California Climate Accountability Package Accelerates the Need for Reporting Progress in CA, and Everywhere Else

While public companies await the final SEC climate rule, climate-related disclosure requirements are already here for many US companies.

Don’t let the name fool you. The new California Climate Accountability package passed by the state’s legislature and signed into law earlier this month has implications that reach far beyond organizations headquartered in the Golden State. The two bills comprising the package, SB 253 and SB 261, send yet another strong message to companies that climate and emissions disclosures, in some form or another, are going to be mandatory for all companies, and sooner than later. With these bills, it’s not just public companies that need to step up their climate reporting games; private companies are fully included in the reporting requirements.

According to the press release from Senate District 11, SB 253 and SB 261 “work together to improve transparency, standardize disclosures, align public investments with climate goals, and raise the bar on corporate action to address the climate crisis. At a time when rising anti-science sentiment is driving strong pushback against responsible business practices like risk disclosure and ESG investing, these bills leverage the power of California’s market to continue the state’s long tradition of setting the gold standard on environmental protection for the nation and the world.”

Upon signing the bills into law, Governor Gavin Newsom indicated that the implementation deadlines may be difficult for many companies and instructed the legislature to look into the adoption timeline when they return next year. However, this legislation will no doubt significantly accelerate the need for many companies, and private companies in particular, to ready their sustainability reporting for publication if they have not already done so in anticipation of the SEC climate rule.

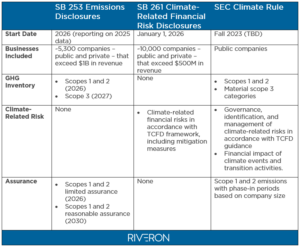

Here’s a snapshot of what companies need to know about the bills and how they relate to the SEC rule.

The climate package addresses emissions data and financial risk disclosures for public and private companies

The Climate Accountability package is made up of two complementary measures-

SB 253 deals with emissions and would mandate annual disclosure of Greenhouse Gas (GHG) emissions data—scopes 1, 2, and 3—in accordance with the GHG Protocol. It applies to all US business entities (public or private) with total annual revenues over $1 billion that “do business in California,” which is defined as “engaging in any transaction for financial gain within California, being organized or commercially domiciled in California, or having California sales, property, or payroll exceed specified amounts.” The bill is expected to impact approximately 5,300 companies.

SB 261 would require public and private companies with total annual revenues of over $500 million that do business in California to prepare biennial reports disclosing their climate-related financial risks. The lower reporting threshold for SB 261 gives it nearly double the reach of SB 253 with an estimated 10,000 companies likely to fall under this bill’s scope. The required reports must be in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) framework and include a description of the measures adopted to reduce and adapt to climate-related financial risk. Reporting companies will need to disclose the reports publicly on their website.

Companies need to start preparing now for reporting in 2026

Emissions data

To comply with SB 253, private and public companies would need to start disclosing emissions in 2026 using scope 1- and scope 2-related data from 2025 and providing limited assurance in the first year. Reasonable assurance is expected for scope 1 and scope 2 data by 2030.

Companies must disclose scope 3 emissions in 2027 using data from 2026. More specifically, scope 3 disclosures will be required within 180 days after disclosing scope 1 and scope 2 data. While third-party assurance around scope 3 emissions is yet to be finalized (and has likely been delayed to ensure requirements are complementary to the final SEC climate rule), the bill states that assurance requirements may be determined by California by 2027 and, if adopted, would require limited assurance by 2030.

California will create a contract on or before July 1, 2027, with an academic institution to act as the emissions reporting organization and companies will disclose emissions to this organization. The organization will be responsible for developing a public-facing report disclosing companies’ scope 1, 2, and 3 data.

Climate-related financial risk disclosures

As for the climate-related financial risk disclosure requirements set forth by SB 261, companies will need to start reporting on or before January 1, 2026. After this date, private and public companies must biennially prepare climate-related financial risk reports.

Per the bill, California will contract a nonprofit climate reporting organization to publish a biannual report highlighting:

- A review of the climate-related financial risk disclosures by industry

- An analysis of climate-related risks facing California and potential impacts on economically vulnerable communities

- Identification of inadequate or insufficient reporting

The California Climate Accountability package works hand-in-hand with the proposed SEC climate rule

While there are important differences to note—particularly the inclusion of private companies in California’s bills—all the measures ultimately underscore the importance for businesses to understand and increase transparency around their environmental impact. Here’s a look at how the forthcoming requirements compare:

The need for progress is the most important takeaway

The California Climate Accountability package puts climate-related disclosures in the purview of many companies for the first time, some of which may have yet to begin thinking through their climate reporting journey. But it’s clear that no company can afford to wait any longer to take the first steps. Companies new to the space can start by assessing and prioritizing the rules that apply to their organizations and the reporting frameworks that make the most sense for their businesses. Remember, whether this is the year to begin reporting or simply to take actions toward establishing a stronger ESG foundation, moving in the right direction is the key to illustrating commitment to the ESG issues most important to stakeholders.

Need help navigating the climate and emissions disclosure territory? Riveron’s ESG experts can provide support specific to your organization’s needs. Connect with our team for expert advice from trusted partners who can guide and assist during every phase of the ESG disclosure process. And be more confident in your ability to meet all the reporting requirements that apply to your business.

Key Takeaway

With the final SEC climate rule still pending, California’s Climate Accountability package makes it clear that companies cannot wait any longer to make sufficient progress on climate-related disclosures.