SPAC Phases: Ensuring Successful Financial Reporting

Riveron outlines financial, accounting, and other considerations to understand when looking at the SPAC lifecycle.

Given the increased popularity of special purpose acquisition companies (SPACs) as a vehicle to access the public markets, accounting and finance teams working through these transactions should ensure they understand the phases of the SPAC lifecycle and the various accounting and financial reporting issues involved with each. Considering that market windows often drive timelines for these transactions, exploring the example timelines below will help management teams better understand each phase.

RELATED VIDEO

Watch this short video for a preview of related content—and more—to be discussed at the 2021 SPAC Conference.

The SPAC lifecycle has two main phases: (1) SPAC formation and initial public offering (IPO) and (2) the SPAC merger, or de-SPAC. Regardless of the phase, to ensure a successful transaction when forming a public entity, finance and accounting leaders must implement the necessary processes, create the appropriate documentation, and mobilize the right team members at the proper times.

Comparing the processes for the two phases of a SPAC lifecycle

(1) SPAC formation and IPO

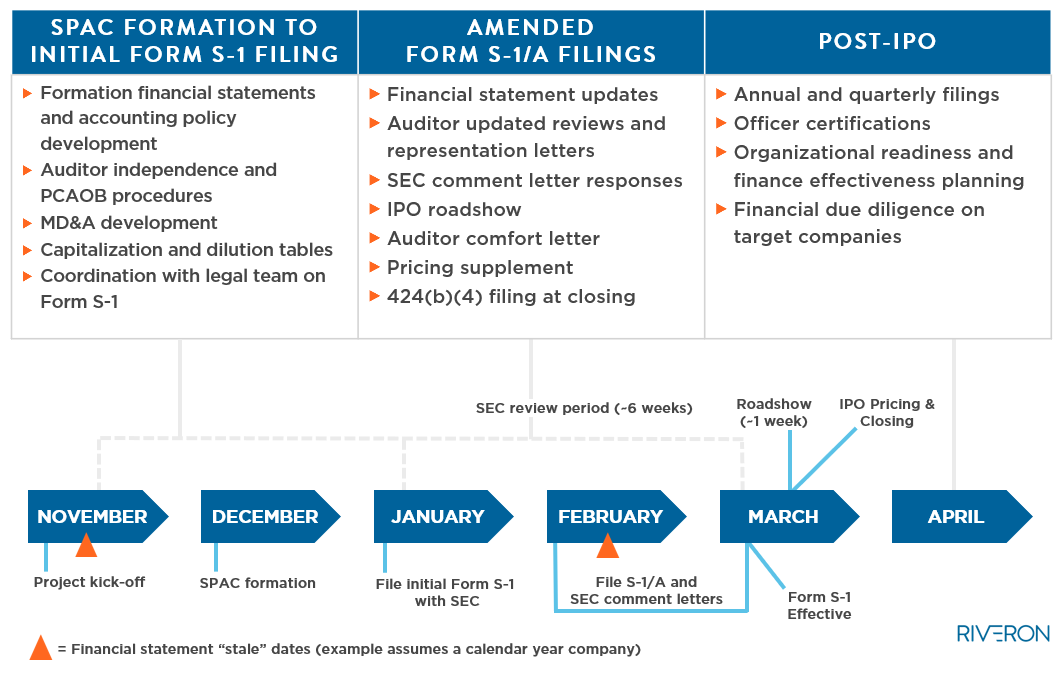

The SPAC formation and IPO generally occurs over the course of three to four months. In this illustration (see Figure 1), a company kicks off efforts in November, forms and funds a SPAC in December, and files its initial Registration Statement on Form S-1 with the Securities and Exchange Commission (SEC) in January. As the SEC filing review period takes approximately six to eight weeks, by February or March, the entity’s Registration Statement on Form S-1 would be effective. This is followed by the roadshow, pricing, and closing which can occur faster in a SPAC IPO than a traditional IPO.

Figure 1: SPAC Formation and IPO: Illustrative Financial Reporting Timeline

Post-IPO, a SPAC seeks a desired target and conducts related diligence procedures. Activities typical for this stage are ongoing SEC reporting maintenance and related officer certifications, public company readiness for the target company and financial and other organizational diligence on any target companies the SPAC seeks to acquire. On the target company side, a similar process happens through a “SPAC-off.” Here, target company management seeks an optimal SPAC acquirer and performs sell-side financial due diligence (e.g., Quality-of-Earnings) to aid in the deal price negotiations.

When sponsors form a SPAC and complete its initial public offering, some key considerations to ensure this process goes smoothly are as follows:

- Assembling the right team. Many SPAC sponsors assemble an experienced team of financial, legal, accounting, audit, and strategic advisors to help them complete the IPO. Cutting costs in this area will often lead to a bumpy road.

- Defining the SPAC identity. A sponsor without a business plan will likely not be successful, and defining the company’s identity early, including how investors see it, is critical. For example, sponsors whose experience is primarily in driving growth and expansion in organizations early in their lifecycle or in nascent industries should generally not focus on creating a SPAC and raising capital from limited partnerships and other institutional investors to target more mature markets.

