Aviation Outlook Part 1: Passenger Demand and Fleet Utilization

At a recent conference, industry experts explored demand and supply-chain-related themes impacting commercial aviation. The first part of this series recaps the current outlook for passenger demand and fleet utilization.

Passenger travel compared to pre-COVID expectations

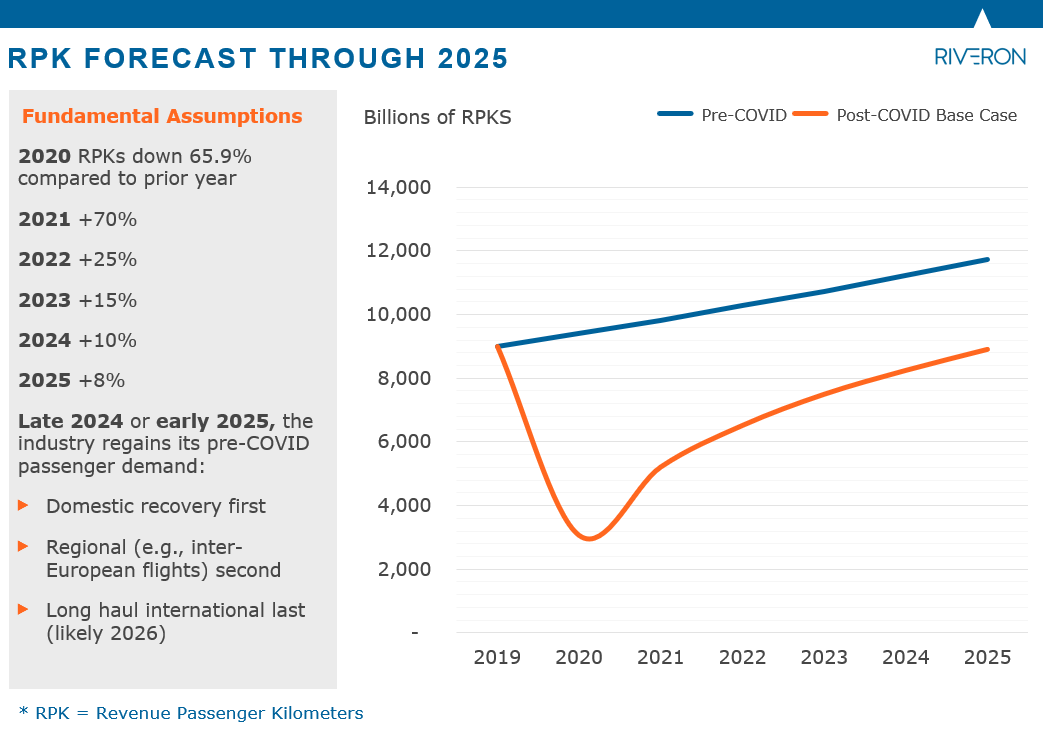

Prior to the COVID-19 pandemic, commercial aerospace passenger demand was expected to grow, on average, approximately 4.5% per year (see Figure 2, below), with revenue passenger kilometers (defined as the number of paying passengers flown in a given period) expected to climb from roughly 9 billion in 2019 to nearly 12 billion in 2025.

The reality of what transpired from March 2020 to the present is a very different story. Instead of enjoying a continued period of steady growth, the industry contracted by more than 65% in 2020, representing the largest downturn in the history of commercial aviation. The downturn was five to six times more severe than activity seen following other disruptive events such as the September 11, 2001 terrorist attacks and the 2008-09 global financial crisis.

Passenger demand has started to recover in 2021, but recovery has been far from uniform. Certain large domestic travel markets within countries such as the United States, China, and Russia have seen progress toward pre-COVID levels of passenger demand, while other sectors such as long haul and regional international travel remain nearly 70% below pre-pandemic peaks. Domestic air travel recovery has been driven by successful mass vaccination programs in certain countries using high-efficacy vaccines. International travel recovery has been stymied by complex and constantly changing travel restrictions, testing requirements, and quarantine procedures imposed by virtually every country in the world.

Passenger demand in the coming years

In 2021, passenger demand will likely increase by approximately 70%, driven by a domestic market recovery in the United States and China, with leisure travel leading the improvement and business travel lagging. Lower rates of business travel are now anticipated because many companies and business models adapted to the pandemic-induced lockdowns by using virtual conferencing tools which, in many cases, resulted in higher productivity and lower travel expenses. This shift is going to be particularly important for airlines because, compared to leisure travel, business travel typically produces significantly better passenger yields and free cash flow. Some airlines, Delta in particular, built their pre-COVID strategy around being the business travel market share leader, and that may require some significant repositioning to remain well-positioned against competitors. From 2022-2025, there will likely be relatively steady growth in both international and domestic markets, with international recovery only occurring as global vaccination rates mirror those of the United States and travel restrictions being rescinded or scaled back accordingly. There are variables to consider with any vaccine-related assumptions, as recent happenings suggest that the ability to produce sufficient doses of vaccine does not mean that there is corresponding distribution capacity or a willingness among some individuals to receive treatment. For airlines, this means global vaccination efficacy rates will be an important factor beyond vaccine production numbers. Airlines will need to establish protocols for those who remain unvaccinated.

