Modern Finance: Working Capital for Growing Companies

For growing companies, technology-backed processes can enable a stronger foundation to manage and improve working capital.

A modern approach to ensuring financial health and stability is of paramount importance in the current business climate amid growth market trends and lingering pandemic-driven uncertainties. Companies must evaluate and optimize their cash positions and sustainably manage working capital: the balance between current assets and current liabilities, netting receivables, payables, and inventory. Effective working capital management requires consistent and timely receivables collections, strategic vendor payment terms negotiation, and minimal inventory holding periods.

Periods of high growth add layers of complexity to the working capital equation for both private and public companies. Complexity often stems from an accelerated pace of cash consumption and unsustainable reliance on external financing. A variety of factors drive current expansion trends, including organic growth initiatives, private equity-backed mergers and acquisitions (M&A) activity, and traditional initial purchase offerings (IPOs) or non-traditional public filings such as SPACs. These scenarios depend on a foundation of liquidity, operational efficiencies, auditable transactions, and short-term financial health, which are made possible by proper systems and processes that enable optimized working capital and sustain growth.

Regular evaluation as part of the normal course of business is a distinguishing characteristic of optimal working capital management. Routine evaluations provide tangible benefits to cash positions, enable better financing opportunities, enhance competitive advantages, and allow management teams to run businesses with increased confidence. By helping businesses run smoothly and supporting fact-based decision-making, technology solutions can further maximize working capital positions.

The invoice-to-cash (ITC) process is a notable opportunity area for rapidly optimizing working capital. While enterprise resource planning systems (ERPs) gradually enhance their product portfolios, targeted point solutions for end-to-end processes have become available, offering advanced, comprehensive features. Along with defined operating models, these modern solutions improve visibility of key working capital metrics and trends—enabling better tactical operations, improving information transparency, and ensuring compliance and clean data. Modern solutions also drive employee satisfaction and high-value utilization through a reduction of tedious tasks and resulting burden. By implementing ITC automation enhancements, some organizations[1] have successfully reduced invoice generation time by 30% to 50% and decreased days sales outstanding (DSO) by 20% to 40% while maintaining or steadily rationalizing functional staff.

Enabling better tactical operations

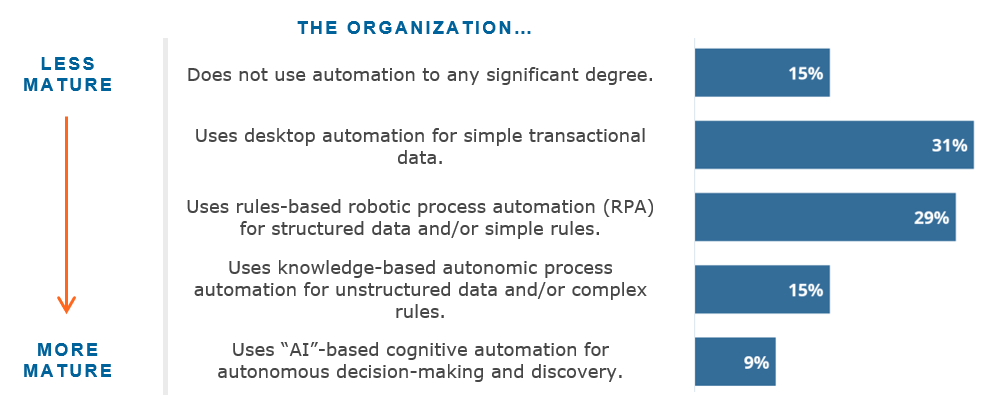

Within the ITC processes, key areas impacting working capital are customer invoicing, collections, deductions and disputes, credit monitoring, customer payments, and cash application. An integrated technology approach to these areas can enable key drivers of working capital as well as enhance the employee and customer experience. In a recent APQC survey (see Figure 1), over half the businesses indicated they have some critical components that contribute to process automation maturity, but fewer than 10% of respondents indicated their organizations had achieved full maturity.

Figure 1: Process Automation Maturity

Shown in increasing order of maturity, fewer than 10% of respondents have achieved the highest level of maturity of automation for end-to-end processes regarding order-to-cash. By contrast, 15% of businesses have not implemented any process automation.

Source: APCQ survey of 150 businesses across many industries with revenues between $100 million and $20 billion.

Customer invoicing: Streamlined invoicing prompts customers to review and pay for goods and services quicker. Whether using home-grown or commercial billing applications, the solutions could integrate invoice data from the ERP and distribute it to customers in real-time. Solutions can either automate electronic delivery to pre-set contacts or enable customers to view and retrieve invoices and pay through a centralized portal. Once fully configured, automation can routinely decrease cycle times by more than half by removing hours or days from the process of generating and distributing invoices.

Collections: Uncollected revenue is a pervasive problem for many businesses with immature ITC processes. Improving collections directly benefits company profitability and value. Automating collections can deliver these benefits in the form of reminders to customers and supply them with the information needed to process payments. Further, it reduces the time employees spend on calling and tracking down counterparts responsible for submitting payments. Technology-based solutions automate the delivery of monthly account statements, send specific payment reminders either electronically or by mail, and attach templated messages to statements and reminders.

