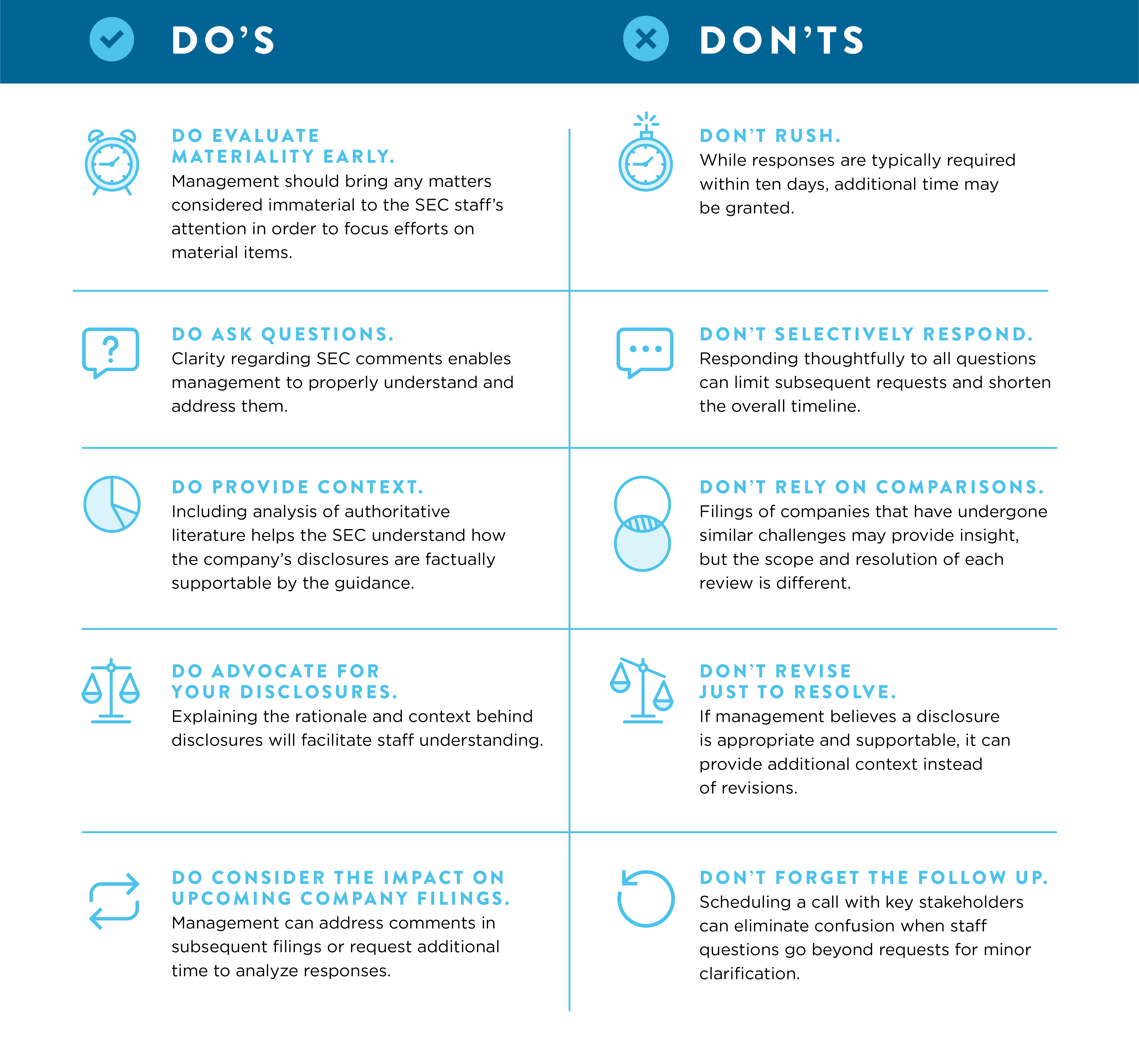

SEC Comment Letters: Do’s and Don’ts

After a global economic slowdown in the first half of 2020, the markets experienced a significant increase in IPO activity in the second half of the year. As a result, many newly public companies will be experiencing the Securities and Exchange Commission (SEC) comment letter process for the first time—either during the registration statement or annual SEC filing process. While this experience can seem daunting for new registrants, understanding common factors can streamline the response process and timeline.

Whether a company’s publicly-held status is recently established or longstanding, accounting and compliance professionals should expect an ongoing cadence of the SEC process. The SEC reviews company filings at least once every three years, with many companies selected for more frequent review. Comments are issued in response to registrant disclosures and other publicly available information, including press releases and analyst calls. Companies can resolve issues quickly by remaining prepared for the process and ensuring comprehensive responses. Keep these Do’s and Don’ts in mind when responding to SEC comments.