Don’t Strike Out on Guidance, Swing for the Credibility Zone

Reaching an agreement on the right guidance to provide can be challenging for finance and management teams. Taking a visual approach that leverages sell side estimates can help internal stakeholders align on achievable, credible targets.

Two weeks ago, we published The Guide to Guidance in 2024, which focused on how to meet or beat external stakeholders’ expectations and avoid negative earnings surprises that are likely to be punished by the Street. For companies to set realistic and achievable expectations, they need to first gain internal alignment around a more conservative approach to financial guidance. Unfortunately, this can be easier said than done and finance and management teams are not always on the same page.

By following a few key steps, teams can more quickly agree on a winning approach to guidance for the year ahead.

Be sensitive to competing interests

While not universal, the dynamics around establishing financial guidance are often the same at many companies. The financial planning and analysis team has thoughtfully built a financial forecast that feels probable, reasonably conservative, and achievable. On the other side of the table is a senior management team that has ambitious aspirations to outperform expectations. These two parties are inherently at odds, as FP&A teams are incentivized to build dependable forecasts, and management teams are incentivized to deliver consistent, aggressive growth.

Between these two parties are the operators (the individuals responsible for executing day to day and delivering on the promises that are communicated externally) and the communicators (namely the investor relations team, responsible for reporting progress to external stakeholders). IR especially wants to reach a guidance figure that walks a delicate line between overshooting and sandbagging. Too aggressive a number, and the company will miss its guidance. Too conservative a number, and investors will think the company is under promising.

Leverage external consensus to reach internal alignment

Where possible, it’s the IR team’s job to guide the folks in the room to a balanced guidance figure that will help ensure an advantageous outcome for everyone. While management teams ultimately have the authority to push through the more aggressive numbers, this can set companies up for failure if they consistently miss their guidance targets.

So how can IR help to walk an ambitious management team back? The trick is for IR teams to use consensus to their advantage. By exploring the range of sell side estimates and understanding where the majority of estimates fall relative to consensus, management teams may be persuaded to take a slightly more cautious approach than usual.

Make it visual to make the point

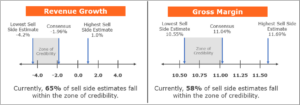

Creating charts that illustrate a company’s sell side estimates—like the examples below for revenue growth and gross margins—can help companies visualize where they can safely set guidance. The charts showcase the high end, low end, and consensus among the respective sell side estimates.

Most importantly, the graphics identify the “zone of credibility,” or the range within which the majority of sell side estimates fall. Using a visual approach can be very effective at persuading management teams that ambitious or aggressive guidance is imprudent and that landing within the zone is the right approach for right now.

Notice that in the examples, the zone of credibility lies between consensus and the low end of sell side estimates, representing outcomes that will be inherently easier for the company to achieve. Furthermore, most sell side estimates fall within the zone. By setting guidance within the range, companies align with the expectations of most analysts and deliver guidance that they will likely achieve or exceed, bolstering the company’s overall credibility.

Ideally, staying in the middle of the zone of credibility is a good idea. In the revenue growth example, if the company were to set its revenue target at -3.5%, it would fall below many estimates within the range and risk its guidance being viewed as an under promise. IR teams can narrow the zone of credibility and avoid an overly broad range by excluding any significant outliers in estimates. This allows companies to establish a zone of credibility that more closely aligns with external expectations and how the company will ultimately perform.

Boosting credibility is a critical win

For companies that have recently missed guidance, setting an achievable target and hitting it can represent a huge win and a significant boost to credibility that may be even more important to organizations right now than aiming for aggressive growth. Remember that analysts do not necessarily expect outperformance every quarter. Use this quarter to illustrate alignment with expectations and get a meet or beat on the books to help set the right tone for a successful year.

Need help with planning guidance for 2024? Connect with the strategic communications experts at Riveron for comprehensive support with your investment narrative and messaging for the new year.