Understanding Operational Due Diligence: Uncovering Value and Mitigating Risks

By conducting thorough operational due diligence, acquirers can mitigate risks, uncover opportunities for value creation, and validate assumptions outlined in the deal thesis.

As the economy improves in 2024, driven by decreasing interest rates and reduced market risk, private equity (PE) firms are expected to increase their transaction frequency as compared to 2023. Globally, PE firms hold around $4 trillion in uninvested capital. The combination of available funds and attractive valuations of target businesses makes investment opportunities more appealing than in the previous year. Amidst the assessment of potential targets, however, it is critical for PE firms to prioritize a comprehensive evaluation of risks. While financial due diligence is typically conducted, operational risks may remain unnoticed, leading to costly issues after the deal is closed. These issues can potentially result in significant financial losses for PE firms and their partners, as well as diminishing the future value of the asset upon exit.

Operational Due Diligence (ODD) plays a pivotal role in the due diligence process, entailing a thorough investigation into the operational facets of a target company. Its purpose is to pinpoint risks, unveil potential avenues for value creation and opportunities, and inform the deal thesis. Unlike financial and legal due diligence, ODD delves into areas such as supply chain and manufacturing, technology integration, human resources management, back-office operations, and operational risk assessment. In contrast to financial due diligence, which predominantly scrutinizes past financial performance, ODD adopts a forward-looking perspective, assessing a company’s capability to sustain current operations and facilitate future growth strategies.

Why Should You Conduct Operational Due Diligence?

Operational Due Diligence serves multiple critical purposes in the deal cycle. It helps identify potential risks that could jeopardize the success of the transaction such as technology vulnerabilities, capacity constraints, or compliance issues. It can also uncover opportunities for significant value creation, whether through optimizing processes, identifying post-acquisition synergy opportunities, kickstarting integration planning and execution efforts, and implementing key performance indicators (KPIs). The information gathered informs the deal thesis, providing qualitative and quantitative insights that validate assumptions and strategic objectives, ultimately enhancing decision-making and deal outcomes. For example, a client was considering two potential targets where key material input costs were critically assessed. At the first target, the deal could not proceed due to the high risk uncovered in the key input cost. Conversely, the second deal went through as the risk was deemed manageable.

Another example, a private equity was interested in a consumer manufacturing company that was planning to push specific products into a warehouse superstore. Through studying the product profitability at the SKU level and analyzing the company’s capacity to double or even triple their sales, the private equity team was able to make informed projections of the profitability of the company and ultimately how it would impact the deal thesis. These distinct outcomes exhibit the potential risks or opportunities that could be revealed through operational due diligence.

When is Operational Due Diligence Necessary? Not all deals are created equal

Operational Due Diligence is typically conducted during the pre-acquisition phase of a deal, primarily by the acquiring party (buy-side diligence). It is essential to perform ODD when:

- Considering an acquisition or investment to understand the operational risks and opportunities associated with the target company.

- Seeking to validate assumptions and strategic objectives outlined in the deal thesis to mitigate risks and optimize deal outcomes, including identification and management of synergies.

- Planning to integrate the target company into existing operations, ensuring compatibility and synergy realization post-acquisition.

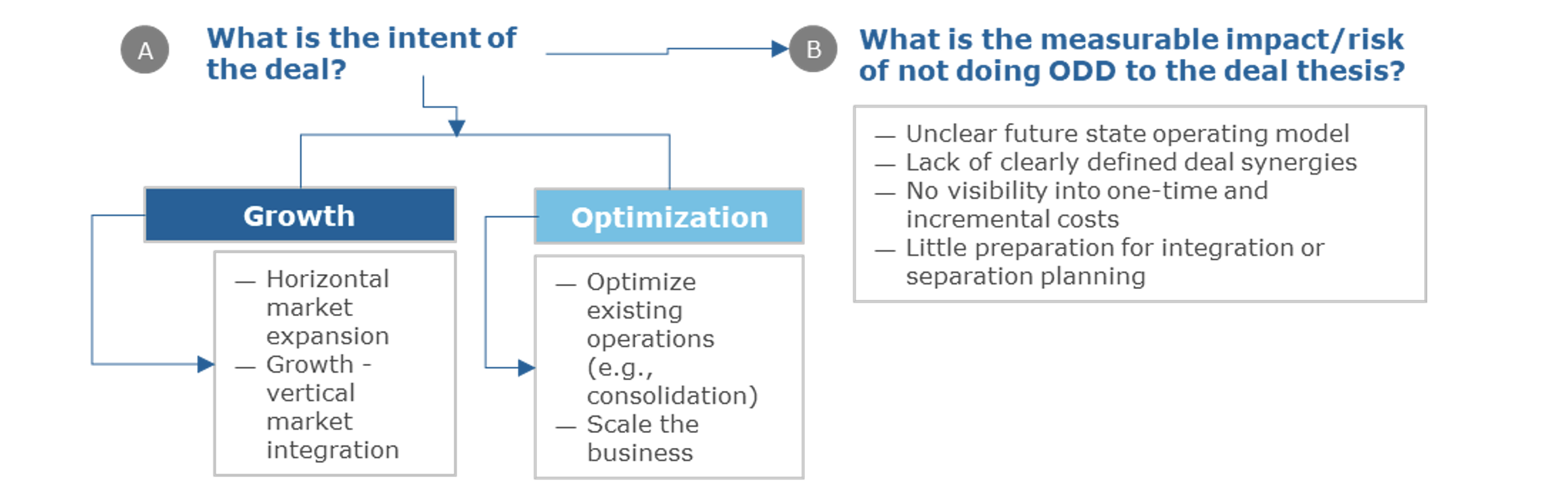

When determining if you should perform operational due diligence, it is important to begin with the deal thesis in mind by answering the following questions:

6 Areas of Focus to Determine if Operational Due Diligence is Needed:

1. What is the size of the company being acquired?

- Topline revenue

- Number of customers

- Number of employees

- Number of sites

- Number of geographic markets

2. What is the level of commercial/business complexity?

- How many lines of business are there?

- How many SKUs/products are there?

- How many markets / geographic locations are there?

- How many disparate customer segments are there?

- How many vendors/suppliers are there?

- How many distribution and/or manufacturing locations are there?

- How much inventory is on-hand? Where is this inventory located in comparison to customer market segment(s)?

- What are the current capacity levels for distribution and/or manufacturing?

3. What is the level of back-office complexity?

- How many ERP systems are there?

- How many CRM systems are there?

- How many Warehouse Management Systems [WMS] are there?

- How many HRIS systems are there?

- Are the back-office functions such as accounting, finance, HR and IT centralized or decentralized?

4. Is the target in a market where there are high levels of compliance-related regulations?

- Federal regulations

- EHS regulations

- People compliance e.g., discrimination, harassment, state wage laws, OT pay

5. Is there a need to assess the talent of the organization and/or the management team?

6. Is there a need to assess the culture of the organization?

Operational Due Diligence is a critical process in M&A transactions, offering valuable insights that can shape the success of the deal. By conducting thorough ODD, acquirers can mitigate risks, uncover opportunities for value creation, and validate assumptions outlined in the deal thesis. Ultimately, operational due diligence serves as a strategic tool for informed decision-making, ensuring alignment with the buyer’s objectives, and optimizing transaction outcomes.