Making Headlines the Right Way: How IROs Can Build a Financial PR Strategy that Works

For years, public relations (PR) professionals have debated whether or not all press really is indeed good press. When it comes to financial media in particular, it can be especially hard to see the bright side when the numbers and the news aren’t all positive, as evidenced by the GameStop saga that we’ve all seen play out in the news this year.

However, whether good or bad, there are always opportunities for investor relations professionals to tell their companies’ financial stories in engaging ways that build understanding and trust with the media, and ultimately with the investor community.

Start with PR 101

Working with the financial media does require a set of fundamental PR skills and tools. This shouldn’t come as a surprise. After all, investor relations is deeply rooted in the world of public relations, and the two practices are inextricably tied by the many synergies that exist between finance and communications. What’s more, PR skills are the key to communicating effectively with any external audience – including investors.

Still, IR professionals aren’t always sure about what it takes to engage thoughtfully with the financial press. As a result, they may miss out on important opportunities to communicate effectively with current and future shareholders.

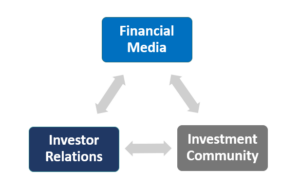

While you don’t need to become the next financial media darling to get your story publicized, you do want to build a good rapport with the press in the same way that you work to maintain relationships with the investment community. This helps fuel the bidirectional sharing of information between all parties that is foundational to a successful investor relations program.

An IRO’s Blueprint for Financial PR

IROs can start building or strengthening that rapport, along with their own confidence level in working with the financial press, by concentrating on the three following areas:

- Understand the role of financial media.

- Investor relations professionals, especially those with little or no PR experience, often harbor anxiety when it comes to the financial press. And much of this is based on the misconception that you have to be a polished, buttoned up PR veteran to make an impact. The case of Tesla CEO Elon Musk should be enough to completely dispel this myth. He’s simultaneously one of the most talked about figures in the financial media, and one of the least eloquent, articulate, or tempered speakers.

- It can also help to remember that the purpose of the financial media is to not distort, but rather to communicate financial news with investors in a transparent, honest, and engaging way. And you can and should use media for strategic business purposes, including connecting with your investors. Sometimes it’s an airline company CEO responding to the impact of COVID-19 on travel demand and its business operations. Other times, it’s messaging how a strategic acquisition will expand the company’s product offerings and translate to bottom line gains. Either way, there are many ways organizations are tactically incorporating financial media into their investor relations strategy.

- Tell your investment story the way you know how.

- There’s no need to recreate the wheel or reinvent your narrative for the financial press. You can leverage your day-to-day messaging and keep talking about the same topics you always talk about, such as products and supply chain, just with a more strategic spin. For instance, you can discuss specific trends directly affecting your company and tie them into the context of the broader market. You can also emphasize how business trends are having a real impact on consumers. These are topics that the financial media really care about, and they can help you secure coverage and influence regarding perceptions of your company, your industry, or the market at large.

- Here are a few specific and recent examples to consider:

- Lydall on CNBC’s “Mad Money” – Lydall capitalized on the public’s increased demand for PPE and high-efficiency air filters to secure an interview with Jim Cramer. President & CEO Sara Greenstein discussed how these items are not just important for COVID protection, but across other use-cases as well.

- Cars.com on CNBC’s “The Exchange” – Cars.com leveraged the recent news on global chip shortages as a springboard for CEO and Co-Founder Alex Vetter to talk about the company’s competitive position during an in-depth interview on this investor-focused show.

- Malibu Boats Featured in Barron’s: After several impressive quarters, Malibu Boats CEO Jack Springer spoke with Barron’s on the company’s recent financial performance, linking overall strength in the boating industry to increased demand for Malibu-branded boats.

- These examples represent ways in which companies can use the media to reinforce positive perceptions with the Street and attract new investor interest—all by simply framing financial narratives in a newsworthy way.

- Identify key internal stakeholders and optimize each relationship.

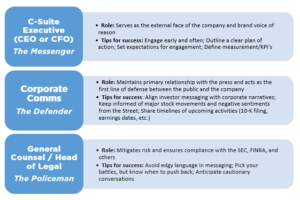

- You will need support to execute your financial PR strategy, and it needs to come from multiple people and departments within your organization. Involvement for each of these stakeholders will vary depending on the gravity and confidentiality of the story you’re telling, among other things. Nonetheless, you’ll want to work closely with each of the members of your PR task force to ensure your strategy is comprehensive and well-informed. It also pays to do what you can to optimize the contributions from each player. Here are some tips for success:

Finally, you’ll need to consider each player’s role and responsibilities in developing FAQs and briefings, conducting media and Regulation FD trainings, and ensuring all stakeholders are aligned on timelines. It is critical to gain buy-in and support from across the organization, and starting at the top can make your work easier and much more effective.

Make News that Matters

Good financial PR strategies and practices are important for creating and building shareholder value as well as for maintaining overall company reputation. When you know how to work successfully with the financial media, you’ll be better positioned to share your company’s story in a way that resonates with current and future investors and the broader press.

Be sure to look out for the next piece in our CP Insight series, where we will discuss how to execute your financial PR strategy. And if you have questions or would like to learn more about how to amplify your company’s investment story through financial media, give us a call. We’re ready to help you optimize your relationships with all of the various stakeholders in your business.