EcoVadis Is Private Equity’s New Swiss Army Knife for Sustainability Reporting

As demand for ESG reporting grows, EcoVadis gives private equity firms a multifaceted tool for understanding, improving, and reporting on sustainability performance across their portfolio company holdings.

Private equity (PE) firms are facing mounting pressure from their Limited Partners (LPs) to assess and report on portfolio company sustainability initiatives and generally to elevate their Environmental, Social, and Governance (ESG) reporting efforts. At the same time, many PE firms are recognizing that aligning with sustainability investment themes not only enhances their reputation but also yields sound financial investments.

The only question left is how to best dive deeper into portfolio companies’ ESG performance?

ESG software vs. ESG ratings services for portfolio companies

The answer comes down to one of two strategic options: invest in specialized ESG software for comprehensive tracking and reporting. Or leverage the expertise of trusted and widely recognized ESG rating services to assess and score portfolio companies’ sustainability practices.

On one hand, there are obvious business cases for ESG software, especially as reporting and assurance requirements become the norm and particularly for companies already down the path of measuring ESG performance and ready to institutionalize the capability. There are also specialized ESG software solutions specifically designed for private equity-backed companies, like Novata, as well as those that support monitoring sustainability across complex supply chains, like Assent, that may be worth considering.

On the other hand, many private equity firms are looking to take their first steps toward ESG reporting, and rating services can offer an easier path. But not just any rating service will do. The most popular rating agencies like MSCI, Sustainalytics, and ISS are designed for public companies and largely score based on public disclosures, so they don’t always make sense for private companies. CDP is rigorous and widely recognized, but the scope is focused exclusively on environmental topics. For measuring ESG performance for private companies and portfolio companies, EcoVadis stands out as an all-purpose tool that PE companies can put to work in multiple ways.

EcoVadis gives PE firms scoring, benchmarking, and performance improvement recommendations all in one handy tool

In our experience, EcoVadis is one of the lowest cost, easiest to implement, and most comprehensive ESG rating services available for non-public companies. As a bonus, it offers a nice mix of ratings combined with the benchmarking and KPI capabilities found in many software solutions. Since its founding in 2007, EcoVadis has generated a network of more than 100,000 rated companies and has received almost $1 billion in funding including financing from PE firms that are not only investors but also users of the service to measure ESG performance among their own portfolio companies.

As part of its own ESG disclosures, private equity firm and EcoVadis investor Astorg notes that 93% of its own portfolio companies have a sustainability rating from EcoVadis:

Some key advantages of EcoVadis include:

- An assessment methodology that considers the quality of a company’s sustainability management system through its policies, actions, and results

- Consideration of a range of sustainability issues grouped into four categories—Environment, Labor & Human Rights, Ethics, and Sustainable Procurement—and based on each company’s unique characteristics such as industry, size, and geography

- The ability for companies to submit documentation of policies, practices, and reports confidentially, unlike other raters that require public disclosure

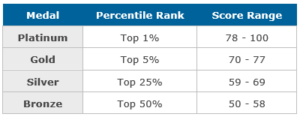

- Simple overall scoring ranging from 0-100 with medals awarded for scores over 50 based on percentile rank across all companies and all industries:

Medal criteria for EcoVadis scorecards as of 1/1/23

- Access to performance benchmarking within the EcoVadis network, allowing private equity owners to compare portfolio companies’ scores to industry peers on a relative basis

- Customized performance improvement recommendations

- Flexible subscription pricing based on company size and selection of basic or premium features

While each EcoVadis assessment is tailored to a company’s industry, size, and location, the rating methodology provides a consistent framework to measure sustainability performance and track progress.

Source: EcoVadis Ratings Methodology Overview and Principles

Private equity firms can use EcoVadis assessments throughout the M&A lifecycle

For private equity firms, EcoVadis sustainability ratings have multiple uses and can come in handy to inform investment decisions at all different stages.

Due diligence

ESG considerations are increasingly core to the deal process. According to a recent survey by KPMG, more than 50% of those surveyed have passed on deals due to material ESG findings uncovered during due diligence. Notably, two-thirds of the investor respondents reported that they are willing to pay more for companies aligned with their ESG priorities.

Using EcoVadis assessments during due diligence allows companies to quickly understand the sustainability performance of potential targets, identify ESG risks and opportunities, and evaluate how well the investment aligns with their sustainability objectives.

Portfolio assessment and performance improvement

Completing an EcoVadis assessment during due diligence provides a benchmark for measuring ESG improvements during the holding period. For example, Neuberger Berman Renaissance disclosed in its 2022 ESG Report that the company performs a gap analysis comparing the portfolio company’s ESG performance at the point of divestment with its status at the time of acquisition. The results of an EcoVadis assessment can formalize the results of such an analysis and further underscore the additional ESG value created during the holding period.

Companies can also use EcoVadis assessments to inform improvement plans. Detailed insights from the assessments help companies identify where they excel or need improvement, particularly when compared with other portfolio companies using EcoVadis’ industry-specific benchmarks. Where portfolio companies do need to improve, EcoVadis offers corrective action plans with recommendations and remediation measures. Private equity firms can work with portfolio companies to implement these recommendations, demonstrating commitment to advancing the environmental and social characteristics of their investments. Bain Capital, which has a minority stake in EcoVadis, announced in its 2023 ESG Report that it has expanded its partnership with EcoVadis “to help portfolio companies track relevant ESG factors and validate progress. Currently, over 15 portfolio companies have been rated by EcoVadis and many have established plans to continue improving their ESG practices over time.”

Companies can go a step further and align management incentives to EcoVadis scores to hold management teams accountable for sustainability performance. And they can extend performance management to the supply chain by having suppliers complete an EcoVadis assessment. By comparing supplier scores against each other, portfolio companies can make more informed procurement decisions.

Reporting to LPs

By leveraging insights from EcoVadis assessments in interactions with LPs, PE firms can exhibit commitment to responsible investing, bolster their credibility, and build stronger relationships with investors who prioritize sustainability considerations. Because EcoVadis assessments provide standardized and comprehensive information about portfolio company sustainability performance, they improve transparency and comparability for LP reporting and can be seamlessly integrated into pre-contractual disclosure. The quality of this information empowers PE firms to offer a consistent and coherent view of their portfolio’s sustainability performance to potential investors.

Further, EcoVadis assessments eliminate the need for PE firms to develop a proprietary ESG survey in exchange for a model that addresses a range of important ESG issues informed by global frameworks and aligned to the market.

Fast track ESG performance with EcoVadis

Incorporating EcoVadis assessments into due diligence and management processes allows PE firms to enhance ESG performance, reduce risks, and capture opportunities, ultimately benefiting both investors and portfolio companies. Getting the most out of the assessments takes time and effort to collect accurate and reliable data, respond to questions, and review documentation. Assigning dedicated personnel such as sustainability managers, ESG specialists, and compliance officers to manage the EcoVadis assessment is crucial, and the time commitment can range from a few weeks to a few months, depending on the organization’s readiness and the scope of the assessment.

Need help getting started with EcoVadis assessments across your portfolio or determining assessment readiness? Connect with our EcoVadis experts and ESG consultants. We can provide guidance on best practices, help with data collection and analysis, and ensure compliance with EcoVadis requirements including implementing the policies, practices, and reports that support a high-performing sustainability management system within your portfolio companies.