Modern Finance: Six Elements that Drive Value for Organizations

Traditional finance functions and roles have evolved exponentially in recent years, as decision-making becomes more complex and the influence of finance teams has a greater, more measurable business impact. Studies suggest that despite the digital transformation of the finance function, it has not reached a maturity level needed to support a modern organization, and one report[1] found that the majority of finance professionals do not have internal and external data that is necessary and readily accessible across the enterprise. Further, most reported an inadequate upskilling investment by their organizations, which limits the finance function’s ability to take advantage of digital reinvention technologies. What is certain is that constant pressures remain for the office of the CFO to be a dynamic business partner, meet the demand for evolving financial skillsets, and provide better value for strategic decision making.

Defining modern finance and why it matters for businesses today

In the era of digital transformation, “modern finance” represents the current evolution in skillsets and proactive decision making; these capabilities improve efficiency while increasing the ability to provide forward looking insight and decision support. Modern finance also illustrates the need for organizations to adapt to remain competitive, using information more effectively and doing so through pragmatic change management.

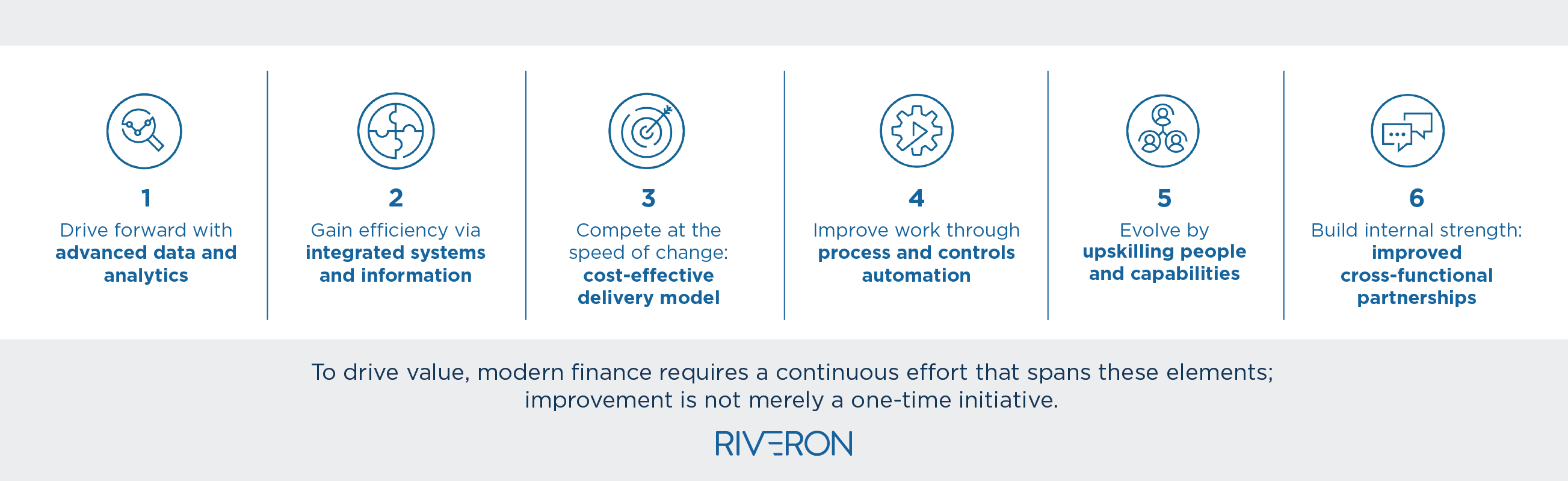

While the emerging role of finance has been broadly conveyed, stakeholders may be uncertain of the core tenets of a modern finance initiative. It can also be complex to grasp the practical applications: how a transformed approach to finance can provide strategic decision-making support to company leaders, external stakeholders, and various functions such as information technology, operations, marketing, and beyond. Not only does modern finance enhance decision-making, it also provides value to the organization by improving controls and transaction-related processes, and it advances the role of human capital. To simplify stakeholder adoption of modern finance, the framework outlined below establishes a basis for how the finance function can create value by providing strategic, timely, data-based insights to all areas of an organization.

Though described individually, each point in the framework is interrelated, and to capture the true value, the points are best viewed as an integrated ecosystem. Further, organizations must view modern finance as an ongoing effort that requires continuous refinement in order to drive strategic improvement, adoption, and results. Beyond better decision making, companies can expect modern finance initiatives to enhance the employee experience by removing repetitive tasks, providing access to cleaner and more actionable insights, and hastening the problem-solving process.

The six elements of modern finance

To cut through complexity and plan toward desired outcomes that increase the overall performance of the organization—impacting people, processes, and technology—it helps to look at the six elements below. These serve as a basis for modern finance initiatives.

