New IFRS Standards to Shape Sustainability Reporting: What CFOs Should Know

New IFRS sustainability disclosure standards released by the ISSB will build upon voluntary frameworks and shape companies’ best practices for sustainability reporting and climate-related disclosures.

Interested in sustainability and other current trends impacting the Office of the CFO?

Explore additional insights in a series on four core themes that can enable year-round success for accounting, finance, and ESG professionals.

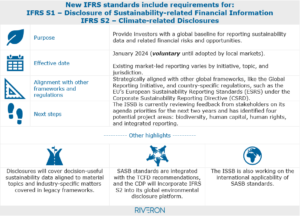

The IFRS sustainability disclosure standards issued in June provide a framework for reporting sustainability data alongside related risks and opportunities. The goal of IFRS-aligned disclosures is to provide investors with a global baseline that can be adopted by regulators and implemented by companies around the world. Company reporting in alignment with the IFRS standards will give investors comparable and decision-useful sustainability data aligned to material topics and industry-specific disclosures. In preparation for reporting sustainability disclosures against IFRS standards and shaping stakeholder-friendly information, CFOs and ESG professionals can consider how to align company sustainability reporting strategies across the enterprise.

About the new IFRS standards

The IFRS Foundation and the International Sustainability Standards Board (ISSB) officially issued its first two sustainability disclosure standards, IFRS S1, General Requirements for Disclosure of Sustainability-related Financial Information, and IFRS S2, Climate-related Disclosures. These intend to consolidate and streamline existing market-led, investor reporting initiatives, such as the Sustainability Accounting Standards Board (SASB), Task Force on Climate-related Financial Disclosures (TCFD), Integrated Reporting Framework, and Climate Disclosure Standards Board. In addition, the IFRS sustainability disclosure standards are supported by several leading global organizations. (1)

Following the IFRS standards can support stakeholder needs and enhance existing strategies

While no companies are currently required to comply with these new standards, many investors are already requesting the sustainability data included in IFRS S1 and S2. Plus, the effort to prepare voluntary disclosures of this data is a natural fit as many companies are already reporting to IFRS-aligned frameworks (e.g., SASB and TCFD).

- IFRS S1 provides guidance on how to identify sustainability risks and opportunities that are financially material to a company’s cash flows, access to finance, and cost of capital.

- IFRS S2 is more specifically focused on climate-related risks and opportunities, with alignment to other global regulations and proposals such as the US Securities and Exchange Commission’s climate disclosure proposal.

While the IFRS S1 and S2 work through the adoption process in local markets, these standards are likely to impact many businesses in three key ways:

- Improving industry insight – If a company is performing or revisiting its sustainability risk assessment, the S1 standard offers a resource for considering industry-specific topics. The provided guidance will ensure ESG reporting approaches include a global point of view for investors and asset managers.

- Enabling audit readiness – The quality of a company’s data collection and reporting processes can enable success. A closer eye or specialized expertise may be needed to enhance internal controls and governance over sustainability data collection, aligned to COSO’s recent study. Now is the time to plan and prepare processes that will provide audit-ready, high-quality public disclosures.

- Strengthening stakeholder success – Even if an organization is not directly subjected to regulatory proposals, its largest customers, suppliers, and investors may request data and assess available sustainability disclosures against their expectations and requirements. Following the IFRS standards can ensure a comprehensive and stakeholder-friendly approach.

What CFOs and ESG reporting professionals need to know

Outlined below is an overview of the IFRS sustainability standards, along with answers to questions that frequently arise regarding adoption timelines, relevance to other frameworks, and the ongoing refinement of the standards.

When will the IFRS Sustainability Disclosure Standards become effective?

The IFRS Foundation and ISSB announced a January 2024 effective date for the inaugural standards, but because they are voluntary until adopted by local markets, this effective date does not equate to an implementation date for companies preparing sustainability reports.

These standards will not be mandatory for IFRS accounting standard reporting companies until capital markets and securities commissions formally adopt and require the standards. A quick response by regulatory bodies is anticipated, given public statements by IOSCO and other global organizations. For example, the United Kingdom, Japan, Hong Kong, Australia, Canada, and Singapore, alongside many other countries, have initiated the review of the IFRS sustainability disclosure standards to enact local interpretations in their markets in the coming years.

Meanwhile, US-based companies that prepare sustainability reports annually aligned to the core frameworks of these new standards (e.g., SASB and TCFD) must be aware of the global integration and demand from investors for consistent data and disclosures in line with IFRS S1 and IFRS S2.

The ISSB has also strategically aligned with other global frameworks, like the Global Reporting Initiative, and country-specific regulations, such as the European Sustainability Reporting Standards – the standards implemented under the European Union’s CSRD, to help companies identify material sustainability risks and opportunities and to help prepare relevant data and disclosures for use across multiple reporting needs.

What if a company is already reporting against an ESG framework?

If a company is already (or preparing to) reporting against TCFD or SASB, then aligning to the IFRS sustainability disclosure standards may only require an incremental level of effort. The IFRS sustainability standards were designed to be universal and were built from existing initiatives developed to encourage corporate transparency and disclosure. The IFRS S1 standard closely maps to the structure of the TCFD reporting framework – governance, strategy, risk management, and metrics/targets. Similarly, the IFRS S2 standard is aligned to TCFD and other climate reporting requirements and proposals globally, including CDP and the World Business Council for Sustainable Development’s Greenhouse Gas Protocol, the basis for GHG emissions inventorying under the SEC climate disclosure proposal and the European Union’s recently issued climate standard.

In July, the IFRS Foundation announced that it will take over the monitoring of progress on TCFD disclosures in 2024 at the request of the FSB, demonstrating the continued integration of legacy reporting bodies. Similarly, the CDP and the ISSB also announced that the CDP would incorporate IFRS S2 into its global environmental disclosure platform. The announcement means that CDP’s 17,000+ voluntary users will disclose data structured to IFRS S2 in the 2024 disclosure cycle.

What’s next for the ISSB?

The ISSB is currently reviewing feedback from stakeholders, including investors, companies, regulators, and advisory firms, on its agenda priorities for the next two years. The ISSB is also working on the international applicability of SASB standards, with the goal of finalizing changes by the end of the year to help companies with the adoption of IFRS S1 and the preparation of quality IFRS sustainability disclosures.

In the near term, US companies that prepare sustainability disclosures will likely receive more pressure from investors and stakeholders to align reports to these global standards. As regulators adopt the IFRS sustainability disclosure standards, companies that embrace SASB and TCFD will be best positioned to comply with IFRS-aligned regulations and related requests from investors and customers.

Notes:

1. Organizations that have supported the IFRS standards include the G20, G7, Financial Stability Board (FSB), World Economic Forum, and World Business Council for Sustainable Development (WBCSD). In addition, IFRS S1 and IFRS S2 have been formally endorsed by the board of the International Organization of Securities Commissions (IOSCO), which has promoted the use of the IFRS sustainability disclosure standards by IOSCO’s members.2. Other relevant references:

ISSB issues inaugural global sustainability disclosure standards

IFRS – Ten things to know about the first ISSB Standards

IFRS S1, General Requirements for Disclosure of Sustainability-related Financial Information

IFRS S2, Climate-related Disclosures

CDP|ISSB Announcement