The Critical Path for Margins: Optimizing Costs While Balancing Revenue Uncertainty

As part of a series on strength amid uncertainty, these insights explore how leaders can address market constraints and profitability pressure while building strategic differentiation to support long-term resilience and growth.

In recent months, many companies’ margins have been challenged due to the rising cost of goods sold (COGS), continued supply chain headwinds, and inflationary pressures. Some companies maintained modest revenue growth by passing through higher costs to their customers or channel partners, but margins have not kept pace across most industries. For instance, S&P 500 company data shows that over 75% of healthcare companies have had a decrease in year-over-year profit margins. Similarly, 70% of consumer products companies have had negative earnings impact from higher inventory on hand, likely signaling the peak of pass-through pricing capacity for target discretionary markets.

An assessment of COGS, working capital, and SG&A together can deliver a comprehensive understanding of the current cost base and should be performed within the context of leadership’s strategic plans for growth.

Widespread economic volatility is spurring company leaders to shift priorities from expanding revenue toward protecting earnings. While some leaders are relying on traditional sales, general, and administrative (SG&A) and operating cost levers, others are more strategically creating visibility into underlying profitability drivers and leakage across functions and business segments.

The situation calls for a thoughtful and pragmatic approach as management teams commit to change what they must to preserve what they can. Successful companies will optimize costs while maintaining the capabilities that differentiate organizations and preserving opportunities for profitable growth.

Overcoming uncertainty while preserving the foundation for growth

Cost reduction efforts can range in complexity from basic cost management and control measures to a transformational overhaul of business models, as outlined below. Depending on an organization’s recent level of effort, teams are creating pragmatic cost reduction plans as they move from weathering the storm toward transformation and growth. How should today’s business leaders adjust their agendas? In part, the answer depends on what a company has been able to achieve over the past 12 months.

Ways to reduce costs by level of complexity, lowest to highest:

- Enacting basic cost management and control measures, including reducing third-party vendor spend or discretionary spend such as travel expenses.

- Taking initial workforce management measures. For example, pausing recruiting or taking long-overdue personnel reduction actions.

- Rationalizing activities and organizational components such as reducing service levels or removing layers of management.

- Optimizing the business through technology enablement initiatives or enhancing supply chain strategies.

- Making fundamental changes to the operating model by reimagining corporate strategies, transforming core processes, or reshaping product portfolios through strategic acquisitions or divestitures.

Organizations that have already driven impact through the first two levels are now progressing into the more difficult cost-reduction actions outlined in levels three through five. These levers move beyond SG&A expenses and into COGS, cost-to-serve, and working capital considerations.

Thinking beyond SG&A requires an integrated approach to cost optimization

When starting a cost optimization journey, leadership teams tend to start with the “low-hanging fruit” associated with middle and back office and overhead costs within SG&A.

Effective cost reduction requires evaluation and coordination well beyond finance and procurement, often including experts from sales, operations, supply chain, logistics, corporate development, IT, HR, and real estate functions. An assessment of COGS, working capital, and SG&A together can deliver a comprehensive understanding of the current cost base and should be performed within the context of leadership’s strategic plans for growth. An improved understanding of where company profitability leakage is occurring—and what is driving it—tends to correlate with better data-driven decision-making when considering COGS, cost-to-serve, and working capital-related improvements.

There are an array of focus areas and potential levers to deliver successful cost optimization outcomes:

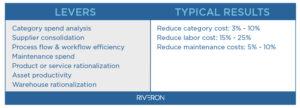

When seeking to optimize COGS, teams often target areas related to manufacturing productivity, direct labor, or maintenance-related spend.

Working capital improvement requires a focus on the various sources and uses of cash flow, including debt and lease obligations. Companies might also choose to address issues ranging from excessive on-hand inventory to non-standard order-to-cash and procure-to-pay processes.

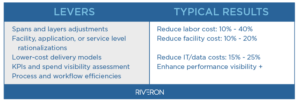

Improving cost-to-serve often focuses on optimizing service levels and rationalizing the activities corporate functions provide to their internal customers. This typically includes assessing lower-cost delivery models like shared services centers and outsourcing relationships for commoditized or transactional services. Similarly, leaders can drive organizational efficiency by eliminating activities (across logistics or pricing strategies, for instance) that do not add value or are redundant.

Building the right plan to target meaningful cost reduction

Regardless of where companies start their cost optimization programs, leaders and their advisory partners should create a program plan based on a clear definition of their current-state baseline, realistic market scenarios or challenges they intend to address, and pragmatic cost reduction opportunity targets. A sound approach will typically follow this framework:

- Articulating scenarios and baselining costs. Informed by likely business conditions, cost structure considerations, and relevant benchmarking, aligning on a set of market scenarios helps leaders provide a current-state baseline, identify opportunities to right-size costs, and create an initial hypothesis. A company might articulate scenarios based on certain market growth and contraction metrics to inform the scale of necessary cost reductions and investments in differentiated capabilities.

- Identifying, prioritizing, and aligning on cost reduction opportunities. Using the baseline and insights from the scenario planning, companies should conduct cross-functional, bottom-up reviews to identify underlying root causes of cost gaps and inefficiencies. As discussed above, this requires input from stakeholders across the business to evaluate trade-offs and implications and for teams to align strategic targets and initiatives.

- Developing and mobilizing an action plan. With a focused set of strategic priorities in place, teams can sequence and plan the actions required to achieve the targeted savings. It is critical to quantify and prioritize quick wins for near-term impact while building defined, actionable plans to support accountability for longer-term initiatives.

Any cost optimization approach should emphasize long-term value and sustainability. It will balance the need for maintaining differentiated capabilities while identifying opportunities to improve how the business operates and optimize the cost structure. The exercise should also be rapid, with the initial analysis to support the program charter taking no more than 4-6 weeks, and result in a clear, actionable plan with milestones. Once planned and executed correctly, most cost optimization programs are self-funding and result in significant functional and organizational upskilling for teams that participate in the program.

A forthcoming article in Riveron’s Strength Amid Uncertainty series will examine additional detailed working capital considerations.