M&A and Tech Synergies: Recipes to Add Value

Whether looking to cut costs or drive strategic change, executives and corporate development leaders can achieve desired outcomes during mergers and acquisitions by understanding complexity and focusing on a coordinated technology effort.

When taking on mergers and acquisitions (M&A), executives and corporate development leaders often seek to add value by implementing changes at a newly combined business. M&A-related changes may take place for various reasons: to optimize existing operations, create new market opportunities or deepen capabilities. Often, these change initiatives involve technology as a central focus—paired with varying degrees of complexity. During a merger, creating technology-focused value is akin to perfecting a recipe.

Realizing synergy is like the culinary term: “umami,” characterized by longevity, complexity, and balanced flavor. Likewise, for leaders facing the complexities of M&A scenarios, planned synergies center on reaping long-term benefits and a desire to bring effective balance to merging organizations. And yet, like a complex umami flavor, ensuring a merger results in its intended value requires ample restraint, focus, and rigor.

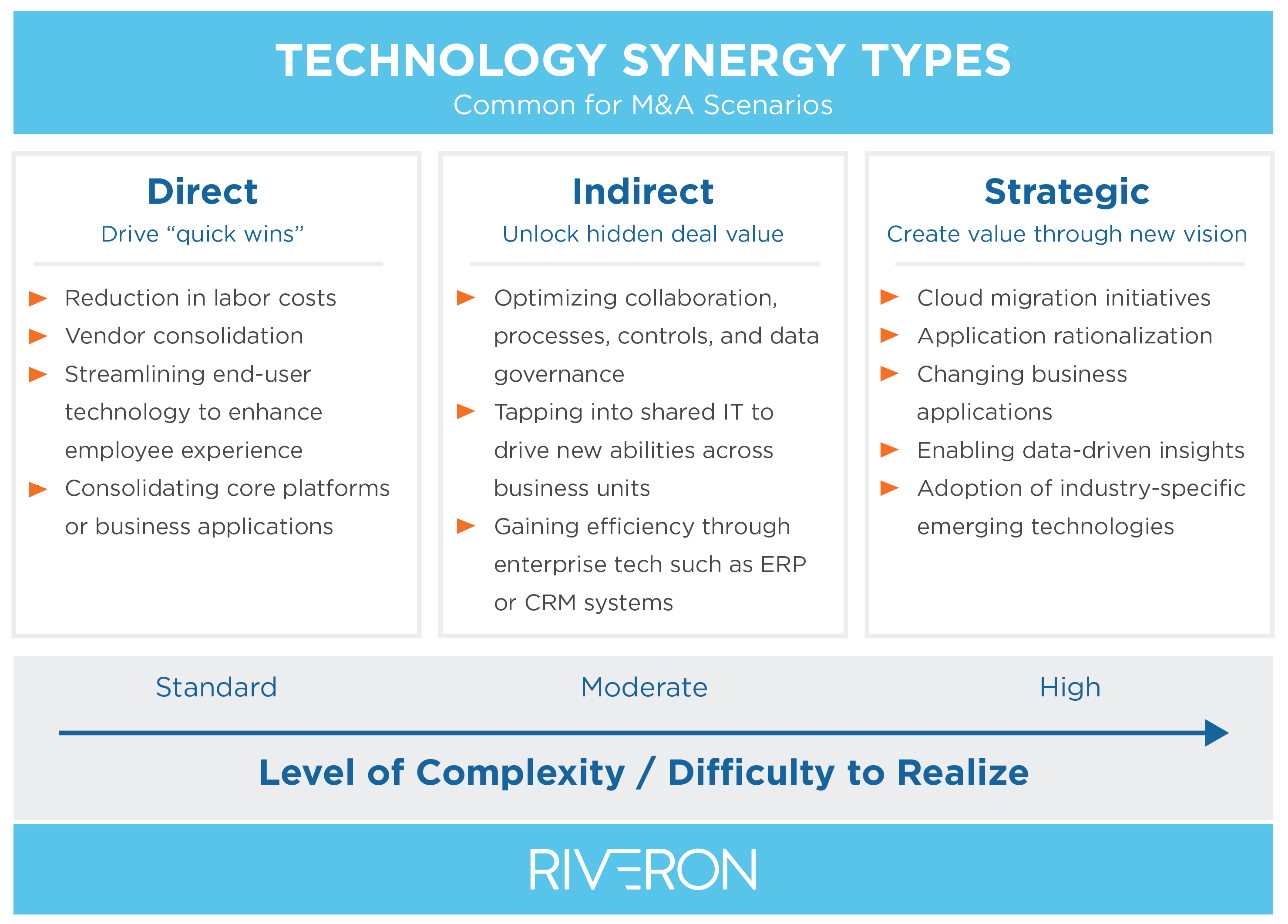

To be well-positioned to harvest intended value from a merger, a company needs to place early and significant emphasis on technology as part of its transaction strategy. Technology synergies often fit into the following three categories:

1) Direct Technology Synergies

COMPLEXITY LEVEL: STANDARD

Key sources of direct technology synergies include reduction in labor costs (including contractors), vendor consolidation (for services and products), streamlining end-user technology. It also can include consolidating core enabling platforms such as hosting services, communication, and collaboration platforms. For example, the integration team may seek to combine multiple hosting services to one provider to enable pricing leverage. In order to plan for this type of synergy, businesses need to engage the technology leadership team during due diligence.

Organizations could pursue many avenues to drive value from direct technology synergies, including those related to encumbered waste in the organization. This might involve eliminating redundant and manual processes, duplicated technologies, dead technologies, or finding ways to stop perpetuating irrelevant history through technology initiatives.

While synergies of this type—ones that reduce costs through vendor consolidation or labor efficiencies—can be realized as “quick wins” within 90-120 days of close, they must be planned and executed with utmost care to not disturb the customer experience or employee effectiveness. Often, these early-stage initiatives set up the momentum for additional complex changes that might be planned.

