Reimagining Operations at US Airports

During recent months, the impact of COVID-19 on the airline industry has been well documented, and data released by the International Air Transport Association (IATA) makes for even more grim reading with beginning of 2021 bookings for future travel down significantly by 70% compared to January 2020. This sharp decline in flight demand leads to falling revenues and requires airport management to implement adapted operational concepts and reduce short-term costs.

Just as with the high street and shopping malls, retail outlets at the airport terminals have also been devastated by the COVID-19 pandemic. However, as passenger traffic starts to return, the airport operators will need to collaborate with all stakeholders to effectively manage a sustainable service delivery ramp-up plan—particularly for passenger amenities such as food and beverage and retail.

(1) Airports must adjust operations as social distancing protocols and longer processing times endure

Even with the roll-out of the vaccines and reducing COVID-19 cases, it is likely that social distancing mandates will continue for the foreseeable future. To ensure public confidence, airport operations experts must consider necessary protocols and address social distancing concerns related to:

Airport space requirements

Immediate impacts include passenger queueing distances, lounge occupancy levels, and modifications related to remote busses or automated people movers. Other details that may change include the number of new or modified check-in counters, security lanes, passport-control areas will be required.

Logistical impacts for passenger processing and connection times

Responding to the latest COVID-19 protocols, airport operations will likely face a massive impact on passenger flow, system capacity, transfer times, and travel duration. Some operational issues to address are: new processes and impact points for passenger flow (for temperature or health certificate checks); impacts to turnaround times (when boarding takes much longer and may influence the stand capacity); how process changes generally impact transfer and travel times; and how to ensure connections with higher MCT (Minimum Connecting Time).

Safely preparing airport operations for an eventual increase in demand

Ultimately, airport operators must ensure the health of staff and passengers, and as demand resumes, prepare for the coming gradual increase in flight operations. Airports face an ongoing mandate to protect staff, especially in areas in which there is an increased risk of infection. Some initiatives like “no touch” will contribute a lower risk profile and may present other benefits for passengers, such as lower wait times and facilitate all aspects of the passenger flow. Airport operations specialists will need to include staff protection measures in process design, and determine adequate workforce levels needed to operate checkpoints to accommodate current protocols and forecasted higher-demand circumstances.

(2) Despite constrained passenger demand, airports can implement changes, recover, and grow

As the global economy shows signs of stabilization related to industrial production numbers, IATA has indicated a lag in recovery for passenger air travel statistics, with air passenger travel numbers lagging far behind the amount of cargo being flown. This prolonged, overall reduction in number of flights has undesirable impacts related to the revenues that airports receive from airlines—meaning falling aeronautical revenues such as landing charges for aircraft and security charges. As fewer people fly, the airports also see a decline in non-aeronautical revenues from parking, facilities, restaurants, or the purchase of duty-free items.

