Acquiring a Business vs. Assets: Accounting Complexities Explained

Given that mergers and acquisitions (M&A) activity remains robust across markets, many organizations are tackling the significant accounting and reporting matters related to business combinations. When preparing for these deals, one of the first steps in assessing the accounting impact is to understand whether the transaction represents an acquisition of assets or a business. By proactively addressing this key difference and the associated complexities, organizations will gain insight into the financial impact of the transaction, allow themselves time to appropriately account for the deal, and set themselves up for a successful audit.

Simplifying business combinations, starting with the screen test

ASC 805 provides guidance around what should be considered a business combination versus an asset acquisition. In order to constitute a business, there must be a set of assets and activities that have an input (such as resources that can be developed into finished products) and a substantive process (such as an organized workforce). Together, these elements must significantly contribute to the ability to create outputs (such as finished or saleable goods).

ASC 805 also provides a “screen test” to assess whether substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or group of similar identifiable assets and allows organizations to assess whether acquired activities or assets are considered a business. The screen test reduces the number of transactions that might otherwise be considered a business combination by providing a method for aggregating similar assets into one acquired “asset group.” This aggregation provides that substantially all of the assets in the transaction be part of this asset group to qualify under the practical screen. This assessment requires similar risk profiles for an asset group, often defined as assets that are presented in one line on the balance sheet (e.g., tangible and intangible assets cannot be part of one asset group). The process for making this determination is shown in Figure 1.

©Riveron

Notes:

[1] The screen test can be performed qualitatively if it is apparent that performing a quantitative test would indicate the transaction is an asset acquisition (i.e., the company is only acquiring customer relationships or a set of fixed assets). In situations when it is not evident, a quantitative test should be performed.

[2] Outputs are defined as “The result of inputs and processes applied to those inputs that provide or have the ability to provide a return in the form of dividends, lower costs, or other economic benefits directly to investors or other owners, members, or participants.”

[3] Inputs are defined as intellectual property, resources that can be developed into outputs, and access to materials or rights that enable the creation of future outputs.

[4] ASC 805-20-55-6 defines an assembled workforce as “an existing collection of employees that permits the acquirer to continue to operate an acquired business from the acquisition date.”

[5] While this criterion not being met would generally indicate that the transaction should be accounted for as an asset acquisition, there are situations in which the acquired processes cannot be replaced without significant cost, or situations in which the processes acquired are considered unique/scarce. In these cases, the transaction should still be accounted for as a business combination. For instance, if a company acquired a set of oil and gas properties as part of a transaction and determined that the set includes inputs (i.e., properties and related equipment) and substantive processes. Even though the equipment is considered an input, there is also an automated process performed that significantly contributes to producing outputs that cannot be replaced without significant cost to the buyer. As such, this set would be considered a business even though a workforce was not acquired.

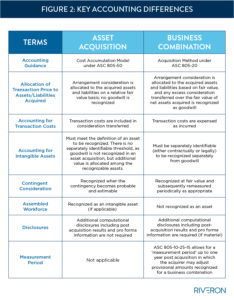

When comparing a business combination and an asset acquisition, there are several other notable accounting differences, such as how to account for matters related to contingent consideration.

© Riveron

Three example scenarios

1) When properties are an asset acquisition:

Company X entered into a transaction to purchase real estate from Company Y, including plots of land and hotel buildings associated with that land. While Company X is technically purchasing two different types of assets (buildings and land), the assets should be considered a single asset under ASC 805, given that the building cannot be removed from the land without significant cost. As such, the buildings and the land will be treated as one asset for purposes of the screen test and be accounted for as an asset acquisition.

2) In other cases, properties might be classified a business:

Alternatively, if Company X purchases this same group of assets but is also acquiring the brand names associated with the hotel buildings, it would be inappropriate to combine the intangible asset (i.e., brand name) with the buildings and land. As such, the intangible asset is considered separate from the buildings and land, and the assets would need to be assessed further to determine if they constitute a business under the provisions of ASC 805.

3) Restaurant franchises commonly require scrutiny:

Company R purchases a group of restaurant locations across the United States. Each of these locations is homogenous in its risk profile as it follows the same procedures and protocols from the corporate company. Accordingly, restaurants meeting this similar risk profile would be grouped together as one asset for purposes of the screen test. Conversely, if each store were considered to be independently operated by different franchise owners, then the acquisition of each of these stores would need to be considered further for its risk profile, location, etc. Doing so will help to determine whether each store meets the provisions to be considered separately identifiable for purposes of the screen test. Likely these would need to be assessed under ASC 805 to determine whether they qualify as a business.

Proper accounting helps businesses reach acquisition goals

Beyond the requirement to properly account for these transactions, by understanding early in the process whether the deal represents an acquisition of assets or a business, management can ensure an organization achieves its desired financial results and realizes the operational efficiencies offered by strategic M&A activity.

For instance, at the onset of a transaction, an entity being acquired might appear to represent a set of assets. As a result, a company might forecast an over-time amortization of certain capitalized expenses incurred as part of obtaining the asset. A more thorough accounting analysis might reveal that the transaction instead represents a business acquisition, in which case the company may be required to expense those transaction costs in the period incurred, which would result in decreased net income for the period. This example underscores the importance of investigating assumptions early in the process to avoid undesirable impacts.

Companies contemplating a business combination should take steps to understand whether the company is acquiring a business or set of assets under the guidance. Management teams should be proactive about this assessment to adequately prepare investors for prospective changes to the business and resulting financial statement changes. This will also enable internal accounting departments to be prepared for the reporting changes and the independent audit that will take place post acquisition.