Professionals’ Top Concerns this Audit Season

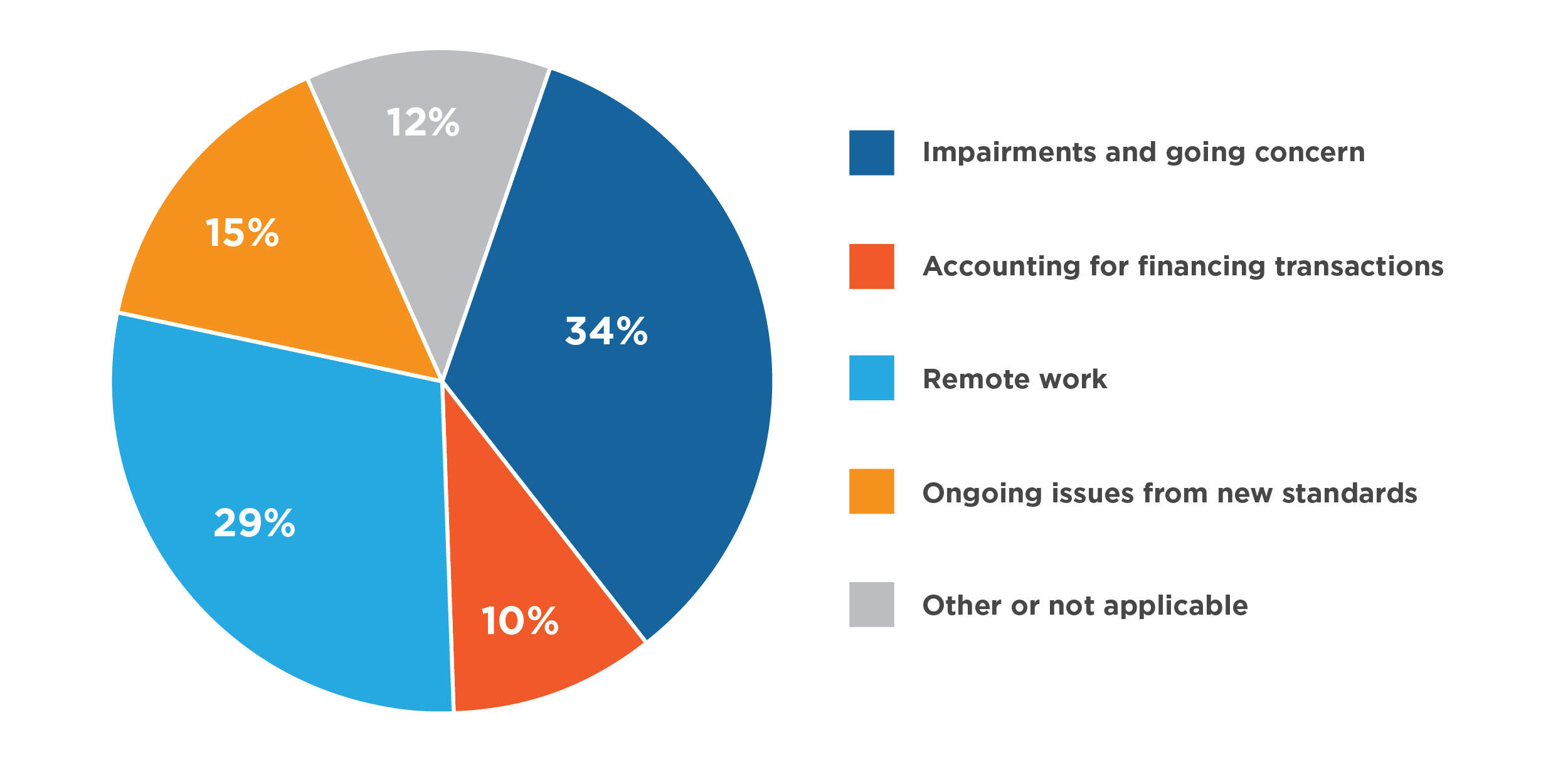

As accounting and finance teams endeavor to complete their 2020 audits, the issues they face are likely informed by the unprecedented challenges companies encountered over the past year. According to a recent survey [1] of accounting and finance professionals, the most challenging issues for this year’s audit cycle are impairments and going concern (34% of respondents) and remote work (29% of respondents), followed by the ongoing complexities of implementing and accounting for activities under new accounting standards, including leasing, revenue, and CECL (15%).

Not coincidentally, these were some of the primary topics covered during the 2020 AICPA Conference on Current SEC and PCAOB Developments as discussed in Riveron’s recent webinar presentation. In this webinar, Riveron experts endeavored to help accounting and finance leaders distill information from the conference with the goal of providing key, actionable takeaways as companies work through new, sometimes pandemic-driven issues that businesses have faced in the past year.

Ask the experts: Professionals indicated impairments and remote work among top issues this audit season.

(1) Going concern and impairment

Uncertainty surrounding the short-term and long-term financial and economic impacts of the coronavirus pandemic has resulted in accounting and finance teams devoting much more time and effort to the construction of a going concern assessment than in years past.

Companies that may have previously provided qualitative assessments should be prepared to deliver detailed financial forecasts that indicate whether sufficient liquidity exists to continue to meet obligations when they are due. Any shortfalls in liquidity should be identified and addressed with plans to increase cash flows that meet a company’s obligations.

Similarly, the economic environment is creating potential impairment triggers for goodwill, intangibles, and other long-lived assets. Most audit teams will have a default position that the events of 2020 are an impairment trigger, which will require incremental analysis and multiple layers of review from audit teams.

Companies will need updated forecasts reflecting detailed plans for continued cost containment strategies, management’s best estimate of timing and pace of recovery, and detailed plans on changes to leased assets. Strategic changes in a company’s plans for physical space, for example, and a shift to long-term remote work arrangements, will require an impairment assessment of right-of-use lease assets.

(2) Remote work

Pre-pandemic, the inherent benefits of the typical office setting—a collaborative environment, on-prem tools, and information security—had been taken for granted. Amid lockdowns, most organizations implemented a number of workarounds to enable remote work arrangements and ensure business continuity.

After acclimating to these new working conditions, organizations across the globe face new challenges in preparation for annual audits. With so many significant changes condensed into one year, an inevitable and perhaps material impact to companies’ internal controls over financial reporting will occur.

Proactive leaders can better prepare for year-end audits and ensure operational and design deficiencies in controls are addressed. To guide success, leaders can start with three key tasks:

- update their risk assessments,

- revisit key estimates and their underlying inputs and assumptions,

- and review IT changes made over the past year.

(3) New standards

Despite the FASB offering relief delaying the implementation of the new leasing and revenue standards for certain private companies by a year, many private companies are still grappling with the adoption and complex post-implementation challenges. Issues remained prevalent in cases where companies were unable to take advantage of the relief, or delay windows offered little benefit if new standards had already been implemented. Others face challenges working in a remote environment while embarking on early stages of implementations—often coupled with other complexities such as recent acquisitions.

For new implementers, successful adoption begins with fully understanding the requirements of the new lease accounting rules and establishing an appropriate approach, timeline, and budget. Implementation needs vary in light of the industry, nature of operations (e.g., decentralized versus centrally managed), and the volume of potential lease contracts. As part of a successful adoption, companies will also need to consider and plan for the ongoing effort to account for leases under the new rules going forward.

And for those struggling with post-implementation issues, methodical clean up and establishing decisive processes will help create efficiencies for ongoing success.

[1] Over 100 respondents in a poll conducted during an “Ask The Experts Webinar” hosted by Riveron in January 2021.