Three Success Drivers for Technology Due Diligence

For any business engine today, technology serves as the fuel. During a merger or acquisition scenario, technology can be fraught with risks and hidden costs. Prudent investors must uncover this information to better realize synergies during a transaction. Consequently, it is essential for investors to conduct IT due diligence and assess a target company’s technology landscape. The process ensures a realistic valuation by identifying short- and long-term investments necessary to bridge any technology gaps, and it helps build a strong integration strategy.

IT diligence examines many aspects within the organization: the technology strategy, processes, and organization structure, existing business applications, IT infrastructure, and IT risks and controls. Because diligence covers many facets, the depth and focus of these efforts should be tailored to the integration thesis and overall strategic objectives of the transaction. Here are a couple of examples:

- One buyer’s integration thesis might include system rationalization and consolidation, with strategic objectives primarily focused on cost reduction. In this case, the diligence effort might place more emphasis on the target’s business process requirements, developing a fit-gap analysis with the future state business applications, and ascertaining cost targets for the business application integration.

- By contrast, another transaction might seek to leverage the target company’s technology platform for a new use case. Here, the diligence team might turn more attention to understanding the business model, capabilities, scalability, and security of the platform. These efforts could accommodate the future technology use case as part of the diligence assessment.

During diligence, a trusted business advisor can help by uncovering hidden risks and enabling buyers to appropriately plan, mitigate issues, and safeguard their investments. To ensure success during IT diligence stages, buyers and their trusted advisors should use three elements as a guide: 1) maintain a technology executive’s perspective, 2) deploy a consistent yet tailored approach, and 3) translate findings to address and mitigate key risks.

(1) Maintain a technology executive’s perspective

The due diligence process should look at the full technology landscape through the lens of acquiring company’s technology executives: the chief information officer (CIO) or chief technology officer (CTO). In a company’s journey, these IT leaders are key players who not only increase shareholder value through the application of technology and data but also help realize the shareholder value in the chosen timeframe.

As such, CIOs and CTOs should also play an active and strategic role in the diligence process to help identify technology-related opportunities, costs, and risks. To frame this perspective, several important questions to ask include: 1) what are the short-term and long-term technology strategies? 2) what systems are currently in place and how are they used? and 3) how well can those systems (and the data housed by them) integrate to form a new infrastructure? and 4) what are the business needs now versus in the future? and 5) how quickly does integration need to happen? and 6) is technology going to be a value differentiator or a support mechanism? The answers to these questions can help shape the scope for an IT due diligence assessment.

By identifying key risks and engaging technology leadership early on, acquiring companies can develop appropriate mitigation plans. If the assessment indicates substantial impact on the operating model or will need considerable investment to bridge the identified gaps, this information can be leveraged during negotiations.

During the diligence phase, advisors should coordinate with the technology executives and the diligence team to validate the vision, strategic direction, and goals of the transaction so that the engagement can be properly scoped.

(2) Deploy a consistent yet tailored approach

An IT due diligence team should deploy a consistent diligence framework to ensure that IT capabilities remain a priority and are adequately assessed. The framework should target key areas of risk, and the IT diligence efforts should be structured to support the larger due diligence effort.

Generally, a successful approach is accomplished by conducting a holistic current state assessment of the target’s organization’s IT landscape. The holistic assessment should focus on risks associated with the target company’s existing IT organization, business applications, and IT infrastructure.

