Modern Finance: Maximizing Operations at Newly Public Companies and SPACs

Preparing to be a public company—whether through a SPAC or other type of initial public offering—requires holistic operational readiness spanning areas such as core accounting and financial reporting, business insight, corporate governance, and internal audit/controls. Applying the six interconnected principles of modern finance can help companies to assess and build operational readiness, prepare for a smooth IPO filing compliance, and accelerate a post-IPO standup process. A successful transaction tackles short-term requirements while supporting scalability needs and the long-term vision for operating as a public company.

When planning to take a company public, chief financial officers (CFOs) and other finance and accounting leaders often need guidance in determining the effort, associated investments, and tradeoffs involved the with various avenues to meet the requirements of internal stakeholders and external regulators such as the Securities and Exchange Commission (SEC). Adequate guidance needs to be obtained up front, before the filing date and SEC compliance time frames, which typically loom three to four quarters ahead. To achieve operational readiness and guide necessary changes, company leaders also need to be prepared by understanding and shaping their teams’ appetite for change.

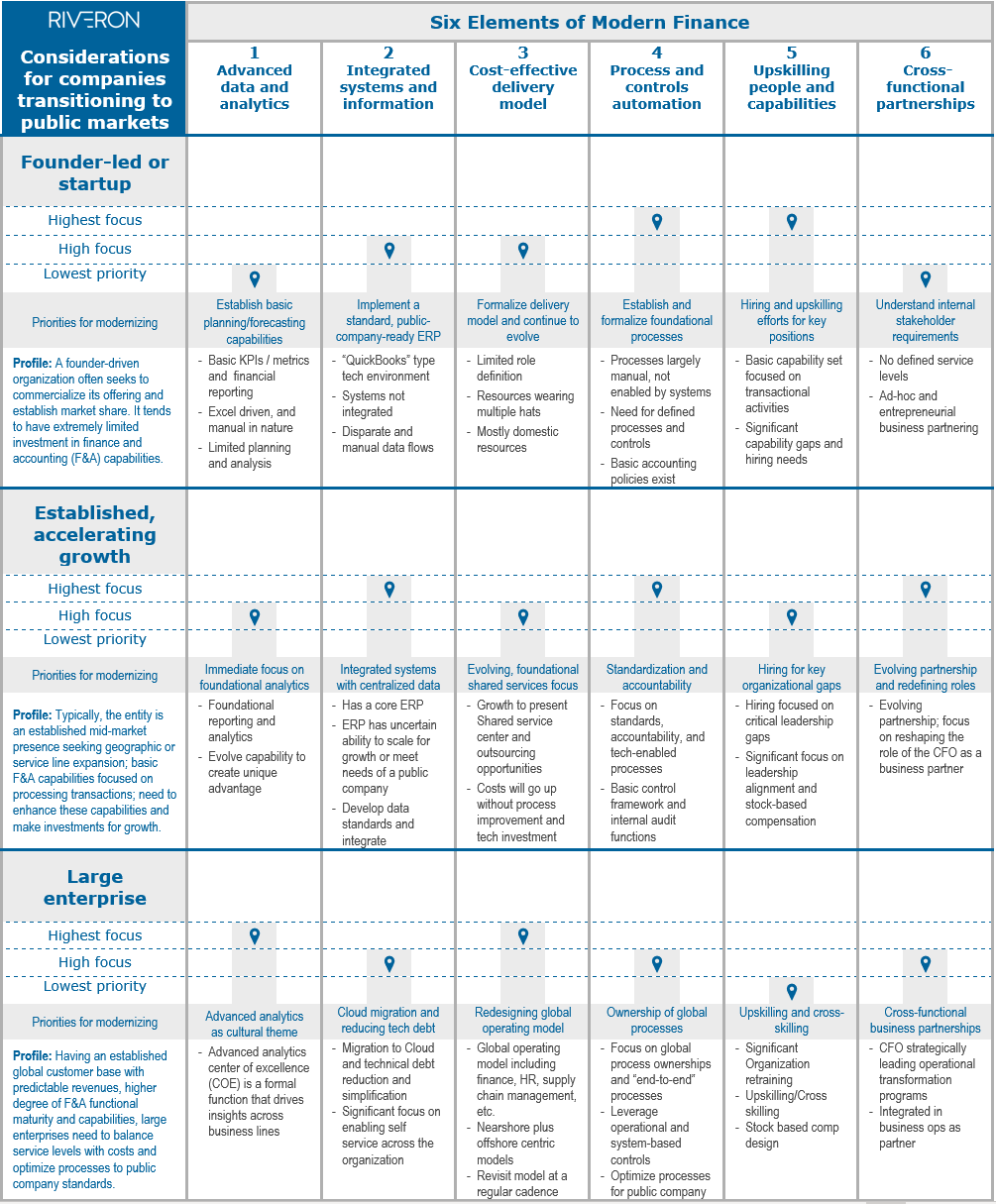

The principles of modern finance dovetail into focus areas for improving operations as a public organization—whether an entity is a founder-led company or startup, an established organization seeking growth capital, or a large enterprise. Figure 1 outlines key considerations and success drivers for these three common company profiles.

Figure 1: Maximizing Operations by Company Profile

Modern finance considerations and priorities for three typical profiles of companies transitioning to become public.

COMPANY PROFILE 1 : FOUNDER-LED COMPANIES AND STARTUPS

Typically, an owner-driven company that has minimal investment in operations, and the strategic focus of the business is skewed towards achieving sales. Often labeled startups, these organizations are characterized as young companies with strong growth potential, limited core finance and accounting capabilities, and having entry-level enterprise resource planning (ERP) packages led by a small team of individuals wearing multiple hats to deliver results each month.

