annual or monthly recurring revenue (ARR or MRR). Additionally, the collections of SaaS companies almost always precede revenue recognition on a net basis, creating a need to analyze the deferred balance in conjunction with the PL and revenue trends (MRR and ARR) as part of the overall investment thesis. Further, SaaS companies can often have negative NWC, which can indicate both healthy operations and complexity in agreeing to target levels. A cost-of-service consideration is typically analyzed in these transactions due to the cash received in advance of providing the services to determine an NWC versus indebtedness treatment. As a separate consideration, technology companies often have significant investments in research and development, which can increase their level of intangible assets with consideration in the transaction structure on how to value capital spend.

Net working capital negotiations play a critical role in the M&A landscape and can have a significant impact on the success of a deal. Buyers and sellers should carefully consider their NWC requirements and negotiate in good faith to ensure a successful transaction.