Finance Agility Is More Important Now Than Ever Before

“Plan, Promise, and Pray” is a Dead End

For years, executives have acknowledged the inadequacy of conventional planning in which they “planned” a year down the line, “promised” a result, and “prayed” they had guessed right. Meanwhile, board rooms and leadership teams dealt with the impacts of blown spreadsheets and forecast fantasies. While ERP-based reporting, cumbersome data lakes, and excel spreadsheets were inadequate for executives who had to contend with the ambiguity and uncertainty of shifting global dynamics, they were sufficient for those who were comfortable operating on instinct, not information.

Traditional planning and forecasting has demonstrated its inadequacy, and conventional retrospective reporting that informs management of last month’s situation is no longer a viable way to run a business.

But as our world rapidly changes, stakeholders at all levels are demanding a different way to plan and account for financial performance, scrutinizing all aspects of the business from the supply chain to the shop floor to finance. Unlike previous crises—such as Hurricane Katrina and the Northridge earthquake—which were disruptive but localized events that could be handled within the bounds of normal response, the global spread of the novel coronavirus (COVID-19) is forcing companies to act even more swiftly and precisely in the face of evolving market and government actions that have never before been seen. Many companies are now scrambling to understand fundamental aspects of their business: searching for the 13-week cash flow, validating their hedging strategy, or updating a revenue waterfall as they try and explain to their bankers, investors, and backers how they are doing and what their prospects are in this volatile market. Many are finding they simply are flying blind in uncharted territory.

Traditional planning and forecasting, a cumbersome and occasional process at best, has demonstrated its inadequacy, and conventional retrospective reporting that informs management of last month’s situation is no longer a viable way to run a business. As companies create new operating norms and recover, they should prioritize a shift to more nimble processes that enable them to better plan and prepare throughout this and other periods of global change or instability. This includes:

- Delivering fundamental financial reports and metrics (e.g. 13-week cash flow, balance sheets, incomes statements) without human intervention and manipulation

- Embracing integrated and “continuous” planning using near-time operational and financial data to validate current plans, perform driver-based sensitivity analysis on scenarios, cash forecasts and deliver early detection to executives

- Providing intuitive analytical “drilldown” to support root cause analysis in both operations and financial data by executives and analysts working in a distributed fashion

- Enable real time collaboration, consultation, and annotation among distributed stakeholders to accelerate understanding and decision-making

- Deliver a “single version of the truth” based on reliable data instead of diverse spreadsheets, varied formulas, and disconnected information.

While spreadsheets, email, texts, phone calls, and even ERP systems can’t deliver this type of agile reporting, CPM systems can. And they can do it quickly.

CPM – The Basis for Finance Agility

Corporate Performance Management (CPM) solutions are based on a set of design principles and technologies that make them more flexible and dynamic than ERPs. Built for purpose, they provide companies with a rich set of capabilities that are collaborative and flexible, enabling management to better understand the business, access accurate information immediately, and quickly grasp the consequences of changing circumstances and markets. These capabilities include:

- Financial reporting: Incorporating transactional and trial balance data as appropriate, these systems can quickly replicate or reconfigure a company’s chart of accounts, key hierarchies (entities, geographies, customers, products, industries, etc.), and deliver core financial reports in hours including income statements and balance sheets.

- Cash flow reporting and forecasting: A complex process made simple, CPM systems track cash movements, apply complex accounting rules including currency valuations and international entity adjustments, and roll forward cash balances from period to period before delivering that information in near time to executives via reports and/or dashboards.

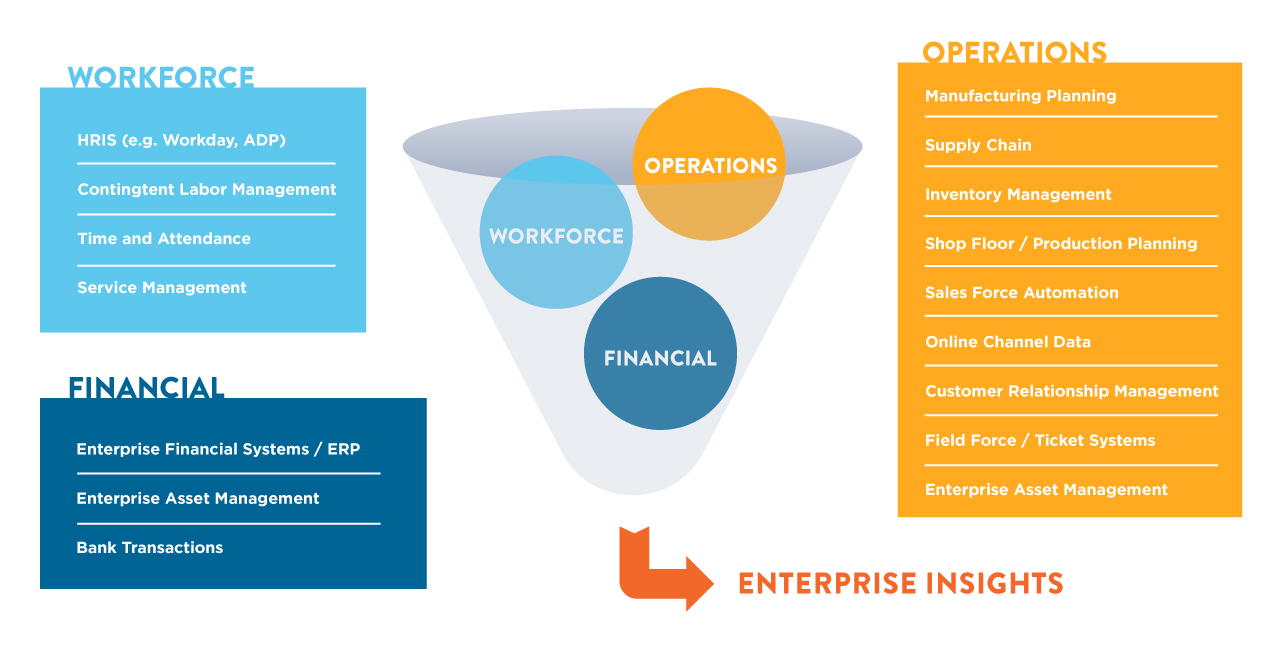

- Continuous planning and forecasting: Providing both top-down and bottom-up capabilities, workflow for approval and process visibility, and Excel (or Excel-like) interfaces and formulas, these systems use a single data repository that keeps all templates and models aligned to a single set of data. By automatically integrating data from HR, operational and financial systems, executives get a 360 view of activity, understand the impacts across the enterprise, and can take appropriate actions when they still matter.

- Constant close and consolidation: Acting with precision requires knowing where a company is each day. Modern CPM systems support this type of management information precision by providing automation of highly manual tasks like reconciliations that are normally left until end of month, automating financial consolidations to deliver a more accurate view of enterprise performance, and providing close task management and workflow solutions that allow finance teams to actively manage their process.

As companies worldwide continue to see the impact of COVID-19 on their businesses, the ability to quickly understand and respond to changing dynamics will be crucial to making important decisions in real time. By leveraging a robust CPM solution, companies can gain the agility and flexibility needed to understand their total business performance so they can better weather the current storm and any future ones to come.