Why Private Companies Should Apply Best Practices to Non-GAAP Reporting

Private companies have many varied financial reporting stakeholders and can benefit from clear non-GAAP reporting policies

Accounting professionals at private companies often provide internal management financial reports to stakeholders (private equity investors, third-party banks, insurers, credit card processors, management, and others) as part of routine financial reporting, treasury, risk management, and procurement processes.

While determining which metrics will best communicate the state of the business, company leadership should insist on a non-GAAP measures policy to document the nature and support of adjustments made and the departures from SEC rules.

These financial reports, although not audited or reviewed, are often presented on an earnings before interest, taxes, depreciation, and amortization (EBITDA) or non-GAAP basis.1 This practice is essential – and in some instances may be contractually required – as it supplements GAAP financial statements and provides stakeholders with pertinent information. For investors, adequate research requires an assessment of both GAAP and adjusted results (non-GAAP), and the validity of non-GAAP adjustments should be carefully evaluated on a case-by-case basis.

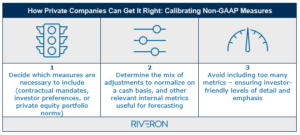

Applying non-GAAP reporting best practices can ensure that stakeholder needs are met, and here are key considerations for accounting professionals at private companies:

Do all private companies need a non-GAAP policy?

Private companies with plans to go public should have a non-GAAP policy. As previously noted, accountants in private companies prepare internal financial reports containing relevant non-GAAP measures to meet the specific requirements of private equity investors and lenders. Companies that may go public will also meet with potential public equity investors (e.g., underwriters) in preparation for an IPO, and those investors will want to understand how the company measures itself, and then compare that information to peer companies that are already public. It is critical that a company decide on what Key Performance Indicators (KPIs) and non-GAAP measures it will disclose, then commit to disclosing those measures as the company starts an IPO process. The company should remain consistent with such disclosures after the IPO so that public investors can evaluate those metrics in their investment decision analysis. These objectives can be achieved through the adoption of an effective non-GAAP policy as part of the IPO preparation process.

Private companies without plans to go public should also consider adopting a non-GAAP policy. In the event of an acquisition, disposition, or financing, this policy will help to quickly identify non-GAAP adjustments in historical financial reports. In practice, accounting professionals “individualize” non-GAAP measures to align with the interests of key stakeholders (company leadership, investors, and lenders). This means that metrics like adjusted EBITDA can vary widely depending on what is allowed as an add-back in a company’s loan covenant calculation. Also, individual private equity firms may have specialized KPIs tracked portfolio-wide.

These metrics are typically operationally focused and adjusted for non-cash items (like depreciation and stock compensation), as well as costs determined to be unrelated to the company’s core business activities, like transaction expenses and restructuring accruals. This approach clearly meets the needs of a private company; however, in the event of a transaction —especially one subject to SEC scrutiny— these measures must be discernible to outside investors and potentially consistent with regulator expectations. While determining which metrics will best communicate the state of the business, company leadership should insist on a non-GAAP measures policy to document the nature and support of adjustments made and the departures from SEC rules.

An example of a non-GAAP measures policy

Consider a private company that enters into a long-term facility lease where the first few years of the lease are rent-free; in other words, rent starts at zero and then increases beginning in year three. The minimum rent will be calculated for the entirety of the lease and recognized evenly over the term. Since the expense is considered non-cash in the initial years, the internal reporting packages of many private company accountants remove the rental expense when reporting to management.

In such cases, private companies can better understand how to approach and identify non-GAAP adjustments by drawing from guidance offered by the SEC. The SEC staff discussed objections to this practice for public companies, stating that this violates SEC rules as ASC 842 contains explicit guidance on how periodic rent expense is determined, and this would be an example of a non-GAAP measure reported using “individually tailored accounting principles.”

The SEC staff referred to the above issue in the review of a registrant’s filing where EBITDA was adjusted to exclude non-cash rent expense from its non-GAAP results. They disagreed with the adjustment since rental expense is a well-defined GAAP concept. Excluding it from non-GAAP earnings could be misleading as it would clearly alter a GAAP expense recognition principle. For non-SEC reporting, private companies with material GAAP expenses for facilities with significantly different cash flow profiles may still decide (or be contractually required) to remove these charges from adjusted EBITDA.

To be clear, the SEC would not comment on a private company financial package not included in a public filing, but this is a common adjustment made in internal reporting packages, and private companies should be aware of the SEC guidance when contemplating potential transactions and documenting the nature of their non-GAAP adjustments.

Determining the non-GAAP measures to include

When preparing a private company’s financial reporting package, accounting professionals must determine the non-GAAP measures to include. As noted above, some metrics, such as debt covenant metrics, may be contractually dictated. Some may be investor-mandated, such as portfolio-wide KPIs required by a private equity investor.

In addition to the compulsory metrics, management may request a mix of adjustments to normalize the business on a cash basis. Management may also consider internal metrics such as gross margin and peer groups’ measures to assess and forecast business performance. With the intent to normalize results on a cash basis, adjusted EBITDA is the most frequently used non-GAAP metric.

Financial reporting teams should also be mindful not to overstuff internal reporting packages. Too many metrics can make it difficult for investors to identify critical ones. To ensure that only pertinent measures are disclosed, management should insist on relevant criteria for inclusion such as the nature of disclosure, decision-making usefulness, and cost/benefit of preparation.

A Non-GAAP measures policy is worth considering

While it may not seem readily applicable to a private company, a non-GAAP policy serves as a framework for (1) evaluating and tracking investor requests, (2) documenting how non-GAAP metrics were determined, and (3) creating and refining additional metrics. A private company does not need an SEC-compliant policy, but it can help identify areas of non-compliance should the company later decide to go public or otherwise need SEC-compliant financial reports. Additionally, understanding the sources and composition of these metrics in a readily available manner can help address investor questions more quickly and clearly. Oftentimes, companies without clear policies may struggle to answer stakeholder questions about their key performance indicators if the preparers of those metrics are the only ones who understand how those metrics were built from the underlying data.

New metrics and non-GAAP, non-SEC-compliant adjustments should have an explicit authorization structure, potentially requiring board or CEO approval, and be tracked in an exception log.

Although not subject to SEC regulations, a private company has many reporting objectives and varied stakeholders. Whether or not the company decides to go public, its financial reporting can be strengthened by establishing a clear policy that documents the metrics stakeholders care about most. Reporting can be further enhanced by disclosing the authorization matrix to approve any adjustments made in those metrics.

Overall, a non-GAAP measures policy will support consistency, encourage compliance, simplify communication with internal and external stakeholders, and prepare private companies for potential liquidity events.

(1) The generally accepted accounting principles (GAAP) are the standardized set of rules and guidelines that all companies in the United States must follow.