Lease Accounting for Private Companies: Transition Strategies and Impacts

The effective dates are fast approaching for private companies to adopt the new lease accounting standard, ASC 842. Most private companies’ 2022 annual financial statements will need to reflect the new standard. ASC 842 aims to provide financial statement users with more comprehensive information regarding the costs and funding methods of property essential to a reporting entity’s operations as well as the standard’s stated disclosure objective of providing information regarding the amount, timing, and uncertainty of cash flows arising from leases.

Implementing the new standard can be complex and time consuming. Private companies beginning this process should set up a steering committee to establish a timeline, process, and project management cadence. Private companies should also explore the lessons learned by public companies, specifically the commonly associated challenges across all parts of the organization.

Lease classification and business impacts

Prior to adopting the new standard, private businesses should understand lease classification rules under ASC 840 and ASC 842, guidance and practical expedients for the transition, and key accounting considerations with potential downstream effects on the business. Specifically, although lease classification conclusions are not likely to differ significantly upon adoption of the new standard, application of the rules can be complex. As lease classification can impact a number of financial outcomes that can be significant to investors and other stakeholders, including EBITDA margins, working capital, debt to equity ratios, and other profitability ratios. Companies should also assess the potential carryover impacts to debt covenants, compensation, and bonuses.

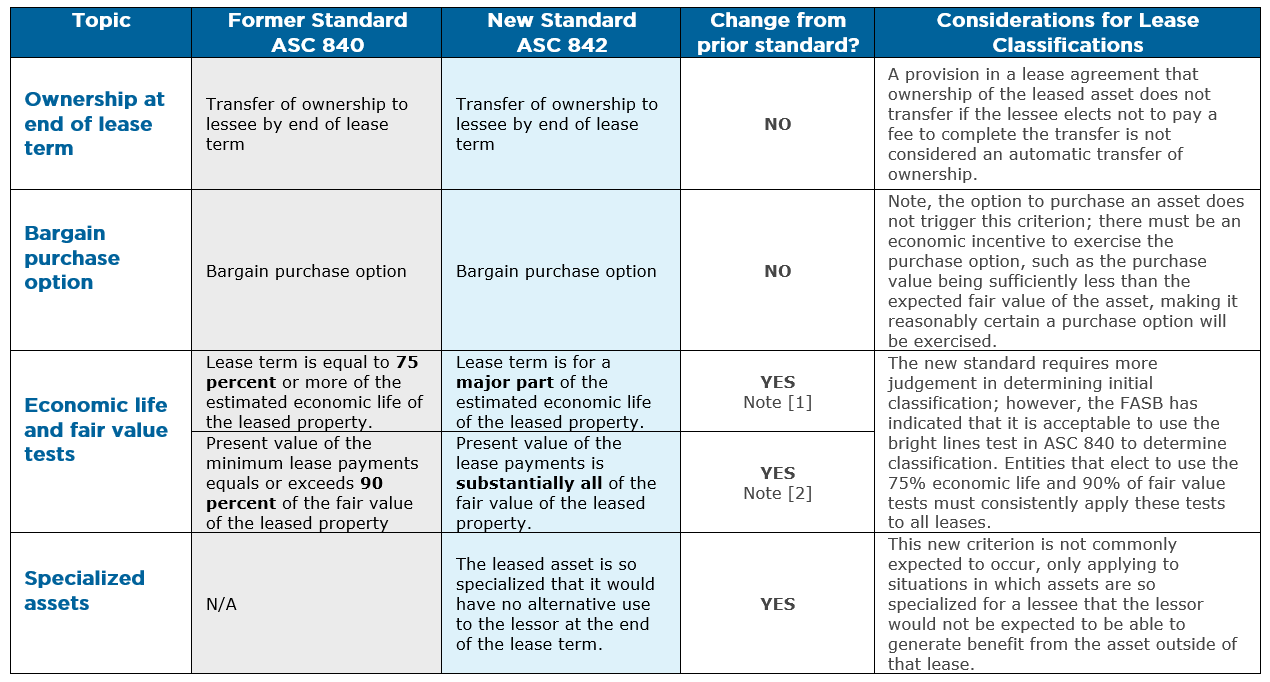

The below table offers a comparison of certain classification rules between ASC 840 and ASC 842, as well as considerations for private companies as they evaluate classification under the new rules.

Figure 1: ASC 840 versus ASC 842

Comparisons and considerations for lease classification criteria under each of the standards:

[1] Using judgement for the major part of remaining economic life: Entities should note that, while often similar, economic life does not necessarily equal the depreciable life of an asset, and specific facts and circumstances should be assessed. For example, if a company leases an asset for five years and typically depreciates similar assets over a five-year period, but that asset is estimated to be able to provide economic benefit to another lessee for an additional three years, then the economic life used in the test should be eight years.

