Meeting the ESG Reporting Needs of Different Stakeholders with Different Expectations

From performance data points to statements of principles, companies must communicate consistently to a broad range of stakeholders.

Every stakeholder has an agenda including a unique set of principles and goals when it comes to a company’s sustainability and ESG efforts and reporting. Customers, investors, governments, employees, rating agencies, and others utilize sustainability information in different ways, even as the ESG reporting ecosystem coalesces around certain global reporting standards. This leaves companies with a laundry list of expectations that don’t always seem consistent or achievable. Understanding the many requests and creating disclosures that address them in a cohesive way is a major challenge for business leaders, especially those who are in the early stages of defining their company’s ESG approach.

To begin to address stakeholder communications demands. companies need a gameplan for prioritizing issues, stakeholder requests, and multiple corporate communications channels. Try these steps to take control of a chaotic landscape and build consistent messaging anchored by materiality and clear linkages to the company’s business goals.

Start by identifying the most relevant stakeholder groups

Business leaders understandably prioritize data requests coming from shareholders. However, the company’s owners are not the only group essential to ensuring superior business performance. For starters, no company will be successful without responding effectively to the needs of its stakeholders:

- customers

- regulators

- communities

- investors

- workforce

Companies also need to factor in the relevance of other key stakeholder groups based on business segments, models, and other characteristics unique to the industry or specific organization. For example, in heavily regulated sectors such as utilities, clear communication with government agencies is necessary. For a small mom-and-pop café, local and community leaders need to be prioritized. The right roadmap to sustainability strategy and messaging must start with creating a list of all the most important publics for the individual organization’s success. Prioritizing stakeholders helps direct focus and ensures no important group is overlooked.

Determine which material topics to disclose

The most material ESG topics depend on factors such as:

- business segment

- model

- maturity

- location

Stakeholder sentiment also weighs heavily in materiality. To start mapping material topics, companies generally conduct a materiality assessment or analysis. This exercise consists of surveys or interviews with members of the most important stakeholder groups to identify what ESG topics are top of mind for each.

The insights gleaned should lead to a list of the most important ESG issues to address. Business leaders can then begin considering how those topics support business strategy, the corporation’s vision for addressing each issue, and how the vision will be implemented through programs, statements, and disclosures.

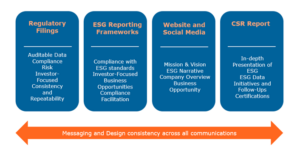

Strategize your communication channels

Once the company has determined what topics to address, and with what type of policies, metrics, and commitments, communicating them effectively is the next big challenge. Companies can do this through a variety of channels, including the corporate and/or ESG website, regulatory filings, investor presentations, corporate social responsibility reports, and customer-facing materials. Some companies also choose to adopt reputable ESG reporting frameworks, such as the Sustainability Accounting Standards Board (SASB) or the Global Reporting Initiative (GRI), which help guide disclosures across other channels.

To leverage the full potential of multiple corporate communications channels, companies must ensure consistent ESG components across the board. Of course, different channels will resonate more or less with different stakeholder groups. And that’s okay as long as everything maps back to the same set of priorities. Within this unifying framework, be aware of the nature of each communication vehicle and its specific data/content needs. In investor presentations, for instance, focus on the link between ESG and company performance, and be sure to flag the most material data points for the public, such as greenhouse gas emissions and workforce health and safety. With a consolidated ESG or CSR report, take advantage of the format to present all the data and ESG-related communications all in one place. An ESG report that speaks every stakeholder’s language allows multiple groups to easily find and focus on the components that matter most to them.

Develop consistent ESG messaging aligned with business goals

With material topics and priority stakeholders defined, a company has a framework for identifying the pillars of ESG strategy. Pull these pillars into an ESG messaging document that forms the foundation of the company’s ESG narrative. Then flesh out each pillar and how it connects to corporate goals. Follow the dos and don’ts of sustainability communications, staying focused on evaluating and communicating the factual progress against each pillar and avoiding any over or understatements.

Creating a communications calendar that reflects development timelines for each communication, including the corporate website, proxy statement, and investor presentations, can help visually connect the dots and reinforce the importance of consistency across vehicles.

Create or improve your data collection, monitoring, and reporting procedures

As investment-grade ESG reporting increasingly becomes the expectation from most key stakeholders, companies must give ESG data collection and reporting processes the same level of attention and care as they ascribe to their financial reporting. More and more types of ESG data, such as greenhouse gas emissions and workforce statistics, are expected as part of regular filings and reports going forward. Every company needs a robust system to collect, consolidate, verify, and report this information consistently.

Keep in mind that the first iteration of this system will not be perfect. However, the process will improve as data owners gain more experience and business leaders provide the appropriate level of support for their development. Consider adopting sustainability software solutions to ensure consistency, repeatability, and efficiency in this process, similar to the solutions used for financial statements and other business-specific reporting.

Make consistency in communications the priority it needs to be

Yes, there are many stakeholders with many different expectations around ESG that can make the ESG reporting landscape feel overwhelming. Companies that approach the challenge by setting strategic ESG priorities grounded in materiality and aligned with overall corporate goals will have a distinct advantage. With the right roadmap and framework, companies can more easily ensure consistency across every channel and message, addressing diverse stakeholder groups’ range of needs in a cohesive and unified way.

Need help prioritizing stakeholders, topics, and communication channels?

Riveron’s ESG and Strategic Communications consultants are available to perform peer research, conduct materiality assessments, or help you shape consistent, effective ESG communications for your company website and formal reporting processes. Give us a call to start the conversation, and we’ll help you send the right messages to the right stakeholders in the right ways.

Simplify the complex ESG reporting landscape

Prioritizing ESG stakeholders, material topics, and communications channels lays the groundwork for an effective ESG communications strategy that ensures consistent messaging tailored to each critical stakeholder’s needs.