Worried About New TCFD-Reporting Mandates? Here’s Everything You Need to Know Now

The Task Force on Climate-related Financial Disclosures – better known as TCFD – is an old framework with a new mandate. Or, more accurately, several new mandates. The Task Force was formed back in 2015 and TCFD-recommend disclosures first became public in 2017. But the topic is getting more attention today than ever before and is now frequently found at the top of board agendas, due in large part to regulatory momentum and global investor pressures.

If you’re giving TCFD some serious consideration for the first time – or even if you’re elbow-deep in the process – you’ve no doubt got questions. What exactly is TCFD? How is it different from or aligned with other ESG frameworks? Who endorses it? And, perhaps most importantly, how do you get started?

We’ve covered all the essential information below to help you gain the knowledge you need to be ready for the soon-to-be-mandated climate change disclosure in public filings.

What is TCFD?

The Task Force on Climate-related Financial Disclosures was formed in 2015 by the Financial Stability Board to help tackle the systematic under-reporting of climate risk in financial markets. The Task Force built a set of disclosure recommendations, essentially a framework, for addressing climate change risk. TCFD is widely considered to be developed by the market, and for the market, to help investors, lenders, and others understand climate risk and opportunities through mainstream financial filings.

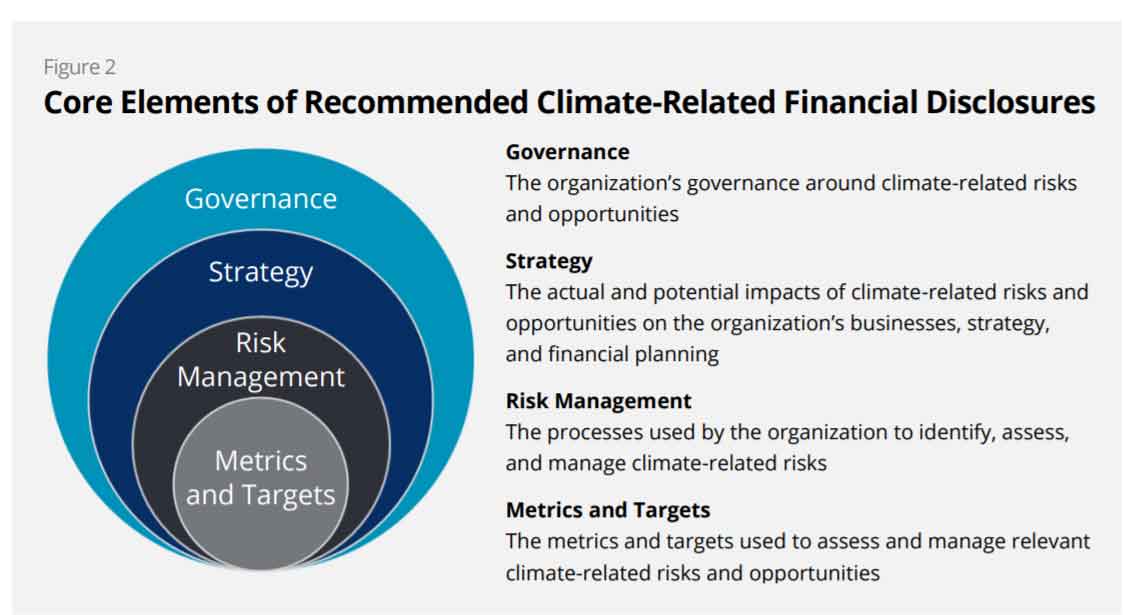

TCFD disclosure recommendations are structured around four thematic areas integral to an organization’s comprehensive approach to climate risk: Governance, Strategy, Risk Management, and Metrics and Targets.

What’s Unique About TCFD?

While many reporting frameworks seek to capture a company’s impact on the environment, TCFD recommendations provide a structure for companies to report the financial impacts from climate change on the business.

TCFD also uniquely asks companies to consider risk through two separate dimensions: physical risk and transition risk. Physical risks include threats such as changing climate patterns, rising sea levels, and extreme weather events while transition risk encompasses policy and regulatory changes, disruptive technologies, and forthcoming shifts in consumer demand. Both types of risks clearly have the potential to significantly impact a business’s ability to operate successfully.

Finally, TCFD asks companies to report on the resilience of their strategies for managing climate risk through the disclosure of multiple climate-related scenarios, including a 2°C or lower scenario. To learn more about climate scenario analysis and jump-starting your climate change strategy, see our recent piece on How to Start Sharing your Story Now.

How Does TCFD Fit Into the Larger ESG Reporting Landscape?

The last few years have seen a reporting convergence around prominent ESG frameworks and standards such as GRI, SASB, UN SDGs, and CDP in addition to TCFD. The begs the question, how do they all work together?

As a climate-focused disclosure framework, TCFD has a significant, yet specific role to play in the overall ESG reporting space. It works in tandem with the other frameworks, especially SASB and CDP. While SASB facilitates companies’ reporting on material, industry-specific sustainability topics, TCFD focuses on material climate risks and opportunities. So, the two frameworks are not mutually exclusive; rather, they complement each other. Companies can use climate specific SASB metrics in their response to TCFD’s Risk Metrics and Targets pillars.