- Striking the right balance of speed and quality. Sponsors face “the SPAC clock,” which is a defined period to identify a target and execute the de-SPAC or merger. The time-related pressure is due to the significant downside if a sponsor does not complete its objectives in the window; however, it is important to avoid sacrificing a quality target to achieve the timeline, and parties must conduct proper diligence despite time constraints.

(2) SPAC Merger Phase

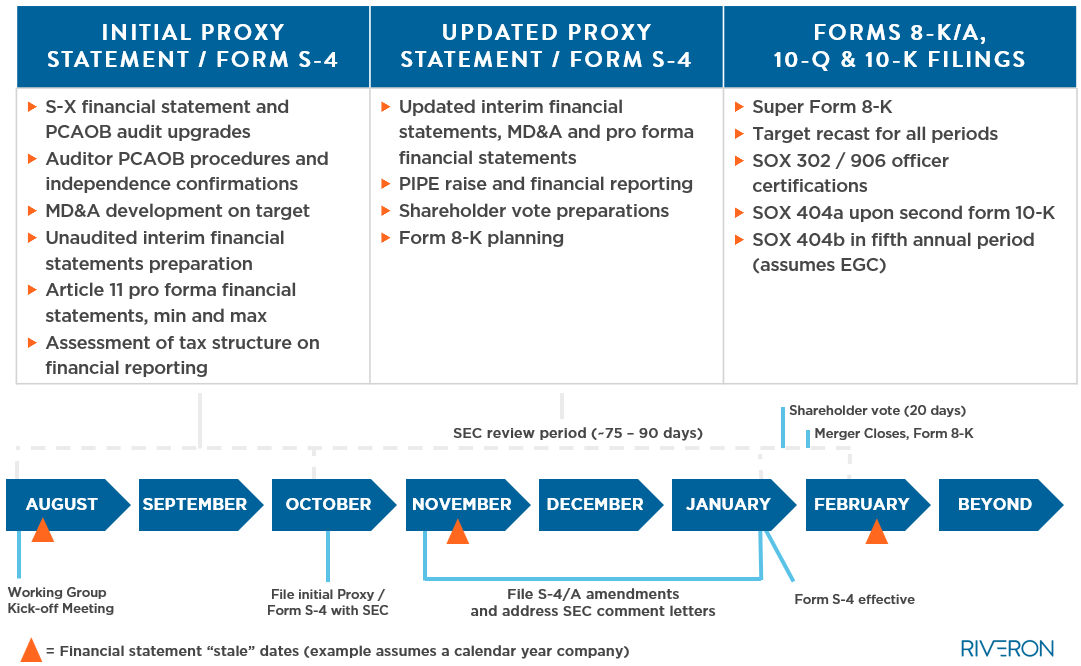

During the SPAC merger phase (see Figure 2) a sponsor and target company management team will kick off its working group, and generally within a few months file an initial Proxy Statement on Form S-4 with the SEC. The SEC review period typically lasts 75 to 90 days, but the period can vary based on the volume and complexity of SEC comments. Further, deal terms sometimes change during this process. The company will file a Proxy Statement on Form S-4/A amendments, address SEC comment letters and conduct planning for a “Super 8-K” as well as plan for shareholder vote preparations. A Super 8-K is required to include all information typically found within the registration statement for companies that are going public through an avenue other than a traditional registered IPO. Once the S-4 form is effective, the company moves onto other filings, undergoes a 20-day shareholder vote process, and the merger closes.

Figure 2: SPAC Merger: Illustrative Financial Reporting Timeline

For the SPAC merger phase, some key considerations include the following:

- Preparing for complexities. Readiness is key to success because the de-SPAC or merger is the more complicated phase from an accounting, financial reporting and organizational readiness standpoint. Conducted early and in a comprehensive manner, a public company readiness assessment ensures a successful transaction. A readiness assessment can be conducted formally in a workshop, resulting in a tailored project plan, or it can be done concurrently with the workstreams that take place as part of the Form S-4 content creation.

- Understanding technical nuances of the Form S-4. A de-SPAC has a handful of technical accounting and financial reporting matters that are unique to this type of capital markets vehicle. For example, various forms of debt and equity are often issued to the sponsors or finance partners which can require complex accounting analysis. A sponsor needs to garner the right technical support on these matters to ensure a smooth on-ramp and to be effective in the process.

- Establishing relationships that enable flexibility. Specifically, being able to tap into a group of people who have experience with these types of transactions, the way the process works, the structure of the agreements, and the related accounting and finance issues will be instrumental to success. For this type of transaction, the more a sponsor’s structure and process becomes non-routine, the more inefficiencies will arise. These relationships must also be flexible because, as the transaction evolves, changes to deal terms or other factors are almost guaranteed to happen, and accommodating those changes is paramount.

From initial planning through operating as a public entity, many complexities will arise during the SPAC lifecycle. Sponsors can ensure a seamless process by setting the right guidance and relationships in place to prepare for the associated financial and reporting complexities of each phase. More information about navigating the SPAC lifecycle can be found in Riveron’s Ask The Experts Webinar series.