Figure 1: Revenue Passenger Kilometers (RPK)

For airlines, RPK is a standard measure of distance traveled by paying customers.

Implications for the fleet

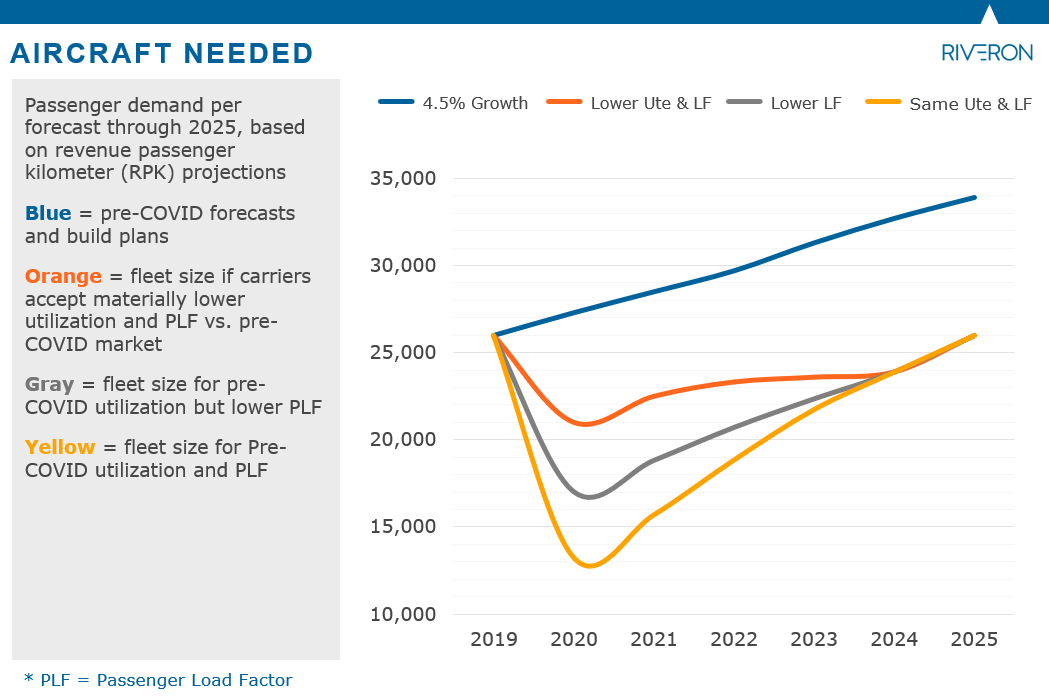

The bottom line is that the airline industry does not need any incremental aircraft for at least the next several years, owing to the large drop in demand, underutilization of the existing fleet, and anticipated recovery in passenger demand. At the lowest point of the pandemic, an estimated 60% of the global fleet was in short or long-term storage. That put the active fleet back to levels last seen in the early 1990s, and the recovery thus far in 2021 has been localized and inconsistent.

As a result, carriers are now experiencing low passenger load factors and low aircraft utilization (the number of hours an aircraft is flown per day) as capacity ramps back up. With the percentage of fleets parked reduced to roughly 30%, this means a tremendous capacity remains available in the portion of the fleet that is flying. It also means single-aisle aircraft (predominantly the B737 and A320 fleets) will likely return to normal levels of utilization sometime in 2023, while the wide-body fleet (such as B787, B777, A350, or A330 aircraft models) will likely recover to historical utilization rates significantly later—possibly in 2025, or shortly thereafter.

Figure 2: Aircraft needed

For the air travel industry, the recovery of passenger demand is going to create tremendous opportunities for revenue growth, market share capture, and strategic repositioning in many sub-sectors of the commercial aerospace ecosystem. However, the fundamental lack of need for new airline capacity is going to lead to a prolonged period of depressed demand for airframe and engine components in the aerospace manufacturing supply chain. While some original equipment manufacturers (OEMs) have been publicly talking about achieving new record line rates in the coming years, this may have been a display of strategic posturing rather than plans based on the fundamental need for more capacity.

A second part of this series explores the inventory position of the commercial aerospace manufacturing supply chain.