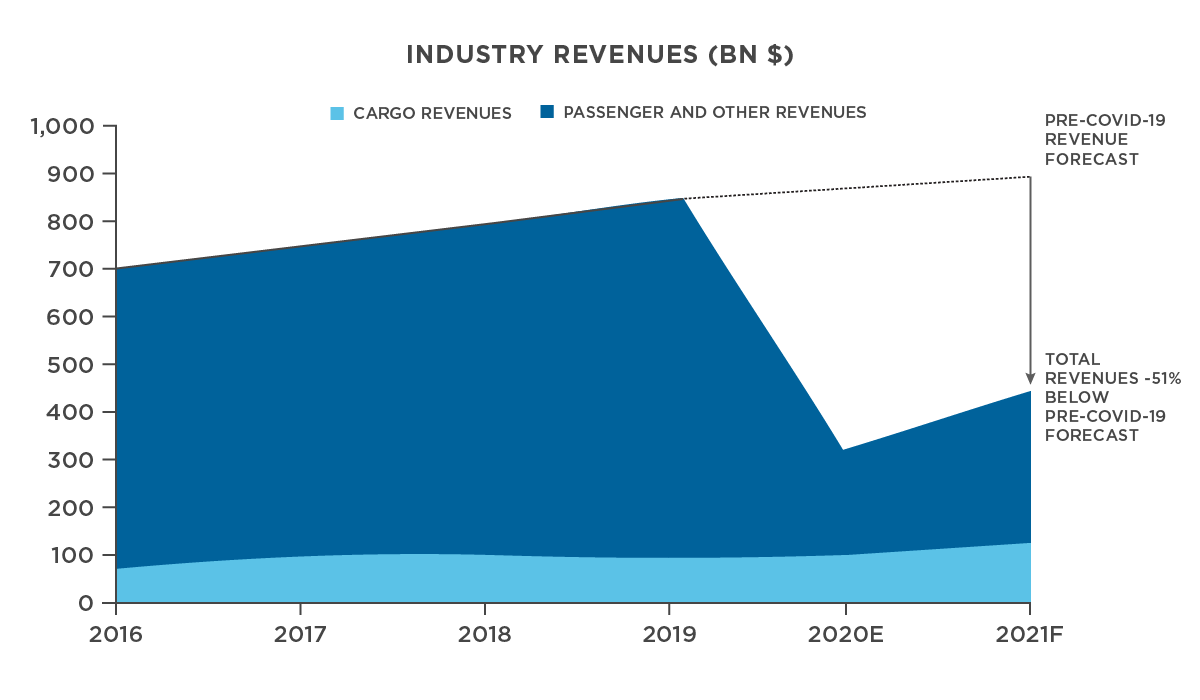

Figure 1: lower revenues call for a reduction in costs for the airline industry and airport operations. 2021 revenues projected to be 50% of original expectations prior to the COVID-19 crisis.

Sources: IATA Economics

Airport executives and operational planners will have to make several critical financial decisions that will address immediate and longer-term viability of airport operations, focusing on the following areas:

Managing cash, appraising future capital expenditures, and determining future liquidity requirements

Entering 2021, the reality of the COVID-19 pandemic on airport operations is that cost containment has been unable to keep pace with revenue shortfalls. The debt-to-EBITDA ratio is a direct illustration of an airport’s liquidity position and its future health. A higher ratio implies that an airport operator is heavily leveraged and therefore may be struggling to pay off its debts. An airport industry report from ACI discussed the fact that the airport sector debt-to-EBITDA ratios are set to double from five to 10 as a result of the revenue shortfall.

Not only is the debt-to-EBITDA ratio worsening, but numbers reported by a commercial airport trade association estimate the total outstanding debt for US commercial airports is growing. US airports—irrespective of revenue shortfalls—must pay $16billion to service the debt for 2020 and 2021 fiscal years.

Due to the pandemic, credit metrics from S&P Global and others have assigned a generally negative outlook to many airports, primarily driven by uncertainty over the length of the recovery period for the airline industry. Airport operators will therefore need to carefully manage their debt exposure and avoid debt financing, and conserve capital for unexpected issues or to reinvest once air travel demand patterns seem more certain.

While airports have high fixed costs, many are already taking steps to reduce variable costs where possible. These cost reduction measures include closing certain runways, furloughing staff or reducing salaries, curtailing contract services, and postponing capital expenditures (CapEx).

However, most of the cost reduction decisions made to date appear to have been focused on short-term revenue shortfalls. As the future starts to become clearer, certain cost optimization policies and decisions are going to be critical to support financial health.

Another key area for airport operators to focus on reducing costs is to accelerate biometric innovation. Biometric capabilities can reduce costs while significantly reduce human-to-human interaction points from curbside to terminal gates. This increasing use of total airport management systems is expected to revolutionize the entire operations of terminals at an airport.

Diversify airport revenues non-aeronautical

Typically, increasing passenger traffic will drive enhanced revenues for airports. Main areas for the operators to focus on will include: duty free shops, other retail, food and beverage, car parking and rentals, and developing airport properties. Commercial management will have to drive more foot traffic to airport-based retail and revenue-generating spaces, while increasing spend per passenger and improving concession agreement contract terms.

Prepare the airport workforce to face future phases of returning demand

In the next six months to two years, airports need to prepare to eventually resume higher passenger travel levels; and, to ensure airport workforce is prepared, employers will need to give airport-based employees the confidence to return to work. Airport-based workers will expect wage sources to remain reliably funded—with or without employers relying on government support. To supplement operations, there is no doubt that airports will have to focus on reducing the cost of labor through accelerating automation, introducing digitization strategies, and redesigning jobs.

As airport operators start to implement changes that can proactively address pandemic-related realities, operators must also prepare for US airports to return to normal levels of demand. Current considerations can spark positive change for airport operations, allowing operators to shape a future experience that is safe, profitable, and better suited for the expectations of airline passengers and a modern, airport-based workforce.