TIP | DIRECT TECHNOLOGY SYNERGIES

For many acquisition scenarios, labor cost cuts are often a go-to, attainable win. Instead, leaders should take a more holistic approach, identifying which direct technology synergies are most appropriate for the “quick win” stage, lest a growing company finds itself short of talent when needed.

2) Indirect Technology Synergies

COMPLEXITY LEVEL: MODERATE

Unlike direct synergy counterparts, indirect technology synergies are often not captured as part of the deal rationale. However, indirect efforts remain important levers to help unlock “hidden” deal value. Examples include optimizing process, controls and data governance, shared information technology (that would allow for operational efficiencies if new intellectual property or processes can be applied), and other efficiencies gained from enterprise applications (such as enterprise resource planning (ERP) or customer resource management (CRM) systems, corporate performance management (CPM) software, or others).

For these types of synergies, considerations for success may stem from whether an organization properly harnesses data and has a sound approach to govern its data. Related to indirect synergies and data integration, leadership can consider four key questions: 1) how will data be shared as a joint organization? and 2) how is data collected and what systems are used? and 3) what are the business needs now versus in the future? and 4) does one organization have a better playbook on harnessing data? The answers to these questions can help shape an effective data integration approach to drive indirect synergies. These considerations can also help leaders avoid common integration challenges, such as duplicate records and the absence of a single source of truth, which can result in ineffective strategic decision-making.

Indirect synergies often lag behind integration planning efforts and can cause tension immediately following close. This can happen because combined companies likely have different processes and systems—common barriers to immediate value creation. As such, to avoid business or operational disruption, indirect technology synergies should be included in any day-one or post-integration planning efforts.

TIP | INDIRECT TECHNOLOGY SYNERGIES

Technology leaders should assess these types of synergies in the early stages of integration planning to help mitigate potential disruption to business or operations and unlock deal value sooner.

3) Strategic Technology Synergies

COMPLEXITY LEVEL: HIGH

In the age of rapid technology innovation and disruption, M&A transactions can serve as a window of opportunity to unlock value well beyond the initial transaction. This extended value can be unlocked through the capture of strategic technology synergies such as migration to the cloud, replacing ERPs, and other strategic transformations.

