Strategic Communications Post-IPO Part 1: The Road to Credibility

Preparing for and launching an IPO is not for the faint of heart. It takes months, even years, of planning and countless meetings with potential investors leading up to the official bell ringing. When the newest public company ticker splashes across the exchange, management teams and IROs may feel like they’ve just crossed the finish line. And while the first day of trading should be celebrated, in reality, the journey has only just begun. The first three years after going public are a crucial time for building credibility with Wall Street.

Separating the winners from the losers

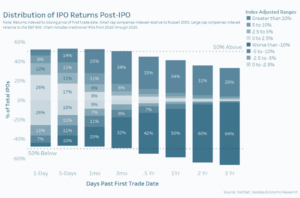

A Nasdaq study examined IPO performances up to three years after entrance into the market. While more than half of traditional IPOs between 2010 and 2020 saw share gains in the first three months of trading, nearly two-thirds of companies saw share prices dip below the IPO price three years after going public.

What happened? Did the initial IPO enthusiasm wane? Did companies miss earnings expectations? Did their stories fail to resonate? More importantly, what did the outperformers do differently to remain in Wall Street’s good graces?

(Source: What Happens to IPOs Over the Long Run? | Nasdaq)

While many factors impact valuation, long-term outperformers do two things very well: they maintain credibility with Wall Street and they maintain alignment with their shareholder base.

Here’s a closer look at how they master these keys to success.

Building Street credibility starts with realistic goalsetting

Life after the IPO is notoriously challenging as management teams strive to balance running the company with meetings investor needs. A new management team typically has just three to four earnings cycles to prove themselves to investors and establish credibility with Wall Street.

Fresh out of the gate, there is no better way to build trust than by meeting the goals and targets promised at the time of the initial offering. The best way to keep that hard-earned trust is to consistently meet those goals, while maintaining transparency along the way.

Here are several steps to take:

- Find the sweet spot. To drive meaningful financial progress, a company must set goals that are within its grasp. Baiting investors with lofty targets may offer short-term gains, but this may come with long-term agony. Find the sweet spot with the company’s targets, then clearly articulate these targets in the go-forward strategy to set the company up to consistently deliver. Be sure to leverage external consensus and consult the “Credibility Zone” when setting guidance.

- Deliver on promises. Conducting an informal “say/do” analysis is a great way to review what the management team said it was going to do at the IPO (and in subsequent quarters), and what it actually did. Maintain a good “say/do” track record, and clearly communicate it with investors as part of the company’s IR program.

- Be transparent. Chances are that even companies with good records won’t hit every goal they set. Being transparent about why a goal was missed and the plan to get back on track will go a long way toward reinforcing the strength of the management team and maintaining credibility. Adding a score card to investor materials is another easy way to keep investors informed on the management team’s progress toward the initial goals set out at the IPO.

- Engage in proactive sell-side targeting. Make use of the company’s covering sell side analysts as much as possible by attending their conferences and asking for introductions to target investors. But don’t stop there. Not all sell side firms limit conferences to covered companies. Find the best sell side analysts in the industry and begin building relationships to secure conference invitations. Even if the sell side is at capacity, continuing to cultivate a relationship is time well spent and can help a company stay on the radar and keep its story top of mind.

- Analyze industry peers. It’s always a good idea to know how the company stacks up against its peers. Conducting a valuation diagnostic will show the company where it currently ranks in terms of valuation. This diagnostic exercise can reveal how a company’s messaging differs from common industry practices, which KPIs peers disclose, how peers address certain industry-wide topics, and what type of guidance other companies provide. All this data not only sheds light on how performance impacts valuation; it can also be used to inform messaging that will help increase credibility with the Street.

- Bump up ESG on the priority list. With all the other public company requirements, some newer companies don’t always make ESG a top priority – but they should. A subpar sustainability story can cause a company to miss out on access to over $8 trillion in U.S. sustainable investing assets and can damage overall credibility. Even if investors are not specifically asking about a company’s sustainability strategy, make no mistake that behind the scenes, a multitude of analysts are evaluating the company’s commitments, initiatives, and progress on environmental, social, and governance topics to reach a valuation. The ESG narrative should be just as transparent as the financial narrative.

Keep your foot on the gas pedal

Completing the IPO process is a major milestone well worth celebrating. It also marks the beginning of a long-term investor relations journey that will require the right tone and constant attention from the investor relations team and management. Getting the cadence and the communication right is particularly critical during the first three years, and companies that do it best can expect to continue outperforming for years to come.

Need help thinking through your investor relations program post IPO? Reach out to the strategic communications experts at Riveron for comprehensive advice and hands-on assistance. We can help you take a proactive approach to surfacing and effectively messaging the goals, strategy, and demand drivers that are so critical for investors to understand in your initial years as a public company.

Looking for more insight on how to prepare for an IPO?

View a replay of our webinar, IPO Readiness – A Guide for the C-Suite and Board, which took place on February 29, 2024.

Our expert panelists walked through significant milestones and key IPO success factors while highlighting how to avoid common mistakes. We will also explore how to build an informed investment narrative through feedback, create best-in-class investor relations, and drill down into operational and financial changes needed to successfully go public.