Check Your Proxy Twice – 6 Topics That Should Be On Every Company’s Disclosure List In 2022

Tis the season—the 2022 proxy season, that is. As your company gets its Form DEF 14A ready for the new year, it should come as no surprise that ESG will continue to be a hot topic for disclosure. Indeed, ESG-related disclosures in the proxy statement have increased exponentially in recent years, and we fully expect the 2022 season to bring even more detailed communications with stakeholders—not only pertaining to governance, but also environmental and social issues as well.

From Riveron’s perspective, there are six issues that must be covered in detail in your 2022 proxy. By including the following topics in your statement, you can be sure to deliver on your investors’ wish lists.

Board Oversight of ESG

Investors have expressed, in no uncertain terms, that insufficient board oversight of material environmental and social issues can lead to legal, financial, regulatory, and reputational risks and damage shareholder interests. Now, they’re putting their votes where their mouths are. Starting in 2022, ISS will generally recommend a vote against or withhold from directors at high carbon emitting companies in cases where climate risk mitigation strategy, including board oversight, is not disclosed. Similarly, in 2022 Glass Lewis will recommend voting against the governance committee chair of any company in the S&P 500 index that fails to provide explicit disclosure concerning the board’s role in overseeing risks including climate change, human capital management, diversity, stakeholder relations, and health, safety, and environment.

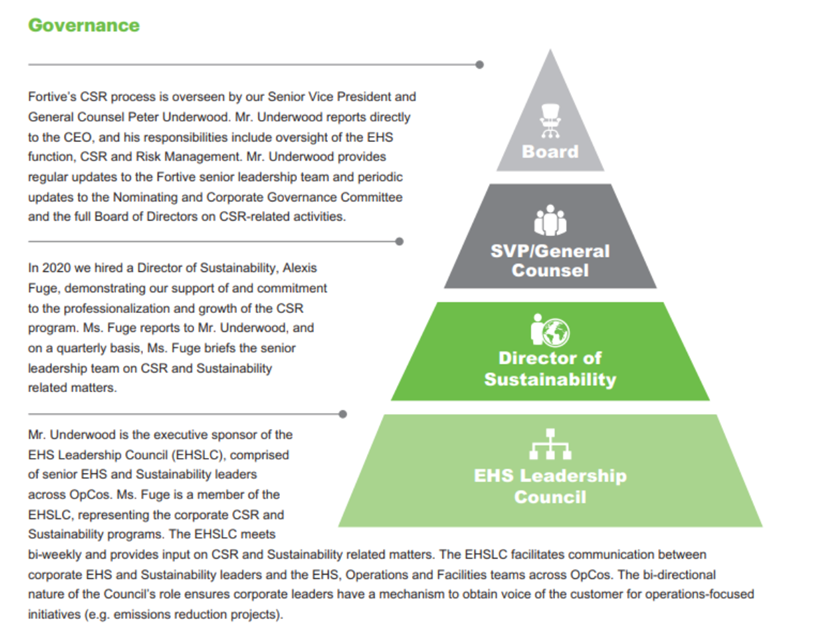

Companies differ in how they present the ESG-specific duties and responsibilities of their board members and board committees. Some provide lists of ESG Committee responsibilities while others highlight the integration of ESG in the company’s strategy and processes. However, you choose to disclose, be sure to give ample detail. In its 2021 proxy statement, Fortive Corporation did an excellent job of telling its oversight story, using a graphic and accompanying descriptions to outline how ESG management and processes are integrated at all levels of the business, introduce the company’s Director of Sustainability, and discuss its EHS Leadership Council.

ESG Strategy Overview

While your CSR is the right vehicle to go into detail on your ESG program, investors need a way to get the gist at a glance. Including a scannable ESG “cheat sheet” in your proxy is a great way to give investors the highlights with a link to the CSR report to learn more. This simplified version should include:

- Reference to any frameworks with which you align (SASB, GRI, TCFD, and UN SDGs)

- Top-level ESG ratings (CDP, MSCI, or others)

- ESG targets or KPIs that have been fully vetted and passed through internal controls

For the proxy, specifically, focus on recent achievements rather than lofty promises. While forward-looking statements can help communicate new initiatives, with Commission filings in particular, it is always better to highlight smaller wins than to overpromise on long-term goals, which may be perceived as greenwashing.