Cash application: Once payments are received, it is important to expedite the turnaround time to close out unapplied cash and reflect status on reporting. Connecting received payments to the bank(s) synchronizes and centralizes the flow of information. Cash application technology uses machine learning to match incoming payments via the bank’s remittance detail to open accounts receivable (A/R) items within the general ledger. When properly configured, software can also automatically match parent-child relationships and prepayments. As with invoicing, automation can accelerate cycle time by more than 50% by removing manual steps, while decreasing the likelihood of human error almost entirely.

Credit and risk monitoring: Real-time monitoring enables a business to proactively manage customers’ credit ratings and provide indications of potential payment delays or bad debt. Linking customers with systematic daily monitoring alerts notifies changes to relevant details such as credit scores, buying behavior, news, legal filings, and bankruptcy filings. Having access to the latest credit and financial data of customers strengthens the expected cash from revenue and allows for informed decisions and quicker approvals.

RELATED SUCCESS STORY

Positioned for rapid growth, a private equity fund and its leading portfolio company worked with Riveron to help the company achieve the envisioned scale. Both the private equity firm operators and management team understood that at least two key performance indicators (KPIs) needed to be optimized: DSO and on-time invoice delivery.

Riveron assessed available ITC automation software that met the client’s business requirements and proposed a shortlist of vendors for the client to evaluate. After an accelerated implementation and configuration process, the client began to see immediate results: initial decrease of 10% in DSO followed by a downward trend month-over-month enabling reinvestment of newly available cash into strategic growth projects. Customers also gravitated to the self-service portal for invoice reference and retrieval, leading to a spike in on-time and early invoice payments.

The impact and effectiveness of this approach is a product of leadership buy-in, thoughtful selection, low initiation cost and other barriers to entry, and commercial availability of targeted solutions. Within the middle market and beyond, businesses can gain a competitive advantage by leveraging this type of automation to enhance ITC and accounting service delivery more broadly.

Improving information transparency

Once an organization’s processes and technology evolve to a maturity level that produces reliable and accurate information, businesses can then use data to bring working capital management to the forefront of operations. Data flow and intelligibility will improve to a point where information is delivered cross-departmentally, which promotes accountability and better decision-making abilities.

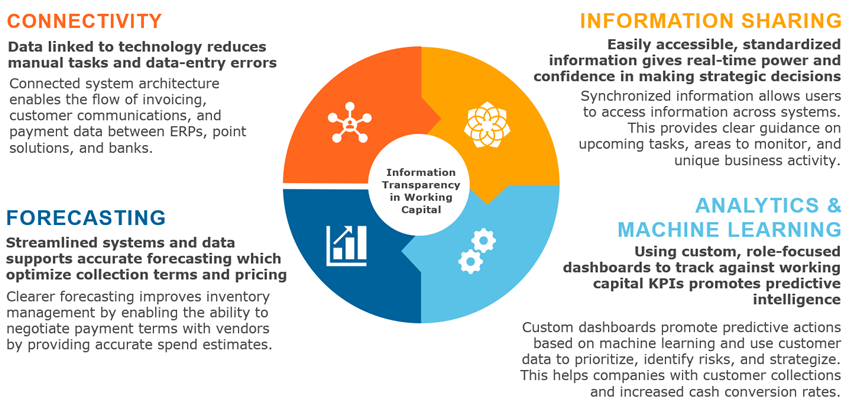

Digitizing working capital processes can enhance information transparency across four major elements: connectivity, information sharing, forecasting, and advanced analytics.

Figure 2: Information Transparency in Working Capital

Ensuring compliance and clean data

Creating an integrated technology and process platform for working capital activities centralizes information and makes a clear line of sight throughout the transaction lifecycle. Eventually, these transactions may need to be validated due to diligence or audit needs. Having a systematic workflow helps a company maintain strong compliance and clean data, which will reduce the erroneous nature of spreadsheets. The outcome gives confidence to management on financial positions and reporting.

RELATED SUCCESS STORY

A global professional services firm recently carved-out a portion of its business and wanted to evaluate its post-implementation environment, seeking to produce reliable financial information that informed key business decisions and enabled better audit readiness. Working with Riveron, the firm narrowed its primary challenges to outdated accounting rules embedded in its project management tool. The team’s audit of project set-up, specifically billing and revenue data, identified a path to correct historical inaccuracies and streamline the process going forward

Riveron evaluated project contracts, corrected the billing and revenue recognition rules within the project management software, processed adjusting entries in the ERP via integrations between the two systems, and applied corrected amounts to invoices and financial reporting. The team also developed and rolled out a new ongoing operating model to better track performance and reduce burdensome manual entry steps.

These efforts enabled the firm’s finance leaders to access billing and revenue snapshots during month-end close analysis more accurately and rapidly. Customers also began receiving correctly depicted invoices, ensuring more timely payments. Finally, the client’s audit trail was made easily identifiable and readily accessible throughout the transaction lifecycle.

Finance leaders wanting to transform their working capital activities now have better opportunities to use technology to improve their businesses. Transformation initiatives can be complex and challenging; however, thoughtful decisions and new applications can produce immediate dividends in cash management and provide other positive business impacts. Leaders can create a vision for what the future can hold by evaluating system capabilities, connectivity, and the ways employees will benefit from modernized tools and processes.

[1]The success metrics of invoice-to-cash initiatives are based on some of Riveron’s recent client engagements. Browse other client success stories here.