Biden’s Proposed Tax Plan and its Impact on Private Equity

As newly elected president of the United States, President Joe Biden has proposed a tax plan which could have a significant impact on the private equity industry. Some of the proposed changes include an increase to capital gains tax rates, an increase to corporate tax rates, a surtax on cross border transactions, and a “Made in America” tax credit. The biggest impacts of the proposed changes for the private equity industry may involve changes in the structuring of compensation of management and changes in the structure of acquisitions between corporate and flow-through entities.

Capital Gains Rate

Currently, the federal capital gains tax rate is 20% for assets held for more than one year. President Biden’s tax plan would increase the tax rate for long term capital gains to roughly 40% for individuals whose adjusted gross income exceeds $1 million. This increase in the capital gains tax rate will have a direct impact on the use of carried interest in private equity scenarios. By increasing the capital gains tax rate to be closer to the ordinary income tax rate, President Biden’s tax proposal can treat carried interest as a capital gain while taxing it at the ordinary income tax rate. As a result, the private equity industry may be forced to revise their investment models. It is also worth mentioning that an increase in capital gains tax rates on the horizon could present an increase in mergers and acquisitions (M&A) transactions as many individuals will be motivated to sell prior to the rate increase.

Private equity organizations should evaluate current and future acquisition structures to determine whether it is more beneficial to operate as a corporation or a flow-through entity.

Corporate Tax Changes

Under President Biden’s tax plan, the corporate tax rate would increase from 21% to 28%, reversing the Tax Cuts and Jobs Act (TCJA) decrease from 35% to 21% in 2018. The tax plan also proposes a new corporate alternative minimum tax on any corporation with annual profits of $100 million or more at 15%. This 15% corporate alternative minimum tax would require all large corporations to pay some tax. As a result, private equity organizations should evaluate current and future acquisition structures to determine whether it is more beneficial to operate as a corporation or a flow-through entity.

Cross-Border Tax Changes

President Biden’s tax plan would impose a 10% surtax on corporations that send manufacturing and service jobs to foreign nations in order to sell goods or provide services back to the US. The additional surtax, along with the increase in the corporate tax rate, could increase the effective corporate tax rate to 30.8%.

The tax plan also provides an incentive to keep manufacturing in the US by proposing a 10% “Made in America” tax credit for businesses that invest to restore production, revitalize existing, closed, or closing facilities to advance manufacturing employment or expand manufacturing payroll. This credit would be available when expenses are incurred, unlike traditional tax credits which are received when the federal tax return is filed. It remains to be seen if such incentives will have any impacts to the activity of private equity firms in the manufacturing sector.

The Tax Cuts and Jobs Act created a new category of foreign income known as Global Intangible Low-Tax Income (GILTI) that is added to corporate taxable income and taxed at a rate of 10.5%. President Biden’s tax plan proposes an increase to the GILTI tax rate from 10.5% to 21%.

Individual Rate

President Biden’s tax proposal includes an increase in taxes to individuals with taxable income above $400,000. The new plan would increase the top individual tax rate for taxable income over $400,000 to 39.6%, the pre-TCJA rate. Biden’s plan would also impose a 12.4% social security payroll tax on income earned above $400,000. There would also be a phase out for Section 199A, qualified business income deductions for individual with taxable income above $400,000. As a result of the increased tax rate for individuals earning over $400,000, the private equity industry should take into consideration the impact the increase will have on gross up calculations when determining whether to acquire the stock or assets of a target.

President Biden’s tax plan appears to take aim at increasing taxes on “wealthy” individuals by taxing those earning above $400,000. The plan also increases taxes on US companies with foreign affiliates and foreign profits, while providing additional incentives for US companies to bring manufacturing and services jobs to the US. It is currently unknown when President Biden’s proposed tax changes would be passed and taken into effect. While it is possible that President Biden and Congress could implement the proposed tax changes for the 2021 tax year, it is more likely that the changes will be put into place for the 2022 tax year. Looking back at the TCJA, it took former President Trump one year in office before the TCJA was passed.

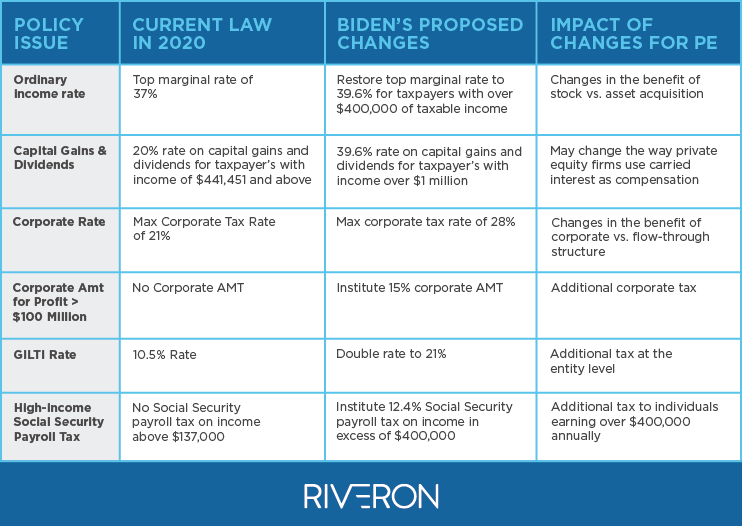

See below for a comparison of the current tax law compared to President Biden’s proposed changes, and what it could mean for businesses backed by private equity (PE).