TCFD also goes hand in hand with CDP. In 2018, CDP updated its climate change questionnaire with 25 new questions that align with TCFD’s recommendations. CDP has even gone so far as to explicitly map its questions to TCFD, facilitating seamless and simultaneous disclosure.

What Are Investors and Regulators Saying About TCFD Now?

Due to an increasing focus on climate change globally, TCFD has gained traction among major investors, international organizations, and regulators. Both BlackRock and StateStreet expect their portfolio companies to report in alignment with TCFD while Vanguard supports alignment with TCFD. Further, the United Nations Principles for Responsible Investment (PRI), the world’s largest investor network for sustainable investing, now requires signatories to publicly disclose several TCFD-based indicators including their management of risks and opportunities related to climate change.

Global regulators have also begun to incorporate TCFD recommendations into climate change policy:

- Most notably, in the UK, TCFD-aligned disclosures will be mandatory across the economy by 2025.

- In New Zealand, the government is moving toward mandatory TCFD reporting, with legislation in Parliament that, if approved, would require about 200 large entities in the financial sector to make climate-related disclosures aligned to TCFD beginning in 2023 at the earliest.

- While TCFD reporting in Japan is not mandatory, Japanese regulators support TCFD-aligned reporting and have published guidance facilitating its implementation. Further, TCFD has garnered private sector support in Japan, with financial institutions and businesses forming the Japan TCFD Consortium to facilitate effective disclosure.

Although the U.S. has not mandated TCFD-aligned disclosures, yet, recent comments from SEC Chair Gary Gensler indicate that the SEC’s proposed rule on climate risk disclosure, set to come this fall, will gather inspiration from TCFD. As outlined in our recent piece, New Climate Disclosures Rules Are Coming Soon from the SEC, U.S. listed companies that aren’t yet following TCFD disclosure recommendations would do well to get started now so that they are ready to incorporate SEC-mandated disclosures in public filings in the next few years.

What’s the Current State of Play of TCFD Reporting?

While TCFD reporting is on the rise, it is far from a mainstream practice. In 2021 YTD, 234 U.S. corporate issuers referenced TCFD in DEF 14A filings, up from 107 in 2020. The most prevalent TCFD reporting is coming from the financial services, technology, telecom, and real estate sectors.

It’s important to note that the quality of TCFD disclosure varies greatly. Many companies are starting to disclose management processes and board oversight aligned with the Governance pillar as well as metrics and targets aligned with the Risk Management pillar. But the Strategy pillar, climate risk assessments, and Scope 3 emissions (e.g., value chains, supply chains, product life cycles) remain highly under-reported. As of August 2021, only 110 companies in the MSCI USA Investable Market Index (IMI), disclosed some form of climate-related risk analysis. These disclosures were across the board, ranging from a mention of climate risk awareness to a comprehensive materiality assessment of group-wide business risks associated with climate change, complete with scenario modeling or sensitivity analysis.

For their part, investors are generally seeking more disclosure on climate risk management including integration into assets, operations, supply chain, operations, products and services, and R&D. Investors also want to see climate opportunities disclosed in greater detail, such as the ability to generate revenue from green sources and low-carbon opportunities.

What Should I Do First?

Although TCFD reporting can seem daunting, taking the framework step by step and ensuring the right structures are in place for TCFD alignment can help ease the process. It’s also critical to get your management team and board involved right away. Here’s how:

Ask management to consider:

- Integrating climate related-risks and opportunities into business strategy

- Ensuring that Scope 1 and 2 greenhouse gas (GHG) emissions are being tracked

- Determining any climate-related risks and opportunities that should be tracked outside of GHG emissions

- Building an internal steering committee or management system that regularly reports on climate-related metrics, issues, and progress

Ask your Board of Directors to consider:

- Overseeing and guiding the integration of climate-related risks and opportunities into corporate strategy

- Ensuring climate-related risks and opportunities are addressed when overseeing annual budgets and major capital expenditures

- Reviewing the company’s climate-related metrics when monitoring implementation and performance

TCFD Can’t Be Ignored. Climate Change Can’t Be, Either.

With institutional investors increasingly expecting portfolio companies to provide TCFD disclosures and a greater number of regulators mandating or supporting TCFD reporting, this framework has to be on your agenda. And, regardless of any expectations or requirements, climate change presents risks for every business. Including yours.

The Intergovernmental Panel on Climate Change’s (IPCC) report, recently found that a 1.5°C or even 2°C future will likely become unreachable unless deep, wide-scale greenhouse gas emissions reductions occur now. Investors and regulators are beginning to work together to meet the challenges of low carbon transition, emissions reduction, and Paris Agreement alignment. Do your part by ensuring your company has board oversight of climate matters, C-suite leadership on climate risk management, GHG emissions calculations, and a TCFD reporting process in place.

And do it not just to comply, but to survive.