Some strategic initiatives that are emerging as favored ways to add value are those that enable data-driven insights. One such initiative is the effort to obtain a 360-degree customer view, which is the idea that a company can get a complete view of its customers by aggregating data from the various touchpoints throughout the customer journey, and this can lead to actionable insights. This often requires an effective data analytics strategy that marries structured data with unstructured data from a variety of sources that require an assurance of data quality.

Integration can also be an opportune time to consider workflow automation to drive additional strategic synergy. Significant advances in automation technology such as robotic process automation (RPA) have occurred in recent years. Today, workflow automation can be applied across industries and functions, with applications across finance and accounting, IT, human resources, legal, procurement, sales, and more. Automation can have numerous benefits on an organization, including cost and time savings, enhanced efficiency, productivity, and accuracy, and turnover reduction.

Cloud migration initiatives, application rationalization, and changing business application products are also examples of strategic synergies. Sometimes these changes occur due to a strategic, leadership-driven transformation initiative. Other times, companies respond to a needed change, such as products reaching end-of-life stages. For example, a certain on-premise technology or legacy application may need to migrate to a cloud-based solution. Often this change is not merely an upgrade, but a full re-implementation, as the new product can be significantly different.

Of the three types, strategic technology synergies are often the most complex and require a higher initial investment. As a result, businesses often pause such activities until core integration activities have been completed, but delays come with potential downsides: prolonging the overall timeline, hampering value realization, and leading to fatigue for the deal itself or the post-deal integration.

Instead of passing up efforts that may drive the most strategic value, organizations should begin at the very early stages of integration planning by thinking about their end-state vision and associated technology transformations needed. Early planning allows associated risks to be validated as part of due diligence. Using this approach, leadership can better forecast and synchronize potential benefits by applying strategic transformation levers throughout the transaction lifecycle.

Three strategic technology questions for leadership to consider: 1) is technology going to serve as the strategic differentiator or just as a tool? and 2) is the go-to-market strategy going to change upon acquisition? and 3) how is the business going to leverage data to drive strategic decisions? The answers to these questions can help shape the journey.

TIP | STRATEGIC TECHNOLOGY SYNERGIES

For companies to optimize value realization, corporate growth and technology leaders should work together to prioritize and develop the organization’s end-state vision. Teams should sequence integration and transformation activities in alignment with that vision.

The right course: balance amid complexity

Decisions related to synergy realizations are not unilateral; often they are punctuated with the fine balance between complexities or short-term gains versus long-term strategies. Additionally, industry trends, evolving regulations, economic patterns, or other external factors must be incorporated into these decisions. Such factors could have lasting impacts on the growth of an organization.

Ensuring early cross-functional alignment between business functions and technology is critical to long term success, but executives should develop an organization-wide agility to pivot when needed. To set up the organization for success, leadership should focus on robust integration planning that overlaps with the organization roadmap coupled with relevant success metrics. Additionally, a robust governance structure straddling both business-as-usual and new integration activities will facilitate a steady operational environment.

TIP | SET THE TABLE FOR SYNERGY

At some stage of the lifecycle, businesses will inevitably “pay” for the integration efforts. So, it will serve integration teams well to ensure the process unfolds as intended—the first time around. A qualified team should be placed at the helm of executing integration activities, equipped with adequate funding. Relevant metrics should also be tracked throughout the process.

Executives sometimes find themselves running M&A initiatives without adequate “sous chefs” that specialize in executing these complex transactions. An unprepared or underfunded team will fail to achieve desired synergies. Engaging technology leadership (CIOs or CTOs) and other qualified advisors early in the due diligence process can help drive long-term technology synergies. These leaders can best identify the spectrum of potential technology-related initiatives that align with the desired strategy and can help build an integrated roadmap suited for the combined company.

Throughout a complex M&A endeavor, technology can be a main component that enables value. Shaping a suitable integration vision—by setting an informed, proper team in place—will guard against technology serving merely as a costly garnish.