ESG Reporting: How and Why Your Business Should Opt to Disclose Scope 3 Emissions

Scope 3 emissions disclosures are a critical facet of ESG reporting—whether or not the disclosures are currently mandatory for your company. Enacting the right sustainability reporting plan can ensure success.

These insights are part of an ongoing series of environmental, social, and governance (ESG) considerations for the office of the CFO and sustainability reporting professionals.

Scope 3 greenhouse gas (GHG) emissions represent one of the most daunting components of climate reporting. Scope 3 emissions are 11 times higher on average than operational emissions associated with scope 1 and 2, according to CDP. Although the US Securities and Exchange Commission (SEC) may not currently require some companies to provide these disclosures, it can be beneficial to set a reporting strategy now and refine climate reporting processes ahead of emerging regulations. While the SEC removed the Scope 3 requirement from its final climate disclosure rule, it’s not surprising that other jurisdictions —such as California and the European Union— continue to require companies to disclose this data. Additionally, many voluntary ESG reporting frameworks and initiatives encourage scope 3 calculations as part of the alignment with that framework or initiative.

For example, the Science Based Targets initiative requires companies to disclose a scope 3 reduction target when scope 3 emissions account for 40% or more of total emissions (scope 1, 2, and 3 combined). The Task Force on Climate-related Financial Disclosures (TCFD) framework, which forms the backbone of many upcoming climate-related regulations (and will now be overseen by the IFRS Foundation, alongside other international sustainability standards), states, “All organizations should consider disclosing Scope 3 GHG emissions.”

Scope 3 initiatives are essential to climate-related initiatives. Here’s why they should be part of every company’s climate reporting strategy and how sustainability reporting professionals can start collecting and delivering the scope 3 data stakeholders want most.

Improve ESG scores while staying ahead of regulations

Companies have many more stakeholders than just the SEC. In most cases, one or more of these audiences will expect or potentially require scope 3 disclosures. Companies that comply will reap advantages and avoid unwelcome consequences.

Get ahead of emerging regulations

The original SEC climate rule proposal from 2022 required scope 3 emissions disclosures for US companies deeming such emissions material. Because of strong opposition to this requirement—including concerns that collecting quality data for scope 3 emissions would prove challenging, if not impossible, and that faulty data could harm investors and companies—the SEC ultimately removed the scope 3 provision from its final rule.

While the SEC continues to stall in making a commitment to scope 3 mandates, other regulations and climate-related initiatives are not backing down. California went ahead and released its own climate accountability package, mandating that private and public companies with revenue of more than $1billion disclose scopes 1, 2, and 3 emissions. While the California package has yet to finalize third-party assurance around scope 3 emissions, the bill states that assurance requirements may be determined by the state by 2027 and, if adopted, would require limited assurance by 2030. The delay on the pending decision likely has to do with ensuring requirements are complementary to the final SEC rule.

Like California’s law, the European Union Corporate Sustainability Reporting Directive (CSRD) requires large companies to disclose their scope 3 emissions where relevant. CSRD specifically asks reporting companies to provide information about which scope 3 categories (out of 15 from the GHG Protocol) are significant to the business.

Improve ESG-related scores

Requirements aside, to get an A from CDP, one of the most widely recognized climate-related rating organizations, a company must verify 100% of scope 1 and 2 emissions and at least 70% of a minimum of one scope 3 category, with verification from an accredited third-party provider. Investors and customers use CDP scores to compare companies’ climate-related initiatives within locations and industries. Achieving an ‘A’ score can give companies a significant competitive advantage.

EcoVadis and ISS also give credit for scope 3 disclosures, and companies that report these emissions can expect higher ratings from these organizations. Within the environment pillar of its scoring framework, EcoVadis requests documentation demonstrating the total gross scope 3 GHG emissions, total gross scope 3 downstream GHG emissions, and total gross scope 3 upstream emissions. Documentation can include an energy report, energy audit report, GHG emissions report, annual report, CSR/sustainability report, or similar.

In addition to giving direct credit for scope 3 emissions disclosures, ISS scores can be influenced by a company’s CDP score, which is generally higher with scope 3 emissions. As investors and customers continue to consider companies’ CDP, EcoVadis, and ISS scores, disclosing scope 3 data becomes increasingly important for businesses seeking top ratings.

Five steps to start disclosing scope 3 emissions

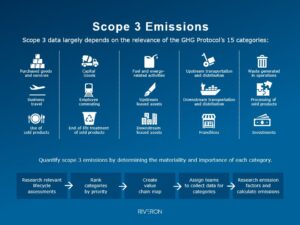

To start, companies must realize the value of moving forward with tracking and disclosing scope 3 emissions. Then, they need a game plan. The following five-step process provides a great framework for getting started.

1. Research lifecycle assessments

A lifecycle assessment analyzes a product or service from its raw materials to its end of life or service use. Researching relevant lifecycle assessments is a great way to understand where most product or service emissions come from within the company’s unique value chain. For example, for companies that utilize steel in their products, the World Steel Association performed a lifecycle assessment on steel that could be useful in understanding the emissions associated with steel manufacturing.

2. Rank categories by priority

It’s essential to consider which of the GHG Protocol’s 15 scope 3 categories are most relevant to the business. It’s a good idea to prioritize relevant categories by the scale of expected emissions, the results of the lifecycle assessment research, and data availability. Companies may also want to consult the CDP guide on the relevance of scope 3 categories by sector.

3. Create a value chain map

The GHG Protocol, the de-facto standard for GHG inventories, recommends this exercise while accounting for scope 3 emissions. Some sustainability reporting professionals might be tempted to skip this step, but it is highly beneficial. The work may seem tedious, but a visual representation of the company’s value chain is a great way to help teams double-check for potentially relevant scope 3 categories that may have been overlooked while assessing lifecycles or ranking categories by priority.

4. Assign teams to collect data by categories

Assign an internal team to each prioritized scope 3 category and begin collecting relevant data. If data is unavailable, teams should collaborate to determine where a data sampling can be created that might lend itself to an educated estimation. For example, if considering emissions from business travel, the company may have relevant data from one airline but not another, covering the same distance. If the company has the number of trips taken, the missing data can be estimated using the data from the airline the company does have.

5. Research emission factors and calculate emissions

Emission factors can be used to estimate emissions from energy usage across all 15 scope 3 categories. The EPA’s emission factor hub lists emissions factors for six of the 15 scope 3 categories. Companies can also find emission factors on supplier/brand websites, especially brand-specific cell phones, desktops, and laptops. Some suppliers directly provide allocated emissions available from cloud computing companies.

Make sure scope 3 is on your radar

While not all organizations are ready for scope 3 disclosure yet, every company should think about why, when, and how they will start disclosing. Many companies receive direct requests to complete questionnaires that they cannot afford to ignore. Even companies that haven’t been approached by their stakeholders should be discussing their disclosure strategies internally as they prepare for upcoming regulations.