To improve operations, CFOs and finance leaders should focus on establishing foundational documentation and setup to drive a formal structure dictated by the following key initiatives:

Rolling out key processes and controls by defining a formal close checklist and associated process with defined timelines for subledger close, accounting close and financial reporting. Place significant focus on setting the foundation with policy definitions. Enable better performance of day-to-day duties by building Level 5 process taxonomies and defining key accountabilities for accounts payable/procure-to-pay, accounts receivable/revenue assurance, record-to-report and hire-to-retire processes.

Improving internal use of data and systems by standardizing and defining a chart of account that captures and reports the true dynamics of the business; reviewing the current ERP structure to assess if it meets the growth parameters of the organization.

Establishing cadences for performance management and compliance by defining a foundational set of key performance indicators (KPIs) and financial reports to comply with the 10-Q and 10-K requirements to measure the business performance, formalizing the revenue streams and recognition methods in line with ASC 605 or 606 requirements, and defining a compliant, foundational audit committee and board structure.

COMPANY PROFILE 2 : ESTABLISHED COMPANIES ACCELERATING GROWTH

Established companies seeking growth capital have a moderately mature operation and a back-office support structure that is functional but not strategic enough to support the business partners.

The focus of the CFOs driving operational readiness initiatives should center on the following aspects:

Improving processes and enhancing worker functions by accelerating the accounting close process withing day 10 with foundational automation capabilities using close and consolidation platforms backed with standalone machine-learning- or robotic-process-based automation (ML/RPA technologies). Organizations should also drive an end-to-end procure-to-pay process to create a purchase order (PO) led infrastructure for better tracking and reporting and integration with accounts payables. Business partners should work together to identify upstream challenges that drive significant manual effort during the core month end close workdays. Cross-functional synergies can be achieved by defining the interfacing responsibilities between accounting, finance, supply chain management, and other operational areas.

Driving unification of financial and operational data using a formal data warehouse or data lake to serve the broader needs of the organization.

Guiding ERP optimization efforts to drive functional strength and flexibility in terms of migrating to and operating in the cloud.

Redefining the global operating model and strengthening the shared service function with incremental transition of processes such as supply chain, HR etc.

COMPANY PROFILE 3 : LARGE ENTERPRISES

Larger, more established enterprises typically operate with greater operational maturity than the first two profiles explored herein. Typically, these larger entities have the operational scale required to maintain current trajectory, having been effectively managed as a private company. Most large enterprise CFOs have already thought through nuances of public company operations and might already closely operate as such. Some companies might have been through a cycle of being public and private before—and might be equipped with current team members well versed with the requirements.

Key considerations for larger enterprises seeking to go public are:

Accelerating the close process through advanced ML automation and accounting policy changes (estimates, materiality thresholds), moving to Day-3 accounting close and Day-5 for financial reporting across all entities. The enterprise should also identify whether there are requirements to operate as an accelerated filer to comply with the 10-Q and 10-K disclosure requirements.

Implementing a global and advanced initiatives including:

- Global instances of a close and consolidation platform focusing on auto-certification and reconciliation.

- Driving key insights to actions and business partnerships through an advanced analytics center of excellence (COE)

- Rationalizing and optimizing the global ERP, spanning multiple versions, to support simplification and efficiency goals.

- Setting up a global transformation office to drive targeted initiatives to drive business impact projects.

Reskilling the organization, aligning to the target state performance requirements of the company.

Conducting an end-to-end review of the controls framework to comply with the internal audit and SEC requirements.

Enacting readiness at any company type

A dedicated team is the starting point to “go public” and to “be public.” Considering how the six pillars of modern finance can be interpreted in the context of these three company profiles, underscores the importance of establishing (or strengthening) an IPO readiness project team—essential for companies of any profile. Finance functions already must navigate their day-to-day jobs, and—unless carefully orchestrated—piling on the additional skill requirements for a public transition success can lead to failure. Enacting a “readiness team” approach will enable preparedness for taking a company public and ensure effective operations thereafter.

An initial operational readiness assessment should review operations holistically across all critical functions that contribute to the public company’s requirements. The IPO readiness team’s key outputs of this phase should include clear observations, recommendations on what must be fixed, and the level of effort and complexity. One example area of review might examine how to achieve the necessary close acceleration goals; here it will be important to review multiple workstreams and identify specific gaps that must be closed before the filing date. For another example, he team readiness team can also identify gaps in the billing operations and revenue recognition methods to be able to perform revenue close and report out revenue and margin by segment. The team can also evaluate the entire procure-to-pay capabilities to identify gaps for a successful close of the accounts payable subledger. Also, the team can drive efficiency across the continuum by reviewing areas for potential automation.

To ensure readiness, the team should identify, prioritize, and mobilize key initiatives, and create a roadmap. The process to identify key initiatives is informed by the base level of effort and the complexity of change that is needed to close any gaps. It will also examine specific tradeoffs, looking at what is necessary for the organization versus what can be deferred after becoming a public entity. Organizations can then mobilize key initiatives by assigning owners to each workstream and establishing a program team that will drive successful outcomes within the filing timeframe and beyond.

Using the elements of modern finance to maximize the operations of a public company follows a highly dynamic path with sometimes non-sequential processes necessary for enacting desired changes. Also, compared to a traditional IPO process, SPAC acquirees face a condensed timeframe to become a public company and may find it necessary to prioritize immediate needs against some of the future-state vision for operating as a public company. Depending on where a SPAC target company or other planning-to-be public entity falls in its maturity cycle, certain focus areas might need to be considered earlier than others, and the support of a robust IPO readiness team will enable companies to drive success.