Minding the Move to Mandatory ESG Reporting

Increasingly, the worlds of corporate governance and financial reporting are colliding with sustainability, and regulations will become the primary driver of this transition from voluntary to mandatory reporting of data. ESG and financial reporting professionals recently took notice at the annual AICPA Conference, where mirrors others, including discussions at the recent Society for Corporate Governance meeting.

As companies contend with this shift toward mandatory ESG reporting, it will impact everything from strategic communications to accounting operations and audit cycles. Ultimately, success will involve tailoring ESG strategies in relevant ways, monitoring risks and regulators’ timelines, and enacting a prepared approach to reporting and audit cycles.

Forward-thinking organizations will also benefit from putting sound processes in place, as the level of scrutiny around reporting compliance may well extend to ESG data beyond climate, applying to other environmental and social metrics.

Chart a reliable course for communications

Companies are being asked to provide high-quality ESG data to a variety of stakeholder groups—whether it be institutional investors, customers, lenders, or regulators. The US Securities and Exchange Commission has made it clear that climate risks represent a material risk that could impact the financial performance of a company, and investors care about this information. As such, the SEC wants to ensure that preparers include material information related to these risks in each 10-K, including both qualitative and quantitative information.

To the extent it’s relevant to the financial performance and financial outlook of a company, material information in the sustainability report should not be omitted from the 10-K. Over the past year, the SEC provided comment letters to several companies that had disclosed variances across these reports. In early 2022, one-third of S&P 500 comment letters released from Dec. 4, 2021 through March 4, 2022 were related to climate change. As a result, data and information that may previously have lived in sustainability report alone are now increasingly coming under the purview of a broader set of stakeholders that require investor-grade, reliable information.

Because companies will face increased scrutiny over their disclosed ESG data and commitments, the data needs to be consistent, reliable, and comparable year-over-year. This requires an alignment of internal stakeholders and resources to manage ESG data and the reporting process. In addition, the necessary alignment also means companies must worry about relevance and priority-setting, which are essential when integrating ESG data and reporting into corporate communications planning.

Look at ESG with a risk management lens

There is an array of disparate reporting frameworks, rating agency requirements, and stakeholder requests for data. Approaching ESG data from a risk management perspective helps identify why certain data is heavily weighted or more frequently requested in a specific industry. Answering risk-focused questions will help transform ESG from a compliance exercise into a competitive business . What risks relevant to your company is a rating agency measuring? What are the risks and metrics that are material in your industry, and how do you use them to drive strategy and internal buy-in? By examining these questions, companies can better engage with ESG. A coordinated and demonstrated commitment to high-quality ESG reporting can position a company as a safe, sustainable investment through reduced liability and greater risk oversight.

Leaning into a corporate strategy that involves ESG is a complex undertaking that must include management review across key reporting functions, such as accounting, finance, investor relations, and sustainability. This comprehensive input will ensure consistent data and messaging for ESG disclosures across the organization. This process will also underline the importance of preparing and reporting reliable, accurate ESG data—including information disclosed in the 10-K, proxy statement, and sustainability report.

Pull a page out of the financial reporting playbook

In preparation for upcoming regulation and broader industry trends, it is time to start treating the preparation and reporting of ESG information with the same rigor as financial data. This means focusing on the accuracy and completeness of ESG data, identifying the necessary team and collection processes, and putting the controls in place to ensure investor-grade information. Before data is reported, it is necessary to know the sources, assumptions, and models associated with all data to be disclosed. Companies must have checks in place over data transfers, complex judgments, and final reported amounts.

Tee up audit season with SEC timelines in mind

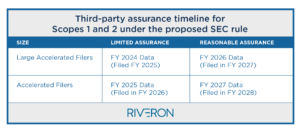

Auditability of an organization’s ESG data is not only a best practice but may be required under the final SEC climate disclosure rule. Currently, limited assurance over climate data would be required for all companies, with different timelines depending on a company’s classification. Each company should start implementing internal verification processes regarding climate data before sending it to a third party.

Though the proposed SEC timeline gives companies a few years of runway, it is important to prepare for compliance now and establish the internal systems, processes, and controls for one or two years of baseline data prior to full adoption. This proactive approach will provide a level of data-related confidence prior to reporting publicly, and it will position a company to address any upcoming regulatory changes while awaiting final rulemaking from the SEC.

Forward-thinking organizations will also benefit from putting sound processes in place, as the level of scrutiny around reporting compliance may well extend to ESG data beyond climate, applying to other environmental and social metrics. In the short term, this looks like gathering top-down buy-in, identifying internal teams that own separate ESG data, and determining which ESG metrics are relevant to the company. In the long term, companies that report accurate and material ESG data present a lower risk and more sound investment. A commitment of internal resources will enable ESG compliance today and may lead to a lasting competitive advantage.

Need help with ESG reporting and audit readiness?

As companies prepare for year-end cycles—especially as the scope of expands to include assurance over climate data—it’s imperative to refine approaches and align ESG procedures with annual financial reporting and audit readiness efforts. Our team of experts is available to guide processes and uncover avenues for competitive differentiation by helping your organization with everything from ESG roadmaps to reporting.