Crude is Fighting a Two-Front War

The oil and gas industry is experiencing a historical one-two punch that pushed crude below $20 per barrel before recovering to $23 as of Friday’s close.

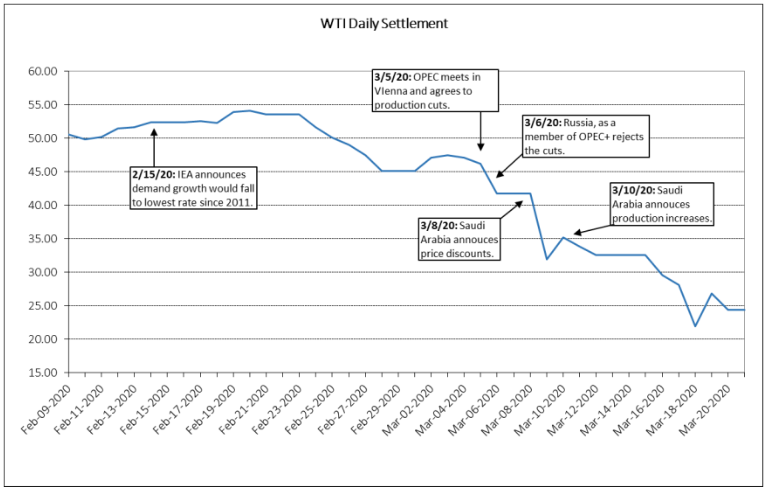

When Russia rejected OPEC’s proposed production cuts, Saudi Arabia declared a price war by hiking production to 12.3 million barrels a day and offering deep discounts for its customers in Asia, Europe, and the United States. In response, WTI dropped 20% on March 9th – the worst single day drop since the Gulf War.

At the same time Saudi Arabia and Russia made the decision to flood the market with excess crude, COVID-19 was declared a global pandemic. With the world economy grinded to an unprecedented halt, demand for oil is cratering.

E&P companies are drastically cutting capital expenditure budgets, and hedges will soften the blow in the short term for those that have them. Oilfield service companies are being forced to furlough employees. After pulling these levers, the macroeconomic situation is largely out of the industry’s control until the virus subsides and Saudi Arabia changes its current policy stance. However, there are several elements in your control that must be managed to limit the impact of these crises and extend your company’s liquidity runway until they subside.

Our Recommendations

Liquidity forecasting

First and foremost, you must focus on near-term liquidity and access to cash. Without adequate liquidity there is no prospect of long-term viability. Consider the following when it comes to liquidity forecasting:

- Update and stress-test your liquidity forecast. Stress testing should include further or prolonged decreases in commodity prices, delayed vendor payments, and supply interruptions.

- Take necessary actions if near-term liquidity is or might be inadequate.

- Evaluate financial covenants and engage with your lenders. Evaluate your lenders if deemed necessary.

- Consider other sources of available credit, e.g. receivables factoring.

Extend credit terms and limit investment

Next, it is important to focus on limiting future cash outflows and reduce liabilities (both on and off balance sheet). Carefully manage liabilities and conserve cash by:

- Reduce discretionary capital expenditures.

- Analyze the impact of non-discretionary capital expenditures and the associated cost of noncompliance.

- Engage governmental and state agencies to defer remediation expenditures and (temporarily) decreased royalties.

- Stretch and renegotiate payment terms on mandatory expenditures. When communicating with vendors, it is important to have a consistent and well thought out message.

Reduce operating costs

Finally, defer operational improvements and cost reductions by:

- Consider opportunities to (temporarily) reduce costs.

- Create new performance metrics and reporting to monitor and manage operational efficiencies.

- Risk management remains a priority and ensure that environmental, health and safety procedures are not compromised.

Strategic alternatives

While planning for a long-term viable enterprise, in certain cases contingency planning is necessary. Educate yourself on strategic alternatives in a down-case scenario.

We can help

No one knows what the future will hold or when these crises will subside but taking decisive action now will put you in the best position to weather the storm.

Riveron has vast experience helping energy companies in distress navigate crises like these. We are here to answer your questions or provide our perspective on your unique situation and help in any way we can.

To learn more, access our guide for dealing with disruption and preparing for the now, the next, and the new normal.