US Shale Producers Could Face Another Bankruptcy Wave

This article first appeared in Hart Energy.

Wall Street’s ongoing pursuit for E&Ps to prioritize investor returns over growth could be driving some U.S. shale producers back into financial distress.

“Absent significant changes in oil prices or renewed access to capital markets, an additional wave of E&P bankruptcies might be forthcoming,” Paul Jansen, managing director of energy advisory services, told Hart Energy.

Behind Jansen’s prediction is the industry’s shift to a lower growth mode being pushed over the past year by Wall Street. E&Ps have largely met these investor demands by retooling their budgets to lower spending. However, Jansen said this has set off a chain reaction leaving some producers, particularly the smaller E&Ps, financially hamstrung.

“Some of the larger E&P companies are more successful just because of their scale and resilience,” he said. “But specifically, the smaller E&P companies are struggling in finding a right balance between capital discipline and maintaining growth.”

The E&P industry already experienced an initial wave of more than 100 bankruptcy filings in the first two years of the 2014 oil crash. The numbers of filings have decreased substantially since then, though, with 24 filed in 2017 and 29 in 2018, according to a report by law firm Haynes and Boone LLP.

Despite improved oil prices since the downturn, crude markets still remain in a period of volatility. The energy sector itself has also grown largely out of favor with investors. For example, energy has fallen from 16% of S&P value at peak in 2008 to 5% currently.

“Investors have been hurt in the downturn that happened [in 2014],” Jansen said. “They’re more skeptical and as a result management has been switching focus from growth to living within cash flow.”

The change in strategy hasn’t been easy for producers and has added another level of pressure to an already volatile industry. A foreboding amount of corporate maturities with approaching due dates also still hovers on the horizon for several E&Ps.

Due to weak energy capital markets, some companies may not be able to avoid restructuring their debt through bankruptcy. And others, Jansen said, may be heading for Chapter 11 for a second time.

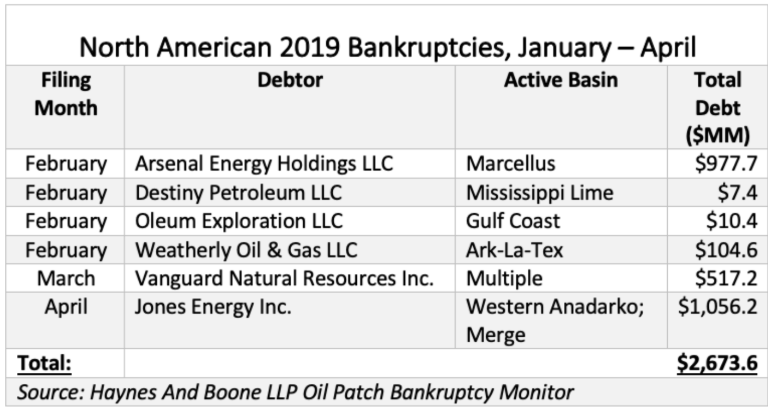

As of May 1, six E&P companies had entered bankruptcy in 2019, including Vanguard Natural Resources Inc., according to a Haynes and Boone report. Vanguard’s bankruptcy on April 1 marked the second time the Houston-based E&P had filed for Chapter 11 since the 2014 oil crash.

Jansen said his team at Riveron took a look at six different E&Ps—Halcón Resources Corp., Amplify Energy Corp., Midstates Petroleum Co. LLC, Sandridge Energy Inc., Ultra Resources Inc. and Vanguard Natural Resources—all of which had entered bankruptcy between 2016 and 2017.

As these particular companies emerged from bankruptcy, they each laid out projections for production plus prices and the revenue cost. Jansen said the predictions of prices were spot on with the actual prices.

“What is different compared to what the companies planned for is the capital that was spent has been significantly less than what they thought they would spend,” he said. “Between the six companies, it’s about 50% less what they actually spent compared to what they thought they would spend.”

Driven by Wall Street’s mandate, companies are spending less capital and therefore drilling less wells. This is leading to a decrease in production for some E&Ps.

“Wall Street, instead of seeing fast growth, want companies to live within their cash flow,” he said. “And to live inside cash flow, companies are spending less and drilling less. As a result, the production is going down along with their revenues.”

Jansen said he believes this will cause a lot of problems for these smaller oil and gas producers. Some smaller E&Ps might find relief from merging, though he noted the difficulty in completing these transactions.

“It’s very difficult to work with those various entities of weaker E&P companies to successfully merge,” he said. “So, even though the consolidation of smaller E&P companies—especially small public E&P companies—might create synergies, I think that’s challenging for the public entities.”

He continued that what we could see is smaller E&P companies with fairly strong balance sheets consolidating and becoming bigger. For example, Amplify and Midstates—two of the companies Jansen’s team analyzed—agreed to merge in early May. That transaction is expected to close during third-quarter 2019.

Even with the challenges, Jansen believes there is a market for smaller E&P companies. “My hope is that once Wall Street sees the shift in strategy from the various E&P entities where they are able to live in cash flow that will change,” he said. “I think there is still massive upside there [but] it might take some time for Wall Street to regain confidence and go back to investing in E&Ps.”