Financial Advising for a Distressed Automotive Supplier

Challenge

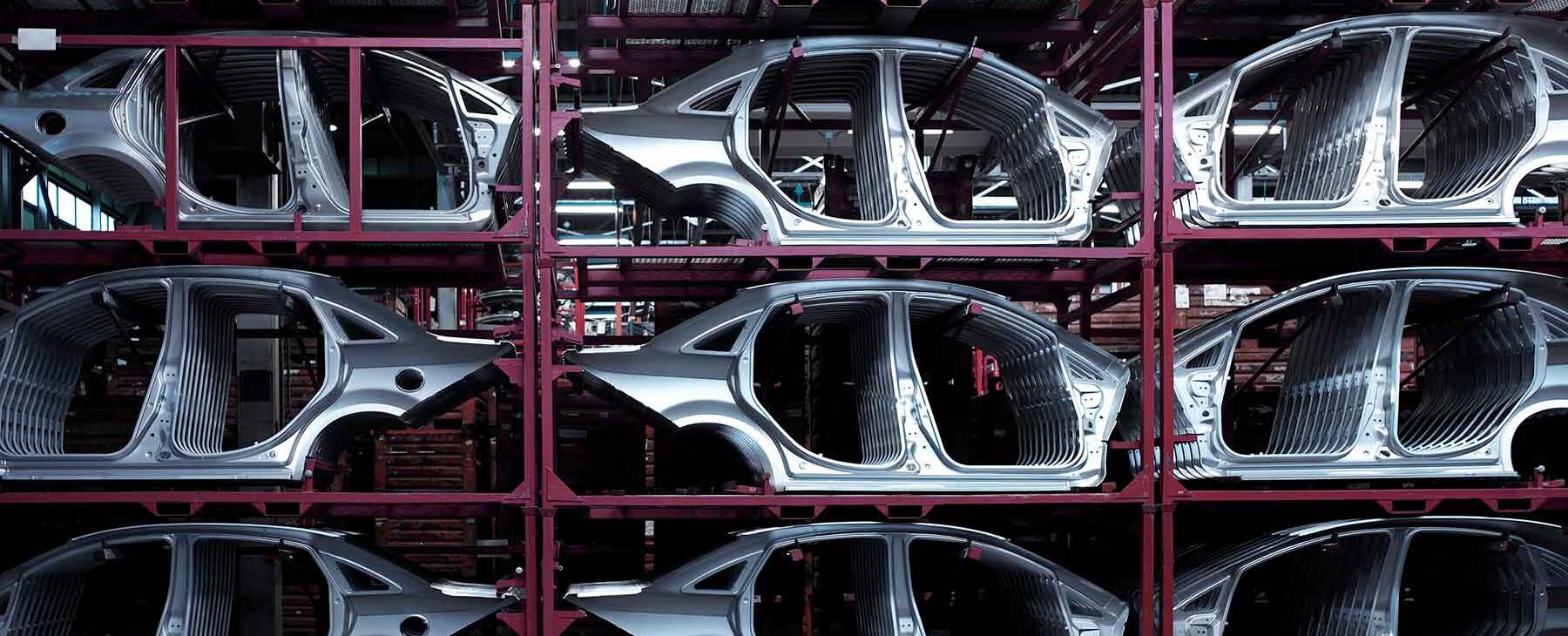

An aluminum die casting company, with over $500 million in revenue, attempted unsuccessfully to enter new markets, resulting in a decline from historical levels in both revenue and profitability. This performance decline, combined with the economic distress caused by the COVID-19 pandemic, forced the debtors to declare Chapter 11 bankruptcy.

Our clients were able to reduce the exit loan exposure by reducing the total loan commitment size by $15M (12%) and implement an additional $12.5M availability block.

How we helped

Riveron was retained as a trusted financial advisor to the asset-based lender (ABL) group throughout the bankruptcy process, including leading communications with the debtor’s management team and their financial advisors. Throughout the bankruptcy process, we worked with the ABL group to evaluate financial projections, reduce potential loan exposure, and improve lending terms.

Results

Despite the unique challenges presented by the unprecedented circumstances, with the help of Riveron, the lenders were able to achieve a first day motion roll-up, debtor-in-possession ABL loan, and improved DIP loan terms by enhancing the financial covenants, liquidity block, and pricing and fees, and increasing the term loan contributions. Ultimately, through our robust financial analysis and expertise, our clients were able to reduce the exit loan exposure by reducing the total loan commitment size by $15M (12%), implementing an additional $12.5M availability block, and negotiating reduced inventory and receivable advance rates while maintaining exit financing assurances.