[2] Using judgement regarding the fair market value (FMV) of the underlying asset: When calculating the present value of the lease payments, the discount rate used by the lessee is the rate implicit in the lease. If this rate cannot be readily determined, the lessee will use its incremental borrowing rate (“IBR”). The IBR the company will use for the FMV lease classification test will require significant judgment. When adopting ASC 842, the rate assumed will also have a significant quantitative impact on the lease asset and liability valuations recorded on the balance sheet. The IBR is defined differently in both standards, but under ASC 842, a company will have to put more effort into identifying the appropriate discount rate to record for each lease.

ASC 842 also requires calculating the fair value of the underlying asset at the level associated with the identified lease component. Estimating the fair value can be challenging, especially for real estate leases or when a company leases a portion of a larger asset; in some cases, companies may need assistance from a valuation specialist to determine the fair value of the leased asset.

Transition guidance and practical expedients

Entities may adopt ASC 842 using one of two transition methods:

1) Modified retrospective approach: Under this approach, the earliest comparative period presented is adjusted by applying the standard to leases that existed as of and after the beginning of the earliest period presented. This approach also requires new and enhanced disclosures for all periods presented.

2) Alternative transition approach: Here, entities would not adjust comparative periods. Instead, the standard is applied to leases that had commenced as of the beginning of the period of adoption through the recognition of a cumulative-effect adjustment to the opening balance of retained earnings. Entities that use this approach must provide all required disclosures under ASC 840 for all periods that are presented in accordance with ASC 840.

Practical expedients

To adopt the new standard more easily, companies should carefully consider all the practical expedients available. For example, a package of practical expedients allows the company to not reassess (1) whether a contract is or contains a lease, (2) lease classification, and (3) initial direct costs upon adoption of the new standard. Under this practical expedient—which must be elected as a package and applied consistently to all leases—classification of leases under ASC 842 will be the same as the previous classification determined under ASC 840, but companies will need to ensure that their previous assessments under ASC 840 are correct. If accounting under ASC 840 has been vetted as appropriate, then electing the practical expedients package can ease the burden of the transition.

Summary of key accounting considerations and downstream business impacts

Balance sheet impact

ASC 842 will have a balance sheet impact resulting in increased liabilities with corresponding right-of-use assets. Companies with significant operating leases under ASC 840 will see the largest changes to their balance sheets.

A key component in measuring the right-of-use asset is the value of the lease liability. The appropriate measurement of the lease liability is critical to properly account for the balance sheet impact. For example, using an inappropriate discount rate when measuring the lease liability could lead to an overstatement of the right-of-use asset and could result in impairment charges during future periods.

Income statement impact

If a lease is classified as an operating lease, expense recognition is consistent under both ASC 840 and the new standard. The expense is recognized as rent expense within cost of sales or operating expenses.

If a lease is classified as a finance lease, the right of use asset is amortized straight-line over the shorter of the related asset’s economic life or the term of the lease. A company will also record interest expense on the lease liability recorded.

Sale and leaseback accounting

Companies may sell an asset to another party and simultaneously leaseback all or a portion of the same asset for all—or part of—the asset’s remaining life. These transactions can be economically advantageous to the seller-lessee, but companies should carefully evaluate all the considerations, especially related to lease classification, under ASC 840 or ASC 842.

Under ASC 842, the sale and leaseback guidance has been substantially revised; specifically, it eliminates special real estate guidance that existed under ASC 840 making it relatively easier to demonstrate that real estate has been sold for accounting purposes under ASC 842 and thus that a sale and leaseback has occurred. In addition, the new guidance supersedes the continuing involvement provisions that existed under ASC 840. Also, the requirement to recognize a gain immediately on recognition of a sale and leaseback transaction has been revised.

Transactions

For transactions under ASC 840 and ASC 842, especially involving real estate, companies should carefully evaluate the lease classification tests, especially relating to the inputs used in the lease classification calculations such as useful life, lease renewal options, lease payments, market rent, fair market value of assets, and IBR. All parties—broker, legal, finance, accounting and tax—also need to align on the considerations, classifications, accounting treatment, and ultimately achieving the desired outcomes.

How to prepare for implementation

Accounting preparation

Entities should begin their assessment of current accounting under ASC 840 prior to implementation to understand the most advantageous transition options and practical expedients. Further, private companies should assess potentially complex issues such as discount rates used in quantifying lease liabilities or transactions involving real estate and determine if third-party expertise is needed for implementation.

Business preparation

Companies should assess current leases to determine existing commitments and the possibility to negotiate lease terms. In some cases, finance leases might be more advantageous due to the ability to add back interest and depreciation for EBITDA calculations. Due to the balance sheet impact of ASC 842, businesses must carefully assess whether to lease or purchase an asset. Finally, before implementing changes, management should assess the new standard’s impacts to key ratios and debt covenants; this assessment would include communicating with creditors and other users of a company’s financial statements.