The Latest Round of PPP Loans: Accounting and M&A Considerations

New PPP Loan considerations for eligible small businesses or parties interested in acquiring target companies with existing PPP Loans.

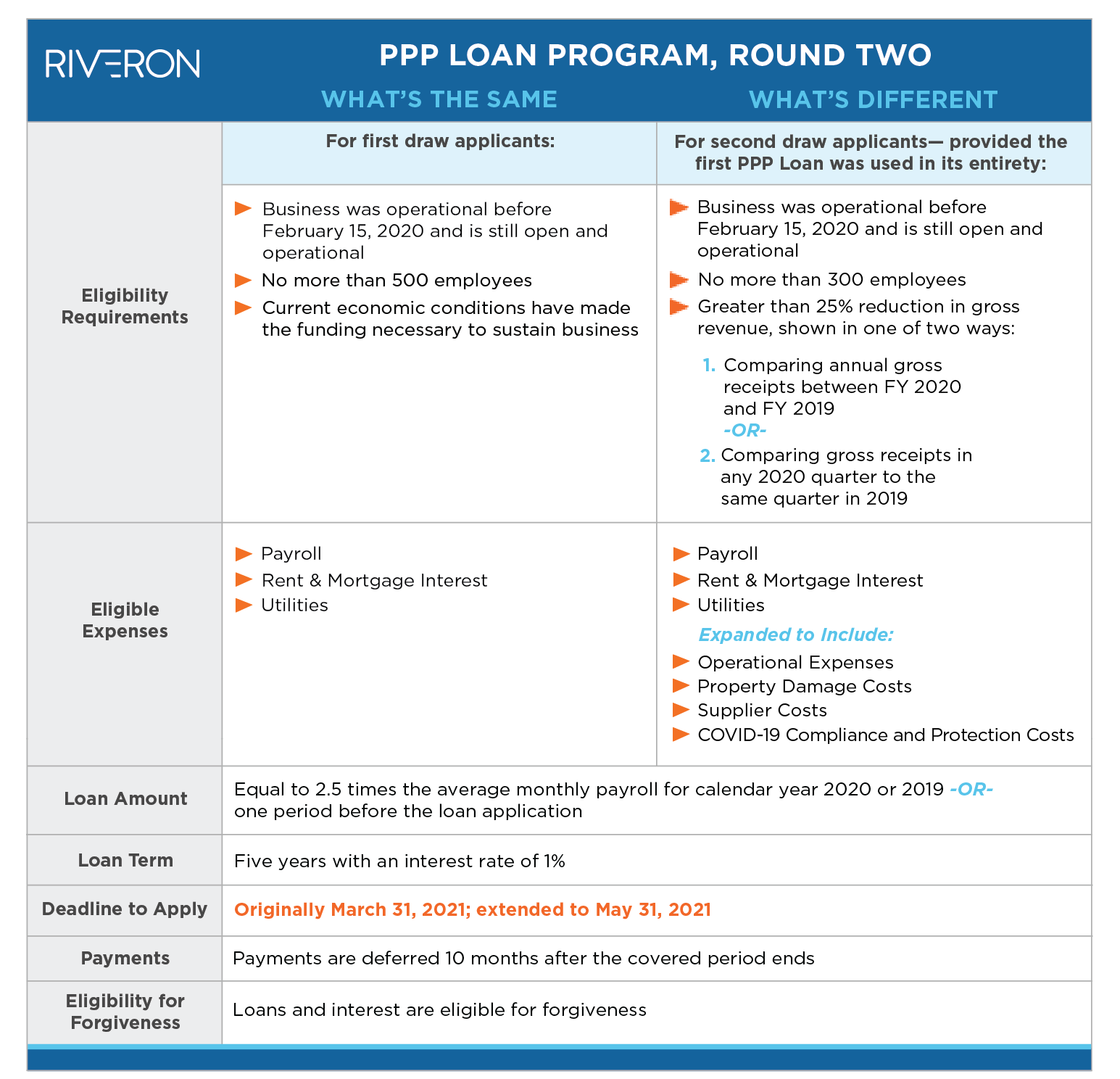

For businesses financially impacted by the pandemic, a new relief bill—signed in December 2020—changed the paycheck protection program (PPP) to allow some businesses to apply for the first time or receive additional funding. A business that already received PPP funding may apply for a second loan if it suffered a decline in revenue in 2020 (see details in the table below). The original deadline to apply for a PPP loan was March 31, but it has been extended through May 31, 2021.

Small businesses should understand the changes under the expanded program, appropriate ways to account for the loans, and how to apply and maximize loan forgiveness. Also, any parties seeking to acquire businesses funded by PPP loans will want to understand the impacts of the program—especially related to diligence and accounting matters.