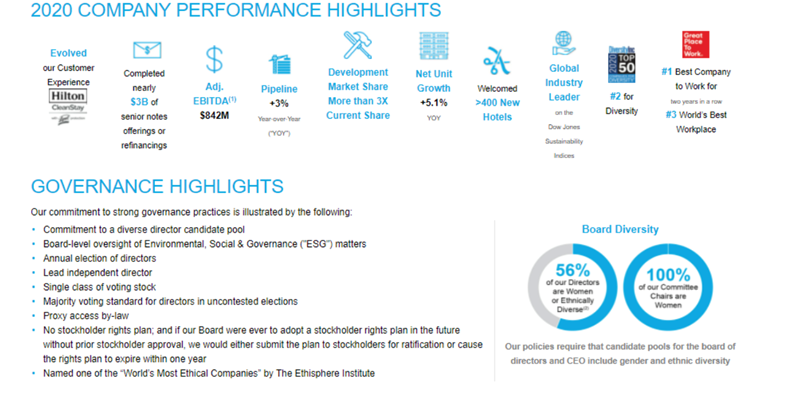

Some companies do this in a bulleted summary. Others, such as Hilton Worldwide Holdings Inc., use visually appealing graphics. On the first page of Hilton’s 2021 proxy statement, the company featured this shortlist of accomplishments including several ESG-related highlights:

Similarly, General Mills, Inc. used a compelling infographic to outline key sustainability and social responsibility achievements across different categories:

Climate-Related Disclosure

Given the expected climate-risk disclosure mandate forthcoming from the SEC, any information related to climate change and risk will likely be getting a closer look. This includes qualitative and quantitative disclosures on emissions and other climate-related issues such as climate risk oversight, strategy, risk mitigation, decarbonization, and target setting. In September 2021, SEC staff published a sample comment letter with a non-exhaustive list of comments and issues that should be considered as you decide what to include in your proxy and what information may be deemed material to your climate disclosures. Of course, the specifics will vary by industry and individual company. But as a rule of thumb, be sure that climate-related disclosures in your CSR report and/or sustainability website align with information provided in your proxy statement and 10-K.

ESG Metrics in Executive Compensation

Increasingly, it’s becoming best practice to link some aspects of executive incentives to ESG factors that are material to the company. According to the 2021 Global Benchmark Policy Survey, 52% of investors agreed that incorporating non-financial ESG-related metrics into executive compensation programs is an appropriate way to incentivize executives, but only if the metrics selected are specific and measurable, and their associated targets are communicated to the market transparently.

The metrics selected vary by company and industry, but some common topics cover carbon emissions reduction goals, energy efficiency, diversity and inclusion, and employee health and safety. In addition, companies differ in whether the metrics are weighted or unweighted, although the use of weighted metrics will probably increase in the near future. McDonald’s Corporation, for example, said in its 2021 proxy statement that it would include human capital metrics as 15% of executives’ short-term incentive plan while Apple Inc. stated that it would increase or decrease named executive officers’ bonus payouts by up to 10% based on an ESG modifier.

