Staying Afloat in US Telecom Amid Chip Shortages, Global Competition

Network communications suppliers stand to benefit from the 5G roll-out and growing network usage, but US-based suppliers face new and enduring supply chain interruptions, mounting global competition, and other pressures.

As major carriers roll out new 5G technology and customers increase network usage, suppliers to major wireless communications providers should experience a boon in business, provided they can overcome supply chain issues and global headwinds. Difficulties in the industry include structural issues that existed pre-pandemic and other constraints that have been building steadily in recent months. Business leaders in the telecom industry can buoy their companies up by considering the global and domestic forces at play and proactively establishing a stronger position in the shaky supply chain.

The chip shortage and other challenges ahead for telecom suppliers

In the United States, today’s telecom suppliers are met with escalating hurdles related to the global semiconductor chip shortage, conflicting priorities for domestic production, a resurgence of orders when pent-up demand releases, and more.

The telecom industry is certainly starting to see impacts of the chip shortage. The scarcity of chips has already shuttered automotive plants, causing auto makers to forego upwards of $75 billion of enterprise value year-over-year. The chip shortage first caused major roadblocks in the automotive supply chain. This disruption has been particularly undesirable for automakers, on a decades-long quest to operate on a just-in-time basis. This sector, focused on hyper-efficiency has also trended as a growing consumer of chips as vehicles have become more computerized; however, auto industry players may not have the same leverage to obtain chips compared to consumer electronics makers and telecom suppliers.

Despite declining end-user demand during the pandemic, telecom suppliers and sub-component suppliers were more apt to maintain purchase levels at the onset of the pandemic. As a result, these telecom companies had a stockpile of inventory that acted as a buffer during initial stages of the shortage. However, based on recent earnings reports and filings[1], network equipment suppliers are starting to blame chip shortages for revenue misses and providing downward guidance for future revenues are in jeopardy if a steady supply is not secured.

As the pandemic fallout remains unpredictable, rolling lockdowns (due to a resurgence of COVID-19 cases or other public health and safety concerns) may negatively impact supply in the US. Many sub-component assemblies that integrate chips come from Europe, Asia, and other geographies, and lockdowns in those regions have a high potential to adversely affect US-based telecom suppliers.

Added to that risk is the escalating political and commercial pressure for chips to be provided to automotive or (non-telecom) consumer electronics manufacturers that have shuttered production in US factories recently. This is bad timing for network equipment suppliers as many are expecting an increase in orders over the next one to two years. Aside from typical end-market growth, pent-up demand due to deferred investment by communications providers during the pandemic will further exacerbate the situation.

In the United States, today’s telecom suppliers are met with escalating hurdles related to the global semiconductor chip shortage, conflicting priorities for domestic production, a resurgence of orders when pent-up demand releases, and more.

Contending with competition in China

Telecom suppliers might face intensifying hurdles related to domestic production priorities, a resurgence of orders when pent-up demand releases, and mounting competitive conditions that may be favorable for China and nearby countries in the production supply chain. There is an aggressive push to invest in 5G, with plans in China to roll it out to every major city. And, given that most chips are produced in Taiwan and South Korea—countries to which China provides critical raw materials—China may be able to use its position in the region as leverage to obtain chips sooner than other global customers.

Ongoing telecom industry supply chain issues in North America

Many ongoing issues have been made worse by the pandemic. Beyond the competition with organizations such as Huawei in China for key components, there are also ongoing risks of geopolitical factors as well as interruptions that can be caused by unpredictable natural disasters, such as winter storms in Texas that caused weeks-long interruptions for some chip manufacturers. Also, the tiered supply chain structure that spans the globe means that a product at one tier level depends on completion at sub-tier levels.

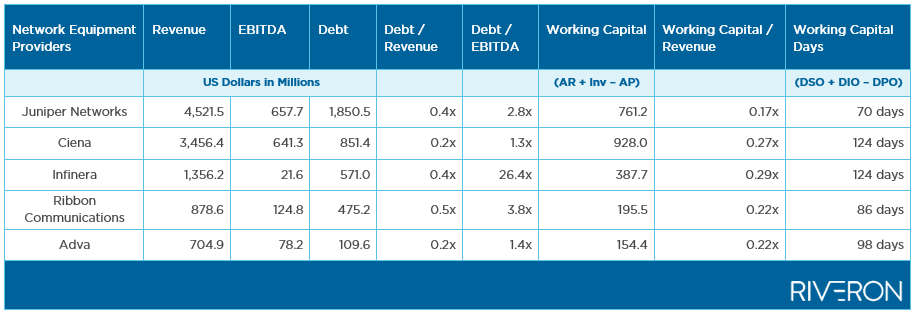

A limited number of suppliers produce the complex and high-tech sub-components needed in the industry, resulting in a highly competitive market for allocation of key parts. The need to stockpile or pre-pay, combined with long lead times, often months, between customer order and delivery results in high working capital requirements relative to other industries that typically operate on a just-in-time basis. Further exacerbating liquidity at major suppliers is the requirement to remain innovative through (often costly) research and development. Combined, these factors result in very capital-intensive businesses that are typically highly levered—this means the businesses have very little room for error in terms of missing a sales forecast. Leverage ratios are generally not concerning at this point, but increased costs and continued revenue misses may cause the situation to worsen. More concerning is the amount of working capital tied up which will only increase as delays in key parts causes delays in sales.

Figure 1: Working Capital and Networking Equipment Providers

Source: S&P Capital IQ data reported through March 2021 except for Ciena, reported through Jan. 31, 2021.

What telecom players in the US should consider

Although an executive order by President Joe Biden seeks to bolster domestic production and strengthen supply chains, it will likely take many years for the order to provide relief. In the meantime, companies, especially Tier-1 suppliers, should focus on raising capital while market conditions are amenable.

Companies should also potentially pursue acquisitions lower in the supply chains in an effort to secure supply and diversify offerings. Consolidation and integration within the supply chain and through the tier network is logical and probably inevitable. For those companies willing to consolidate, first movers will be able to obtain the best assets providing long-run competitive advantages.

Referencing how the automotive industry has contended with similar issues, telecom companies—especially Tier-1 network solutions providers—can borrow the following tactics from the same playbook:

- Implement early warning systems that track the financial and operational health of key suppliers through the tier network. This proactive approach should limit disruption when a link in the chain is damaged or breaks.

- Sacrifice near-term profitability and liquidity by engaging contingency suppliers and building inventory banks, or pursue outright acquisitions of key suppliers.

- Invest in more sophisticated demand-planning capabilities, and seek better alignment with carriers and other end consumers to reduce the amount of working capital that is tied up.

Taking advantage of the boon associated with the roll-out of 5G and overall increased data consumption requires suppliers to operate their businesses with next-wave thinking. Moving fast to address risks will ensure a space for suppliers in the evolving arc of the US telecommunications market.

[1] Infinera announced $15M-$20M in lost revenues in Q1 and an expectation of losing $25M in Q2 due to chip shortages.