Details for the second wave of PPP loans offered

The chart below summarizes the similarities and differences of the new PPP loan program, compared to the initial round of funding available in early 2020.

Accounting for PPP Loans

Debt Accounting

Most companies will account for the PPP loan under ASC 470 – Debt, as PPP loans are considered a legal form of debt. Management should consider short- and long-term classification of the loan based on the guidance in ASC 210-10-45, which should be applied using the contractual loan terms.

TIPS FOR TERM CLASSIFICATION: Upon initial measurement, loans should be accounted for as a long-term liability due to the five-year term of the PPP loan.

This conclusion assumes no amounts will be repaid by the government and the loan deferment will cease after the respective period. Receipt of funds from the PPP loan and any subsequent principal repayments should be classified as a financing activity in the statement of cash flows.

Interest should be accrued immediately upon receipt of the loan as a separate liability and expensed over the loan term consistent with ASC 835 – Interest. Interest activity should be recorded as an operating activity in the statement of cash flows while any subsequent forgiveness of the loan will be disclosed as a non-cash financing activity and separately as a gain upon debt extinguishment on the income statement.

Grant Accounting

Companies are also permitted to account for the loan as a government grant by aligning to the guidance in IAS 20 – Accounting for Government Grant and Disclosures. Before proceeding with this method of accounting, management should have a preexisting policy in place (i.e., grant accounting likely does not apply unless the company received similar government grants in the past). Also, the company should be reasonably assured that the loan will be forgiven.Under this method of accounting, the company would recognize the loan as an income related grant and initially recognize the loan as a deferred income liability. Subsequent relief of the loan would be recorded through income over the periods in which the company recognizes the eligible expenses the loan is planned to offset. This relief can be presented separately or as an offset to expenses but should not be classified as revenue on the income statement.

DEBT ACCOUNTING VS. GRANT ACCOUNTING: Debt accounting is strictly in line with the guidance, whereas grant accounting is interpretive. If management has any doubts about applying the interpretive guidance, it is always appropriate to account for the loan as debt under ASC 470.

PPP Loan Considerations for Acquisitions

As markets continue to see an increase in activity around mergers and acquisitions, companies should consider the impact of PPP loans during the diligence and acquisition process.

Companies considering acquiring businesses with existing PPP loans should ensure that provisions are included in the purchase agreements that clearly outline any responsibility of the loan post-acquisition.

- If the PPP loan is acquired by the buyer, the purchase agreement should include provisions to protect the buyer and potentially adjust the purchase price if the loan is not fully forgiven. Additionally, companies should carefully consider the fair value of the loan, either by engaging a valuation specialist or performing further investigation into how the seller spent the funds, to ensure that the purchase accounting adjustments are recorded appropriately.

- If the PPP loan liability remains with the seller, the seller should ensure they have the funds necessary to pay back the loan if the loan is not fully forgiven.

Forgiveness of a PPP Loan

As soon as PPP loan funds have been spent or as late as when the loan matures, companies are eligible to apply for loan forgiveness, which has related tax advantages. To apply for loan forgiveness, the US Small Business Administration offers three applications (Form 3508S, Form 3508EZ, and Form 3508) for companies. Forms should be selected based on the loan amount, headcount reduction, and the company’s ability to operate under COVID-19 guidelines.

TIPS FOR LOAN FORGIVENESS TIMELINES: Consider applying for forgiveness at least a few months before the 10-month deferral period has concluded so the company is not required to make principal payments on the loan.

Loan principal and interest can be fully or partially forgiven in an amount equal to the eligible expenses incurred by the company during the eight- or 24-week covered period. Full forgiveness can be achieved if the entirety of the loan was utilized to pay eligible expenses and at least 60% of the loan was utilized for qualifying payroll costs.

Management should ensure appropriate records are maintained from the receipt of funds up until the company plans to apply for forgiveness to streamline the process. This documentation involves detailed payroll records, including employee turnover, wage reductions or increases, and hiring practices throughout the covered period.

TIPS FOR TRACKING RELEVANT SPENDING AND PAYROLL: Consider creating and maintaining a separate bank account for PPP funds to easily track how the funds are spent. Ensure comprehensive payroll reports are created or available to allow management to easily track changes to staffing and compensation levels.

Additionally, companies should ensure that thorough records are maintained that show how the funds are spent and that funds are utilized only on eligible expenses to ensure the forgiveness potential of the loan is maximized.

- Tax implications for forgiven loans: After the passage of the relief bill was signed into law in December 2020, Congress clarified that a forgiven PPP loan is completely tax-exempt and is not taxable income. It is also very important to note that Congress expanded the list of deductible expenses and specified that certain business expenses (noted in the table above) paid by the forgiven PPP loan are tax-deductible.