SPACs, DPOs, and Other Trends Shaping Capital Markets

By the numbers: 2020 economic trends.

As a result of pandemic-related constraints, annualized rates of real gross domestic product (GDP) fell 5.0% in Q1 and another 31.4% in Q2. Unemployment numbers also rose in Q2, then arrived at 6.7% in Q4 as worker outlook recovered. The end of 2020 fared better as businesses reopened, enabling consumer spending and an increase in sales. Compared to a 2.2% increase in 2019, 2020’s total GDP decreased 3.5%, but showed positive progress as it rose 33.4% in Q3 and another 4% in Q4.

In one of the most turbulent years for US financial markets in history, the pandemic sparked a historically sharp market decline in early 2020. Then, the US economy showed signs of recovery during the second half of the year. These positive economic signs rejuvenated interest from companies looking to enter the capital markets.

Many pandemic-spurred business interruptions occurred in the first half of 2020, but—across various public offerings and acquisitions-related activities—the year ended with several trends that may continue to favor capital markets activity in 2021.

SPACs accounted for 248 IPOs in 2020, up from 59 the prior year.

Related proceeds continued to rise, as SPACs raised $83.3 billion compared to $13.6 billion the year before, and SPACs in 2020 accounted for nearly half of IPOs that year.

Many large investors took advantage of the boom in 2020, resulting in several SPACs over $1 billion. In July, Pershing Square Tontine Holdings raised $4 billion in capital, making it the largest SPAC to date. In the fall, electric car manufacturer Fisker also went public via a SPAC with a value of $2.9 billion.

The year of the SPAC

Special purpose acquisition companies (SPACs) had a breakout year in 2020. The pandemic pushed investors to consider alternative ways to raise capital by taking their companies public through reverse mergers. SPACs offered these investors unique advantages over traditional initial public offerings (IPOs). SPAC advantages include more perceived economic certainty surrounding deals, better speed to market, and attractive redemption features. As a result, SPACs boomed.

Because IPOs are inherently riskier, SPACs could continue to rise amid any uncertainty that remains in early 2021.

New methods to go public: DPOs spark interest

In August 2020, the New York Stock Exchange (NYSE) received approval from the US Securities and Exchange Commission for companies to sell new shares in a direct public offering (DPO) transaction on the NYSE. In September, the Council of Institutional Investors recently filed a petition against the approval, believing the updated requirements offered fewer legal protections to investors. In December 2020, the SEC completed its review of the petition and granted approval to raise new funding in a listing, which may enable less cost-intensive ways for companies to go public. Palantir and Asana are examples of companies that went public via a DPO.

IPO volume and proceeds doubled in 2020 compared to 2019.

The largest number of IPO transactions happened in 2020 since the 2008 recession. Proceeds raised in 2020 totaled $179.4 billion from 450 IPOs, compared to 2019’s of $72.2 billion from 213 IPOs.

Traditional IPOs break records

During the late stages of Q1 and throughout Q2, the market for initial public offerings (IPOs) hit a significant pause due to pandemic-related concerns. Many IPO candidates began to face funding and liquidity challenges that caused companies to postpone action. IPO volume fell markedly in Q2 but soared during Q3, with volumes up 195% on a year-over-year basis. Further, activity finished strong in 2020 with 168 IPOs recorded, up from 54 at the end of the prior year. Overall, 2020 was a record-setting year for the IPO market.

As IPO volume and proceeds increased in 2020, the year’s IPOs were also larger at an average size of $398.6 million—led by several high-profile IPOs, including 28 that raised at least $1 billion in proceeds. Snowflake, 2020’s largest IPO, raised $3.4 billion in proceeds, making it the largest software IPO in history. During major economic uncertainty in 2020, the traditional IPO market adjusted swiftly.

M&A deals rebound

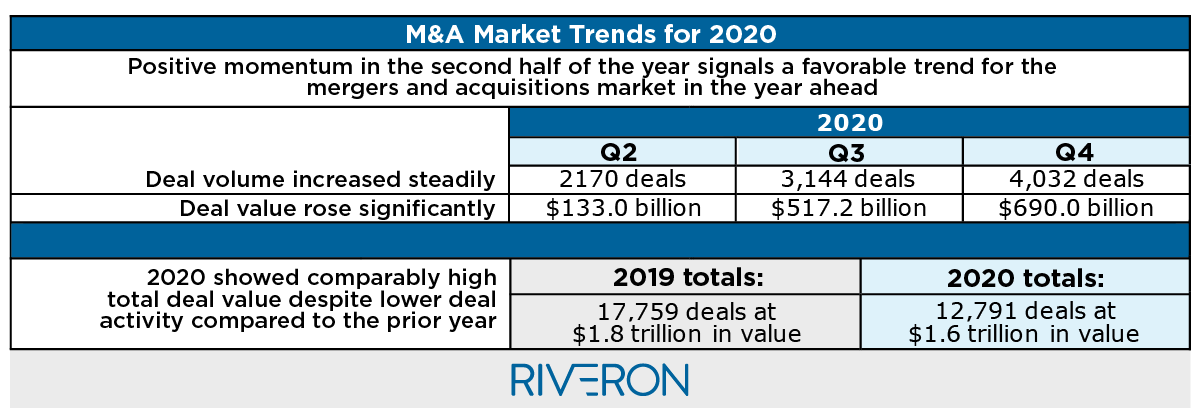

Pre-pandemic, 2020 began strong, but the mergers and acquisitions (M&A) landscape faced heavy disruption starting in March. During Q2, the pandemic sparked the sharpest decline in M&A activity in the past decade, but the market started to see a rebound in activity during Q3 related to the volume and value of deals.

Sources: The Institute for Mergers, Acquisitions, and Alliances (IMAA) and Factset

Although total deal activity is down compared to the year prior, the resurgence of deals in the second half of 2020 signaled market optimism.

A wave of megadeals—at least $5 billion in value—drove the surge in deal value surge at the end of 2020. While the initial shock of the pandemic caused companies to preserve cash in the first half of the year, as the economy began to reopen, banks provided , and many companies capitalized on growth opportunities. The increased availability of capital led to 43 megadeals announced in the second half of 2020—double compared to the second half of 2019.

The technology sector performed especially strong in 2020; the sector alone accounted for 11 megadeals. Notable technology deals include NVIDIA’s acquisition of Arm Ltd. from SoftBank Group Corp. for $40 billion, and Advanced Micro Devices acquisition of Xilinx for $35 billion.

Looking ahead for capital markets

Despite uncertainty related to widespread vaccine effectiveness or the policies of a new presidential administration, many investors expect the capital market trends of 2020 to favorably influence 2021. As the new year unfolds, 123 IPOs are already anticipated to occur, and 100 of these are SPACs.

For M&A activity, an increase in technology sector deals is likely to continue, based on the widespread need for remote technologies spurred by the pandemic. In response, many company executives are planning to expand investments in digital transformation.

With investors expecting earnings to recover, 2021 could be a historically busy year for capital markets. Management teams and stakeholders need to align strategies in favor of the capital market window that currently appears to be open.