Exploring Capital Markets Options: SPACs vs IPOs

This article was updated on February 4, 2020

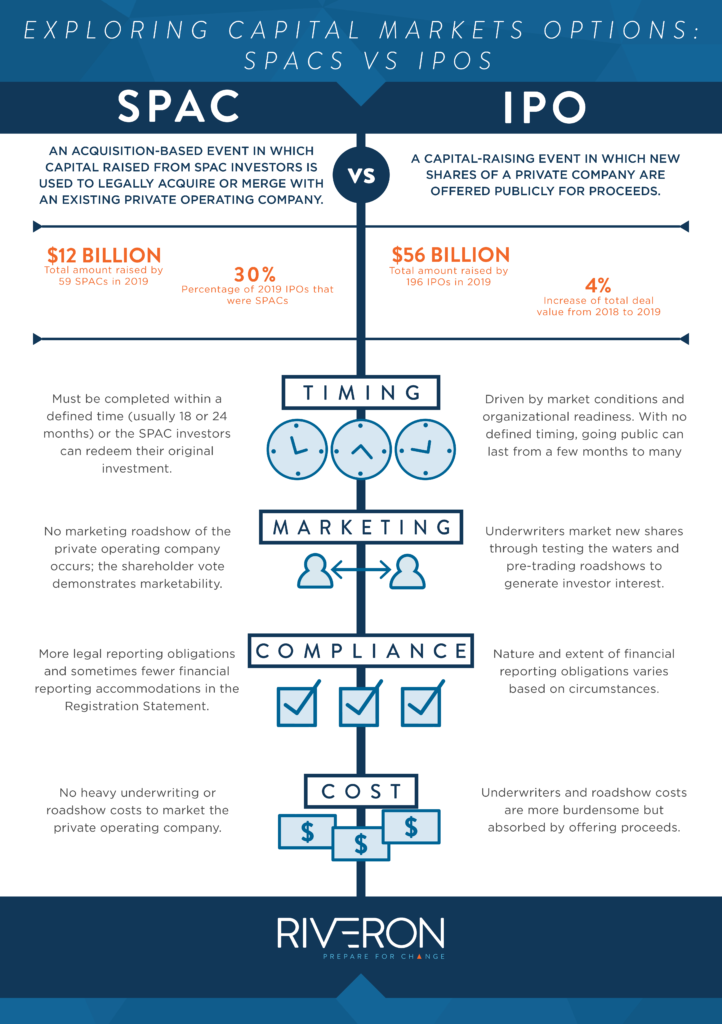

There are different options available for companies that are preparing to enter the capital markets. Increasingly, Special Purpose Acquisition Companies, commonly known as SPACs, are seen as an attractive alternative to a traditional initial public offering (IPO). But is a SPAC merger right for your company?

*Statistics: PwC US Capital Markets Watch

Your owners, sponsors, founders, or other stakeholders may be considering a SPAC merger or traditional IPO. Under either capital markets path, management teams must understand how to get ready. Riveron helps companies navigate the various challenges and pitfalls of both SPAC mergers and traditional IPOs.