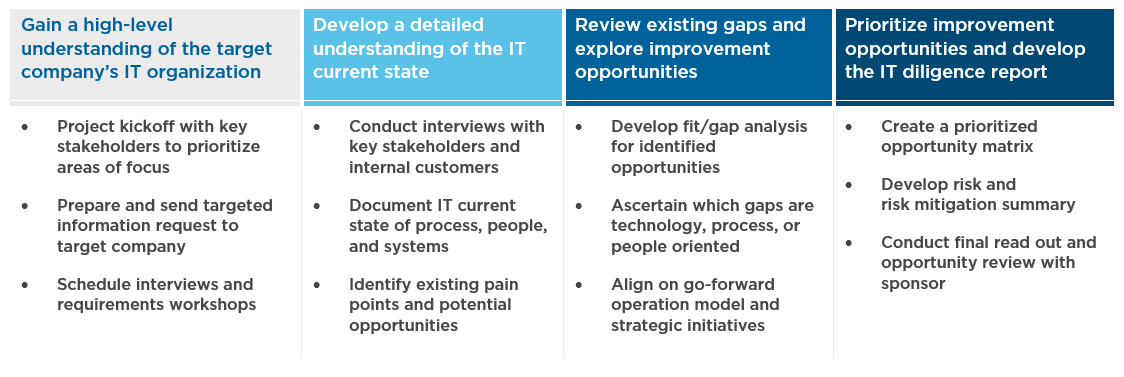

A sample effective IT diligence approach:

Understanding the goals of the transaction and following a consistent yet tailored approach should maximize the value provided through IT due diligence.

(3) Translate diligence findings to address risks

A central benefit of IT due diligence is that it helps buyers identify any risks that could impact the transaction and the ensuing integration. These risks can manifest in many forms: ranging from insufficient licensing to a disintegrated or severe IT landscape. If IT due diligence efforts are inadequate, companies might face several common risks such as:

- Lack of visibility into the target company’s performance: A comprehensive understanding of the technology landscape of a target company is critical to identifying associated risks and opportunities involved and ensuring a successful transaction.

- Uncertainty of the IT landscape and its scalability: IT systems are often overlooked or deprioritized during a transaction, often because the technologies (such as an ERP, CRM, HRIS, or other systems) are assumed to be fitting for current and future needs. Core business applications may not be scalable for growth. The systems might need additional investment to meet the needs of the business and might cause significant inefficiencies because the systems are not integrated. Unforeseen issues might also arise if an application must be transitioned from a seller, which might include data integration and security challenges, and high implementation costs.

- Unknown technology skillsets and in-house expertise: Many teams lack the expertise, organizational structure, and processes to scale for growth. Or teams with limited or no transaction experience do not have the ability to fully evaluate the associated risks and opportunities.

- High transaction costs: Inefficiencies in a merger or acquisition process can increase transaction costs, preventing the ability to realize synergies and capitalize on valuable opportunities that arise.

- Undefined go-forward IT integration plan: Managing the details of a transaction can prevent teams from looking ahead to how the current technologies will impact the organization, post close. Developing a thoughtful IT plan is vital to a successful integration and to ensure that the future state aligns with the organization’s strategic intent.

- Concerns related to the transitional service agreement (TSA): Significant penalty costs and workload can arise from a transaction close to migration from a TSA into stand-alone entity, often with resources that do not have familiarity with this type of effort. In some scenarios, IT-related TSA costs might be underestimated due to limited financial visibility (e.g., complexity related to legacy group cost allocation methodology or lack of granular account expense classification). Costs might also be underestimated if the seller does not provide adequate support during the TSA period, resulting in the buyer’s IT team being unable to implement new projects or make necessary, planned changes to the target company’s legacy IT applications and systems.

Diligence can uncover many IT challenges, including the common ones outlined above. Once risks and challenges are identified, it is important to translate these findings into an actionable integration roadmap. An actionable roadmap will ensure success for all stakeholders, help businesses avoid failure during the integration stage, and help the organization realize the intended value of a merger or acquisition. Diligence findings can be used as a foundation for Day-1 planning efforts and to develop a prioritized post-close integration roadmap. Using these findings integration plans and priorities will ensure that businesses create the desired value while managing risks.

As technology continues to play a critical role in business success, prioritizing a comprehensive approach to technology due diligence will help buyers differentiate the investment thesis and models for post integration operations. These elements can significantly enhance the value of a deal.