Shortages and Other Strategic Considerations for Automotive Suppliers

Systemic issues including widespread microchip shortages and long production lead times cause an uncertain outlook for some vehicle manufacturers and suppliers.

The automotive supply chain is rethinking the entire chip-ordering process and evaluating appropriate quantities and buffers of inventory.

The microchip shortage is systemic and will persist into 2022

The microchip shortage has been impacting the auto industry since late 2020. At that time, the shortage was expected to ease this year by the end of Q2, demand being met in Q3, and catch-up volumes available in Q4, but the predictions now appear overly optimistic. The root cause of the current shortages is systemic, and it was predictable because of timing: order lead times only go out 12 weeks from delivery, but the fabrication lead times are up to 24 weeks in some cases. Also, the system cannot adapt to rapid increases of orders due to chipmakers running at 95% capacity, and additional capacity takes nine months or more to build. The chipmakers were overwhelmed with unprecedented demand because of rapid increase in vehicle production in Fall 2020 combined with the launch of several 5G phones and new gaming consoles and a boost in consumer demand for electronics and laptops. The systemic issues have been further exacerbated by unusual events that impacted production in the near term: weather-related power outages in Texas also took microchip production offline for many weeks, a fire occurred in an automotive-focused chip manufacturing plant in Japan, and current concerns about a drought in Asia could further impact chip manufacturing—a water-intensive process.

An average new car has 1,000 to 1,400 microchips amounting to approximately $427 in content, according to IHS data.

How bad is the situation in 2021?

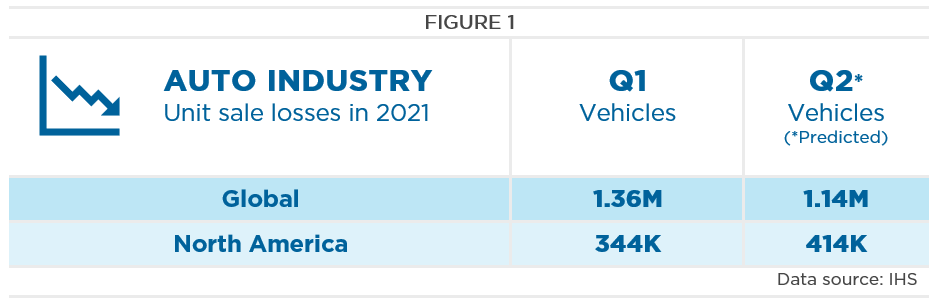

IHS has reported staggering numbers of vehicle unit sales lost in the first quarter of Q1, with numbers for North America looking worse in Q2. (See Figure 1)

The picture looks murky for the second half of the year, to determine whether volumes will catch up in 2021. Being able to correct volumes in the final quarters will be very challenging as the demand for electronics will pick up again in advance of the holiday shopping season, constraining the available supply of chips. Further, the original equipment manufacturers (OEMs) have been reluctant to decrease orders while actively working with suppliers on a host of creative solutions and currently unsure about the potential for success. OEMs want to avoid revising orders downward, later to arrive at a solution but unable to build the product.

It is estimated that the industry will lose production of 2.5M vehicles globally in the first half of 2021 as a result of the chip shortages.

The road ahead

The OEMs are using various tools to manage this situation. First, they have been changing production schedules to prioritize trucks and SUVs, which contain higher profit margins over passenger cars. Second, they are looking for alternative sources of chips which can be challenging, especially because different manufacturers have different proprietary architectures for microcontrollers. A third approach is looking for chips that could be substituted for ones that are not available. This requires a lot of engineering resources to validate performance. It also might cause some functionality to be unavailable, such as a vehicle infotainment feature. Lastly, automakers are building vehicles without certain electronic modules, storing those vehicles until parts become available.

In the past, the industry has repeatedly proven that it is resilient, and this instance will be similar. Demand from consumers is strong and does not appear to be changing any time soon. OEMs and suppliers will continue strong collaborations, looking for creative solutions to produce every unit possible.

The financial impact to the supply base will vary by supplier. Those suppliers on truck and SUV programs will likely see little negative impact, and many have had a strong first quarter. Other suppliers may experience some level of distress, if suppliers have a high portfolio concentration of passenger vehicles or models with delayed launch timelines.

Strategic insight

The automotive supply chain is rethinking the entire chip-ordering process and evaluating appropriate quantities. First, to try and gain additional clout in the marketplace, OEMs are considering buying the chips directly to obtain higher volumes than the suppliers could on their own. Another concept under investigation is creating larger buffers of inventory. This is contrary to “just in time” delivery models, but—given the current mismatched lead times—it will provide much needed insurance against lost production. Lastly, there is a lot of dialogue around increasing the chip-making capacity in North America, and President Biden has identified the chip shortage as a problem for the US auto industry and for the country. Economic incentives are being considered to attract companies to invest and create more chip manufacturing capacity in the US.