Board Diversity

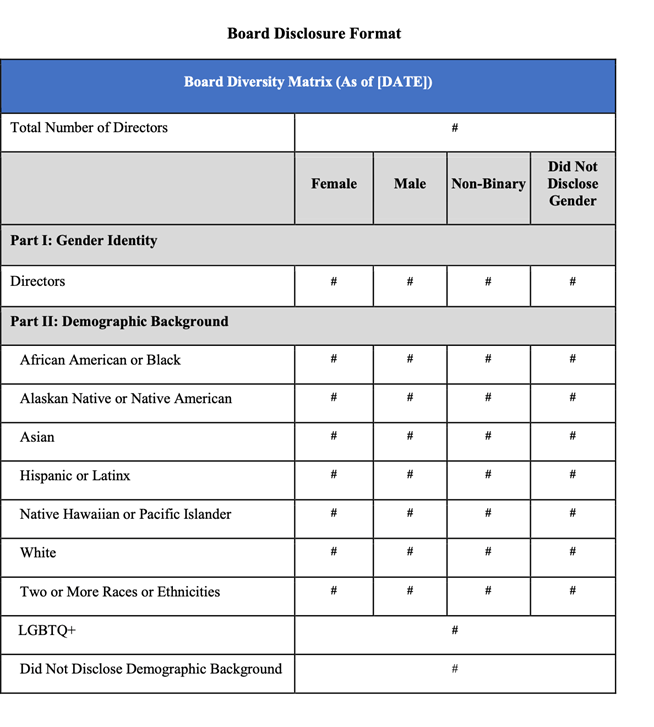

In 2021, disclosure of the board’s racial/ethnic diversity among Fortune 100 companies increased to 86%, up from 54% the previous year. The portion of public companies sharing this type of information in the proxy statement is likely to further expand, given the Nasdaq proposal approved by the SEC in August 2021. The new rule requires companies listed on the Nasdaq exchange to begin disclosing board racial/ethnic demographic information in 2022 following the Nasdaq matrix shown below. By 2023, companies must have at least one diverse director or the board, or explain why they do not. And by 2025, they will need two diverse directors or an acceptable reason why they do not meet the diversity requirements.

Director ESG Skills/Competencies

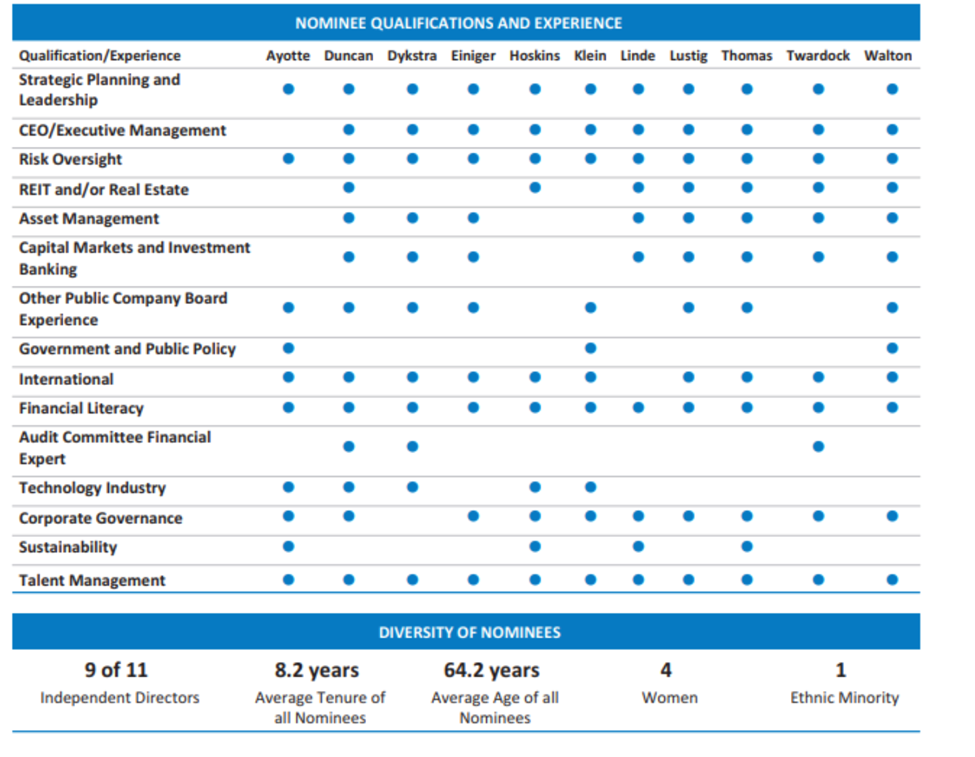

As ESG continues to have its moment, companies are increasingly using board skills matrices to highlight ESG-related competencies such as sustainability, human capital management, corporate governance, risk oversight, and health, safety, and environmental experience. While no single board member can be expected to bring all the perfect skills to the table, a board skills matrix is designed to show the big picture and reinforce that, on the whole, director nominees are carefully selected and well-suited to oversee the company’s evolving business strategy, including navigating current ESG risks and opportunities.

For example, this board skills matrix, published by Boston Properties, Inc. in its 2021 proxy statement, includes a number of ESG skills as well as a snapshot of the board’s overall diversity levels.

Get your ESG story heard

The proxy statement has become an increasingly important vehicle for ESG communications. Even if you have an exceptional CSR or ESG-dedicated section of your investor relations website, don’t overlook this opportunity to share key program highlights. After all, investors will be looking here for specific disclosures. Take advantage of their attention to highlight your ESG successes and get ahead of new and forthcoming disclosure requirements. When you do, you’ll ensure your proxy is as valuable as it can be for both your stakeholders and your business.

As always, we’re here to help. Reach out to learn how we can assist with getting your ESG narrative right in all your investor communications.