(1) Drive forward with advanced data and analytics

Companies today need data to serve as a useful guide for decision-making and performance measurement. Transparency, problem solving, and insight-generation are fundamental principles that are addressed by data orchestration and analytics. Technology and expertise in advanced analytics provide accurate and real-time financial information to decision makers across the organization, enabling agility and collaboration. Finance leaders need to be able to provide this information in packaging that is meaningful to business partners to make it accessible, accurate and actionable. Advanced analytics solutions should also enable self-service when possible, so that finance professionals are not the only purveyors of information. Ideally, a modern organization uses its data in a way that enables predictive, nimble financial planning and analysis (FP&A) rather than reviewing data via reactive methods that may not keep pace with competitive needs or merely serve to revisit business performance in hindsight.

- In a related example, a luxury retailer worked with Riveron to improve its data capabilities and drive timely decision-making. This effort involved standing up a business intelligence and reporting infrastructure that enabled more accurate forecasts, integrating the retailer’s promotional calendar with its real-time transactional data and models based on historical financials, enabling the retailer to reforecast weekly instead of monthly and biannually.

(2) Gain efficiency via integrated systems and information

Whether or not an organization is globally dispersed, technologies need to be as seamlessly integrated as possible to extract maximum efficiencies. This centers on the enablement of digital solutions across finance and accounting to support standardization and access to data.

- Data is often stored in a variety of places, which is a common challenge for organizations with many business applications in the operational ecosystem. Within one organization, the ecosystem might include customer relationship management (CRM), enterprise resource planning (ERP), corporate performance management (CPM), business intelligence (BI) and reporting, human resources (HR) systems—and more. For some companies, the range of existing systems may be too numerous and siloed, which causes inefficient processes and inaccurate information.

A comprehensive solution empowers faster access to data and replaces the need to generate reports from disparate sources to enable finance professionals to quickly digest and interpret data. Strategic technology integrations enable automation, reduce manual processes, and capture meaningful data—to enhance revenue, manage costs, and ensure more accurate and forward-looking FP&A and decision-making capabilities. An organization should place particular importance on achieving a single source of truth in its systems, providing decision makers with an ability to make smarter decisions faster.

(3) Compete at the speed of change: cost-effective delivery model

In business, the competitive landscape and customer expectations are everchanging. In response, businesses must consider and shape the appropriate growth strategies, design of shared service centers, outsource partners, and remote delivery centers. Strategies and tactics must meet the necessary service levels while optimizing related costs. The finance function is best suited to enable a cost-effective delivery model by driving location analysis, constant review of service placements and operating model redesign to meet business requirements.

(4) Improve work through process and controls automation

Repetitive and basic tasks remain abundant in organizations, which result in employee fatigue, attrition, excess costs, and undesirable processes. Modern CFOs are embracing the concept of automation (not merely for its own sake) to identify efficiencies and capture productivity. Desirable automation relies on fully reviewing and reimagining ways to address process and control risks. Then, organizations must overlay the appropriate technologies that best facilitate an accurate and efficient future state.

(5) Evolve by upskilling people and capabilities

While technology and processes are essential, any effective modernization initiative starts with people. With an integrated technology approach to solving a business problem, the organization completely redefines the finance skillset to include robotic process automation (RPA), machine learning, and artificial intelligence as day-to-day skills for conducting business. These additions complement rather than substitute the finance workforce, and the transformational efforts offer new paths to address the needs of finance workers. Success here will hinge upon appropriate change management, upskilling and addressing collaborative structures.

- Often, improvements to roles and processes are intertwined. For example, one rapidly growing manufacturing organization worked with Riveron to upskill its people and improve its processes by restructuring the finance and accounting operating model. This included redefining roles and responsibilities, replacing and reassigning personnel, vetting and onboarding new hires, and enhancing service delivery. By conducting an assessment and then executing order-to-cash process improvements and upskilling the workforce, in six months the company was able to decrease invoice generation cycle time by more than 50%, reduce aggregated days sales outstanding over 40%, and had a 30% reduction in A/R labor costs. Many of the enacted changes complemented the workforce, allowing finance team members to redirect their focus toward higher-value efforts. In a short window of time, the organization was able to kickstart its ongoing journey toward finance modernization.

(6) Build internal strength: improved cross-functional partnerships

Modern CFOs need to successfully identify and build a relationship with the organization’s internal customers of the finance function. An integrated finance partnership should build the platform within the full value chain to provide real-time insights for core operational functions such as supply chain, manufacturing, sales, business unit finance, internal audit, and finance-related shared services. Also, CFOs must embrace their cross-functional formal and informal leadership roles to influence decision making in areas of risk, compliance, and investment Ultimately, this strategic decision-making support is what provides measurable results for the organization.

Finance, redefined

This six-point framework requires the finance function to deeply understand the organization’s goals and strategic initiatives while cultivating new cross-functional relationships to identify new opportunities where these skills can be applied. Enacting these changes in an ongoing manner can help CFOs and finance professionals meet the ever-changing demands of customers and internal stakeholders. Through a modern approach to finance, the office of the CFO can ensure that the organization’s people, processes, data, and technology work in concert, responding to market forces in a strategic and competitive manner.

[1] “Digital Transformation of the Finance Function” Nov. 2020 report by APQC (677 organizations surveyed); one out of five survey respondents reported having access to real-time, internal and external data readily accessible across the enterprise based on need; only two out of five respondents reported having substantially invested in digital skills to help the finance function take advantage of digital reinvention technologies.